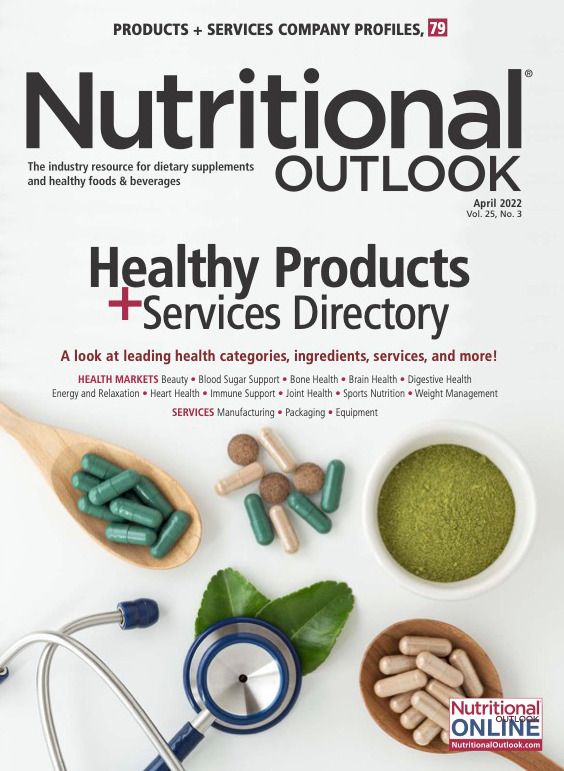

Sports Nutrition: Why brands need to go the extra mile to demonstrate safety and quality

Consumer trust is paramount to ensure long-term success as legislators broadly smear the category as unsafe.

Photo © Diana Vyshniakova - Stock.adobe.com. Edited by Melissa Feinen.

Sports nutrition is perhaps one of the most popular categories of the dietary supplement industry, helping consumers meet their physical fitness goals in a number of ways. Lately, however, it seems the category has a target on its back. Over the last few years, multiple pieces of U.S. state legislation have been introduced that would restrict the sales of sports nutrition and weight management products for those under the age of 18.

Sponsors of these bills have cited concerns about abuse of such products by minors motivated by body image issues resulting from social media. The justification of New York Senate Bill 16D (now in Assembly as A431C), sponsored by New York Senator Shelley B. Mayer (D-NY), states: “Eating disorders are diagnosed based on a number of criteria, including the presence of what clinicians call unhealthy weight-control behaviors (UWCBs). One UWCB of particular concern is the use of pills or powders to lose weight or build muscle, which are often sold as dietary supplements. Although they are sold alongside multivitamins and other supplements largely regarded as safe, these products often contain unlisted, illegal pharmaceutical ingredients that pose serious risks.”

The language of the bill targets “dietary supplements for weight loss or muscle building” and “over-the-counter diet pills.” It identifies these as including, but not limited to, “thermogens, which are substances that produce heat in the body and promote more calorie burning; lipotropics, which are compounds that help break down fat during metabolism; hormones, including hormone modulators and hormone mimetics; appetite suppressants; or ingredients deemed adulterated.”

A similar bill introduced in California (AB-1341), which recently passed Assembly, also targets these classes of ingredients. The NY bill, however, makes a caveat for protein powders, unless the product contains the previously mentioned restricted ingredients.

A recently introduced piece of legislation in Rhode Island (Senate Bill 2613), which passed Committee to be held for further study, was more specific in its language, calling for restrictions on dietary supplements containing an ephedrine group alkaloid, and any supplement containing androstanediol, androstanedione, androstenedione, norandrostenediol, norandrostenedione, and dehydroepiandrosterone.

Advocates for the supplements industry, like the Natural Products Association (NPA; Washington, DC), contend that there is a complete lack of evidence of the correlation between eating disorders and dietary supplement usage. For example, the group filed a Freedom of Information Act (FOIA) request with FDA to determine if any such association existed and found no adverse events or reporting associated with dietary supplements and eating disorders.

Moreover, such legislation poses a major economic burden on retailers, who would have to implement these measures, as well as manufacturers and ingredient suppliers that could fall under the purview of these laws—not to mention the potential regulatory patchwork that would result from their passage.

“While [the bills] do point to some ingredients, there is key language in there that does not limit it to these specific ingredients. So, it’s quite possible that when these commissions get together there are products that we have not considered to be, in their view, something that would warrant being age-restricted that could be possibly on the chopping block,” says Kyle Turk, director of government affairs at NPA. “Something like creatine or beta-alanine comes immediately to mind. I think more generally, though, when you look at thermogens, lipotropics—those are everyday ingredients. They’re found in foods, and they’re naturally occurring. When you look at those and also take into consideration some of the other specific ingredients that [legislation calls out], like some of these pro-hormones and steroids, it’s interesting to us that they’re going to make some ingredients ‘super illegal’ but include products that, by and large, are introduced to the market safely and that a number of companies—not just NPA members but [other] good stewards of the industry as well—take the time to ensure putting quality products out to market.”

Adulterated Products

Adulterated ingredients, however, should not be sold to the public in the first place. Therefore, adulterated products should not be lumped in the same class as those marketed by responsible manufacturers.

Issues of adulteration are often construed as representative of the sports nutrition category and even the dietary supplement industry as a whole. While responsible retailers can curate inventory and ensure that the products their customers buy are on the level, ecommerce can expose consumers to a wealth of adulterated products they may not realize are dangerous. For example, a study published last year in Clinical Toxicology1 found that sports and weight management supplements purchased online that were known to already be adulterated with an unapproved pharmaceutical beta-agonist called deterenol contained additional prohibited stimulants upon analysis in the lab.

In the study, conducted by NSF International (Ann Arbor, MI) and Harvard Medical School, researchers bought 17 products online. Upon testing, they found that four brands contained two prohibited stimulants, two contained three stimulants, and two contained four stimulants. Although researchers specifically targeted adulterated products, the fact remains that these products were easily accessible online, and many consumers could potentially be exposed to a cocktail of illegal stimulants.

While legislation targeting weight management and sports nutrition products could have a significant impact on brick-and-mortar retailers, lawmakers will have a harder time controlling consumer access via ecommerce, which many consumers will ultimately turn to, and where they will likely be at greater risk of exposure to adulterated products.

“For [lawmakers] to say they are going to regulate the internet for this is disingenuous, in my opinion,” says Turk. “It’s hard to regulate the internet. I think we’ve seen that in not just dietary supplements but across the board in a lot of different markets, so consumers are going to turn more and more to these different online retailers to get access to their products. [The legislation] ultimately takes away that relationship that you have with a store clerk. You’re not going to be able to talk to them about what the new product on the market is for sports nutrition or how one brand of omega-3 is slightly different from another. So, it’s going to hurt consumers as much as it’s going to hurt brick-and-mortar retailers.”

Building Trust

Not all consumers are well informed nor do they know what to look for on product labels. Not that it always makes a difference: unscrupulous companies will typically not include their adulterated ingredients on product labels. This is why trustworthy third-party certifications are important for brands. Consumers are learning to seek out third-party certification and rely on it to ensure they are buying a safe and quality product.

“Third-party testing certificates are becoming increasingly popular in the sports nutrition arena,” says Rachel Jones, vice president and chief nutrition officer for GNC. “Consumers are more informed, and with negative attention on professional athletes and banned substances, they are looking for reassurance that the products they purchase have been tested. Third-party testing provides confidence that products will provide a level playing field among competitors.”

For that matter, most sports nutrition consumers who value their health and wellbeing have no interest in consumer “chemicals,” instead seeking out clean-label positioning. Says Jones: “Consumers are also starting to look for more natural or vegan sports nutrition products. With focus on health and wellness and a growing market in the plant and organic space, consumers are more likely to consider a product for purchase with clean-label statements like, ‘made with natural ingredients,’ ‘non-GMO,’ or ‘organic.’”

In Demand

Despite the hand-wringing about product safety, demand for sports nutrition products is enormous, so people are deriving a benefit from these products and are coming back for more. Keeping the theme of online sales, recent analysis from ClearCut Analytics of sales on Amazon.com found that between September 2019 and August 2021, sales of pre- and postworkout products on the site saw 41% year-over-year growth, and protein powder sales saw 29% year-over-year growth. ClearCut acknowledges that these gains are largely due to the pandemic pushing people to buy online, but consumers are spending more than they did prior to the pandemic. It’s worth noting also that while pre- and postworkout products saw higher growth, protein powders brought in double the sales revenue compared to pre- and postworkout in the prior 12 months.

Within the pre- and postworkout category, products containing branched-chain amino acids (BCAAs) have grown in popularity. Products containing BCAAs have experienced 32% year-over-year growth and make up 27% of pre- and postworkout supplements on Amazon.com. Competition is stiff. According to ClearCut, there are 42 brands with greater than $1 million in annual sales, but the top 10 brands still maintain a 51% market share. When it comes to protein powder, whey protein has 50% market share with 26% year-over-year growth. On its tail is plant-based protein, which has 25% market share and has seen 39% year-over-year growth on Amazon.

According to ClearCut, there are 77 protein powder brands with over $1 million annual sales, with the top 10 of these brands maintaining 60% market share. The continued growth and popularity of plant-based protein powders is notable. In fact, according to ClearCut, three of the top five products on Amazon are plant proteins. While many still swear by dairy-based proteins, particularly whey, the tide is turning, with more new and existing consumers buying plant-protein products.

“With so much focus on health, wellness, immune health, and living a more plant-based lifestyle, we’ll likely see more consumers open to switching to plant-based proteins, especially with improvements to the taste of plant-based products through flavor innovation,” says Jones. “However, research supporting the effectiveness of plant proteins compared to whey remains limited. So, until more research is done, whey customers will likely stay put.”

By and large, the sports nutrition category is responsible and meeting immense consumer demand. Consumer trust is paramount to ensure long-term success as legislators broadly smear the category as unsafe. Clean-label formulations and third-party certifications are just a couple of ways to communicate responsible practices and earn consumer trust. Within this competitive space, brands should also strive for continual innovation to maintain consumer attention.

“Sports nutrition consumers are often creatures of habit—they find what works for them as part of their wellness routine and stick to it,” says Jones. “Flavor innovation keeps things fun and interesting, so helping consumers find a product line with lots of flavor options keeps them coming back for more. Depending on their goals, and how they evolve over time, what a consumer needs and wants may also shift. This can result in either the addition of new products to their routine—or perhaps moving on from them.”

Reference

- Cohen PA et al. “Nine prohibited stimulants found in sports and weight loss supplements: deterenol, phenpromethamine (Vonedrine), oxilofrine, octodrine, beta-methylphenylethylamine (BMPEA), 1,3-dimethylamylamine (1,3-DMAA), 1,4-dimethylamylamine (1,4-DMAA), 1,3-dimethylbutylamine (1,3-DMBA) and higenamine.” Clinical Toxicology. Published online ahead of print March 23, 2021.

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.