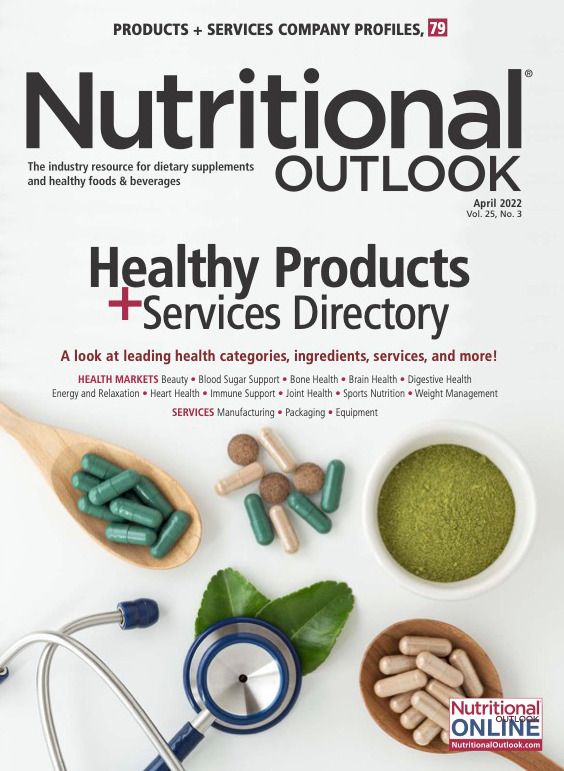

Microbiome market: Research and education are the keys

There’s no limit to the potential popularity of products designed for microbiome support. The only thing standing in their way right now is the availability of clinical research.

According to recent Mintel research1, nearly three in five U.S. adults say they try to eat foods that encourage a healthy gut and microbiome. This wasn't always the case.

When Pamela Wirth Barnhill launched Hello Health (Scottsdale, AZ), a line of dietary supplements for brain, gut, and immune health, the concept of the microbiome was relatively new to many consumers and not on the radar for most. “When we first started this journey about 10 years ago, our neurologist said we had to clean up our son’s gut and needed to use a specific variety of prebiotics and probiotics for the gut and brain to work better,” says Barnhill. “That was really new then. Now, we are learning more every day about the gut-brain axis and its effect on neurotransmitters.”

The link between gut health and immunity is also driving up consumer awareness of the benefits of a healthy microbiome, especially during the COVID-19 pandemic. “The current immunity trend works hand-in-hand with the gut health and microbiome trends, which were burgeoning pre-pandemic,” explains Audrey Ross, senior national educator at Country Life Vitamins (Hauppauge, NY). “Given that, to a certain degree, immunity starts in the gut, the trio of gut health, microbiome, and immunity could emerge as a powerful triumvirate.”

If you ask Kristina Zalnieraite, registered and licensed dietitian and the head of nutrition and wellness at Kilo Health (Vilnius, Lithuania), it seems as though scientists are discovering more about the microbiome every month, and consumers are paying attention as they seek ways to increase energy, elevate their mood, or get a better night’s sleep. The result is a growing interest in the gut microbiome, generally, and an incentive to take a deeper look at daily nutrition and lifestyle choices. It’s why MarketsandMarkets estimates that prebiotics, probiotics, food, and other products marketed for a healthy microbiome will represent a $1.598 billion market by 20282, growing at a CAGR of 21.3% between 2025 and 2028. The only thing capable of restraining this market? A lack of expertise and inadequate research on the human microbiome, the market researcher says.

Education First

At Hello Health, it’s all about education, whether it’s disseminating existing data or performing its own research. The key, says Barnhill, is helping consumers make decisions based on quantitative data, rather than qualitative data.

That’s also why Country Life Vitamins utilizes its social and digital platforms, in addition to retail-ready educational materials, to educate and bring more awareness to this topic, breaking down scientific findings into easy-to-understand nuggets of information for consumers. That said, there’s a lot of work left to be done.

Zalnieraite points out that we already know so much about the gut microbiome: it can influence everything from energy to immunity, it can be influenced by diet and lifestyle, and probiotics and fiber can improve gut health. But there’s so much we still don’t know, she says. For example: Which is better, natural probiotics or probiotic supplements? Can microbes influence food choices and appetite? How do low-dose antibiotics or pesticides found in food affect our microbiome? Is organic food better for gut health?

“As you can see, there are still a lot of gaps in knowledge about the topic,” Zalnieraite says. “We must collect more clinical evidence that can be translated into clinical practice.” Ideally, she adds, this data would be collected via randomized, controlled clinical studies that use consistent matrices of prebiotics or probiotics. And, collaboration will be key.

MarketsandMarkets says that private businesses should be prepared to cooperate with public organizations, to discover new applications for obesity, liver disorders, diabetes, and other metabolic disorders. Indeed, Zalnieraite says the science of microbiota is still in its infancy, and researchers are currently challenged with finding the causal correlation between microbiotics and human disease. In the meantime, brands can collaborate with scientists to distill and share what we know now.

“We, as consumers and health and wellness companies, need to further collaborate, provide education, and be given assistance to provide factual research and case studies,” says Barnhill. “The more we ask for informed data and clean products that impact whole-body benefits rather than treating symptoms, the better off we are in our families and our communities.”

References

- Mattucci S. “The Future Foundation of a Healthy Gut.” Mintel blog. Published January 6, 2022.

- MarketsandMarkets report. “Human Microbiome Market by Product (Prebiotics, Probiotics, Food, Diagnostic Tests, Drugs), Application (Therapeutic, Diagnostic), Disease (Infectious, Metabolic/Endocrine), Research Technology (Genomics, Proteomics, Metabolomics)—Global Forecast to 2028.”

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.