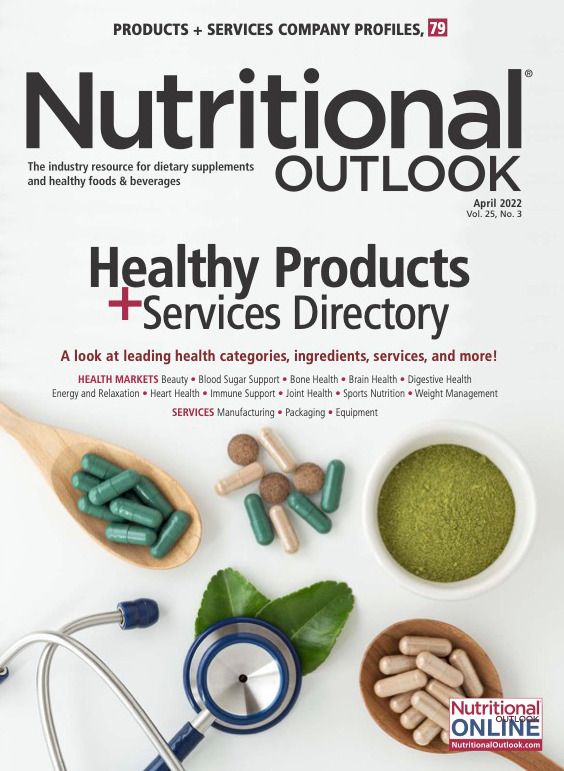

Consumers don’t just want clean-label beauty products. They want clean-label products that really work.

The opportunity for the nutricosmetic space is huge, but benefits should be well researched and communicated so that consumers get what they pay for.

Photo © Svetlana Lukienko - Stock.adobe.com

Increasingly, a stronger association is being drawn between beauty and one’s health. When it comes to body care, consumers are becoming more wary about what they put on their bodies and therefore associate healthy body care with natural, clean-label, and organic positioning. According to market research firm SPINS (Chicago), body care products positioned as natural saw 14% sales growth, compared to a little over 1% growth for conventional-positioned body care products, in both the natural and multioutlet retail channels during the 52 weeks ending January 24, 2021. Across all channels, cosmetics labeled “vegan” grew in sales by 34%, and those labeled “organic” grew 52%. In addition to this, well-informed consumers are actively avoiding certain ingredients like triclosan, talc, oxybenzone, and octinoxate.

Beyond the positioning and composition of body care products, consumers are also beginning to see the value of body care products as an extension of their overall wellbeing. For example, topical skincare products that utilize calming ingredients such as chamomile connect with consumers’ desire to reduce stress in their lives. Functional ingredients associated with wellness make body care products more appealing to consumers. According to SPINS, sales of body care products with probiotics have seen 22% sales growth, for instance, and products with turmeric have experienced 41% sales growth.

Beauty companies are tapping into consumers’ growing acceptance that different aspects of our health are interconnected. And while consumers understand that what they put on their body may affect what happens inside their body, they also understand that what they put in their body also affects what happens on the surface.

Beauty from Within

“Beauty from within is no longer a niche or micro-trend but is now encompassed by many via dietary, functional foods/beverages, and natural health products to suit almost any lifestyle and product preference,” says Paula Simpson, nutricosmetics innovation and formulation expert, founder of Nutribloom, and author of Good Bacteria for Healthy Skin. “Today, people are looking for integrative ways to care for their aesthetic appearance beyond topical interventions. Nutrition- and nutricosmetic-focused products complement topical regimens and work on a systemic level, which can also provide whole-body health benefits beyond skin, hair, or nails.”

On a very basic level, it’s understood that our health impacts our appearance; therefore, it’s not difficult for consumers to accept that nutritional intervention can have a positive impact on skin, hair, and nail health. In clinical settings, dietary intervention has been a valuable way to treat symptoms of skin conditions.1 For example, a survey of 270 psoriasis patients found that over half tried between one to four dietary interventions or supplements to treat symptoms. These included diets such as the ketogenic diet or supplements like probiotics. Also, according to the survey, 30% of respondents attempted to lose weight, with one-third of those trying to lose weight experiencing a positive impact on their psoriasis severity. Of those who endorsed weight-loss interventions, 50% attributed improvements in psoriasis to the ketogenic diet.

In the dietary supplements realm, vitamin D was tried by 32% of survey respondents, 25% tried oral fish oil, and 21% tried probiotics. Of those who took probiotics, 29% reported improvements in psoriasis symptoms, while 28% and 26% of patients taking vitamin D and fish oil, respectively, reported improvements in symptoms. While dietary supplements cannot claim to prevent, treat, or cure diseases, the survey demonstrates how dietary supplements may positively impact both physical wellbeing and appearance.

At this point, consumers are no strangers to hair-, skin-, and nail-support ingredients such as collagen and biotin. In fact, those ingredients are still seeing great growth. Collagen, for example, saw 61% sales growth in the hair, skin, and nail category of the mainstream multioutlet channel, according to SPINS, during the 52 weeks ending October 31, 2021. Demand remains high for ingredients that tackle more urgent concerns such as hair and skin health, because those have a more immediate impact on our appearance. However, the category is getting more sophisticated with products that tackle long-term aging and the health of the microbiome.

Beauty and the Biome

A relatively recent entrant in the skin microbiome space is For The Biome, which was cofounded by Paul and Barbi Schulick, who are best known for cofounding the New Chapter dietary supplement brand, which was subsequently acquired by Procter & Gamble. In an interview with Nutritional Outlook2, Paul Schulick explained that while many topical body care products tout themselves as being microbiome friendly—meaning they do not disrupt the skin’s microbiome—nutricosmetic brands like For The Biome encourage microbiome diversity from the inside out.

Probiotics and other microbiome products are already immensely popular, so it’s only natural that they become adopted by the nutricosmetics space. The concept of the skin microbiome can be expected to evolve further as probiotic manufacturers do more research and development and brand owners adopt these ingredients.

“Microbiome science has exploded over the last few years. And although it is a complicated science to understand, the ‘skin minimalist’ movement, along with a growing number of education platforms and brands, have helped move this category more into mainstream,” says Simpson. “The concept is the opposite, too, of what we have been taught previously from a skincare perspective. ‘Squeaky clean’ today is a completely different concept over what it meant even 10 years ago. This market will continue to evolve as the science becomes streamlined in a way that the consumer can fully relate to.”

The Case for Nutricosmetics

One of the biggest challenges with introducing innovative products and product categories is educating consumers about the value of these products. This is particularly true if the benefits they offer are a bit abstract.

“When supplementing for hair and nails, visible improvements are noticed more quickly over, say, ‘antioxidant formulation to combat skin aging.’ So different claims and formulations need different marketing and proof-of-concept to peak consumer interest and brand loyalty,” explains Simpson. “Also, when topical products are applied, there is often an immediate result or effect. Nutricosmetics work on a whole different physiological mechanism and thus should not be marketed [the same way] as topical regimens. They certainly complement topical products, but the two are completely different in the way they work.”

It may therefore be beneficial to manage expectations, because immediately tangible results are not always possible. On other hand, offering consumers more specialized support is an important way to set your brand apart, says Simpson. Again, the key is clear communication.

“Although multifunctional products are on the upswing for consumer demand, my biggest recommendation is to identify your unique point of difference, how the product works, and never rush through the education and marketing of the product. It will only get lost in the noise,” Simpson advises.

Ultimately, good science, sound marketing, and consumer education are key when it comes to broadening the scope of nutricosmetic products. New concepts need time to take hold, but consumers are open to trying new things if they can understand clearly why they should be taking a product. For example, what are the benefits of a healthy skin microbiome? Communicate these benefits, but don’t make irresponsible claims. And while consumers may be willing to try innovative new products, they won’t continue to use the products unless they work.

Herein lies a potential trap for manufacturers of finished products: Because of the popularity of alternative dosage formats such as gummies, or functional foods and beverages, there is a desire to also produce more of these products to meet the demand. However, says Simpson, do so only if there is no loss in product efficacy.

“The downside is that certain actives are best manufactured in certain forms for optimal bioavailability and formulation stability. So, although a unique product format hits the market, the ingredients may not work as effectively if in other formats,” Simpson points out. “This is where I see product efficacy losing the battle with marketing trends. Always something to be wary of.”

The nutricosmetics space appeals to people’s vanity. In fact, vanity is often what motivates people to eat healthily and work out. When you put it that way, the opportunity for the nutricosmetic space is huge. Emerging trends within the category, such as skin microbiome support, offer important points of differentiation, but benefits should be well researched and communicated so that consumers get what they pay for and these new trends don’t die on the vine.

References

- Hilton L. “Patients share experience with dietary intervention, supplement use.” Dermatology Times, Psoriasis Supplement, vol. 42, no. 2 (2021)

- Grebow J. “Microbiome-friendly formulations are the future of skincare, says For The Biome cofounder Paul Schulick.” Nutritional Outlook. Published March 12, 2020.

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.