Dietary supplement contract manufacturers continue to navigate current challenges and seize opportunities as they arise

As the dietary supplement and natural products industries continue to recalibrate in the wake of the global pandemic, contract manufacturers are meeting market demands through various means.

Photo © Nuamfolio - Stock.adobe.com

While the industry continues to recalibrate in the wake of the global pandemic, contract manufacturers are meeting market demands through various means. Of course, none of this is without its challenges; ongoing supply-chain obstacles, critical personnel shortages, inflation, and cost spikes are just a few of the disruptions the industry is still grappling with. Thankfully, contract manufacturers, understanding their value as turnkey solution providers, are adapting to the needs, both old and new, of their customers. Here’s how the contract manufacturing landscape is changing for all involved.

Turnkey Transition

Not too long ago, contract manufacturers were often expected to provide finished products, Steve Holtby, president and CEO of Soft Gel Technologies Inc. (Los Angeles), explains. The trouble with this, however, is some manufacturers only make one product, so they’d have to outsource the manufacturing of other forms—in turn making them a manufacturer and a distributor. Throughout this process, he says, products would change hands multiple times, often running the risk of undergoing limited verification and testing. These days, however, he says, it often makes more sense for companies to deal directly with the manufacturers.

Because of this, “Within that limitation, the broader the types of services and expertise the contract manufacturer can offer, the more enticing it will be for marketers to work with them,” he adds. After all, contract manufacturers don’t aim to call themselves “one-stop shops” for nothing. Some of the best contract manufacturers are helping their clients from concept to completion.

Companies want to minimize the number of outside suppliers used, so, as Holtby points out, having a contract manufacturer with broad, turnkey capabilities is still important to its clients.

Bob McCrimlisk, director of manufacturing and business development, Ashland (Wilmington, DE), agrees and says that Ashland continues to enhance its own services. “For example, we have invested in broadening our unit-dose—stick pack—operation,” McCrimlisk explains. “As such, we can now provide the raw material, fill the individual packs, put them in retail cartons, and palletize them.”

The Pandemic Dilemma

It’s no secret that contract manufacturers, like everyone else, dealt with supply-chain interruptions due to the pandemic, but many were able to adapt and even meet unique demands in the face of chaos.

“During the pandemic, we fielded a lot of requests with short lead times as customers tried to respond to interruptions in the global supply chain and availability of raw materials,” McCrimlisk says. “For example, much of vitamin C in granular form comes from China, and as the pandemic spread, supply of this material was restricted. Because [one of our] customers was ultimately making tablets, they needed material that was compressible, free-flowing, and dust-free, and therefore required a granulated material.” Because one of Ashland’s facilities had granulating expertise, McCrimlisk says, the manufacturer was able to procure the raw vitamin C, fast-track qualification, and produce material for its customer.

And that’s just one example of what Holtby points out: “Those contract manufacturers who were able to quickly and successfully adapt to rapidly changing supply-and-demand situations were able to grow their business and solidify their relationships with new and existing customers. We have experienced a high demand for our contract manufacturing services since the pandemic. Since we already had our quality systems in place, we had very few disruptions and have been able to provide seamless customer service.”

As for the future, he says, “We continue to focus on balancing growth with the potential instability of the current economy and the continued impact of the global pandemic on all aspects of life.”

But COVID-19 didn’t just interrupt supply chains; it interrupted consumers’ lives. The upside, however, is that this interruption renewed many consumers’ interest in wellness, which, according to Mark A. LeDoux, chairman and CEO of Natural Alternatives International Inc. (NAI; Carlsbad, CA), has translated into “a burgeoning interest in dietary supplements to enhance human immune function and help prevent opportunistic infections from having a significant deleterious impact. With consolidation in the industry and renewed interest by a whole new set of consumers, both domestically and internationally, the current environment for manufacturers who have adequate personnel, facilities, inventories, and capital has never been better.”

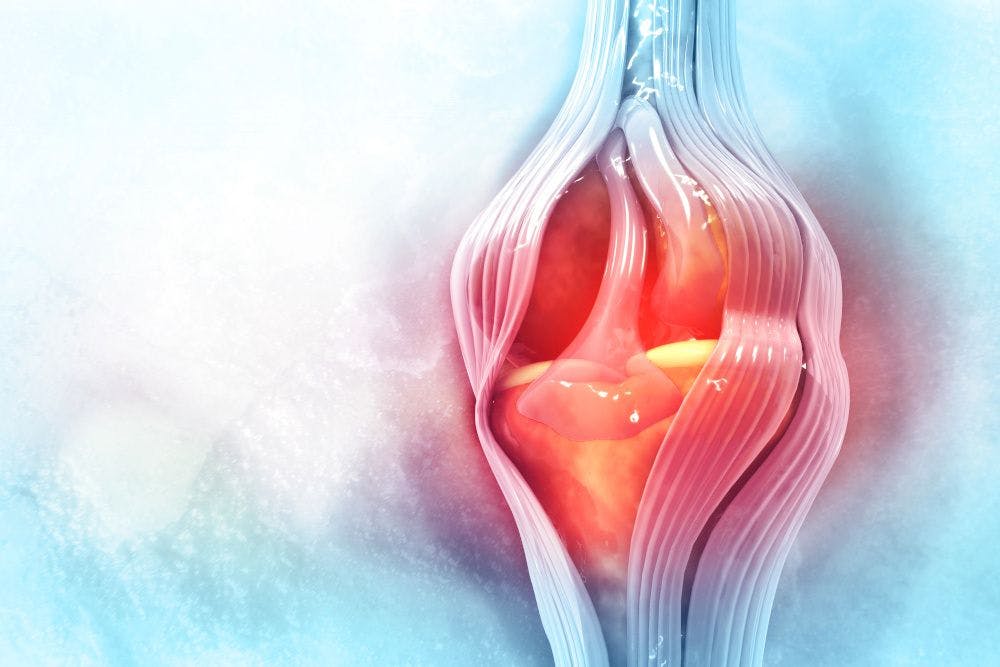

There has also been an uptick in demand for specific dosage forms and ingredients. Kapish Karan, senior R&D leader, nutraceuticals and pharmaceuticals, at Ashland, says there has been an increased demand for premixes for non-tableted applications such as gummies, chewables, and stick packs. “Consumer demand for these types of formats continues to grow as consumers seek variety, convenience, and portability,” Karan says. “In terms of ingredients, we are seeing an increase in demand for fermented vitamins and organic ingredients.”

Best Formulations (City of Industry, CA) has also seen a rise in gummy demand because, as CEO Eugene Ung, points out, “Gummies present an easy and fun way to introduce dietary supplement to adults and children alike. Even before the pandemic started, we had been looking into gummy manufacturing based on our customers’ requests. We had made the decision to build out gummy manufacturing last year and look forward to commercialization this year.”

For Dan Peizer, vice president of global strategy and marketing, consumer health, at Catalent (Somerset, NJ), what’s made it possible for Catalent to keep up with trends and evolving demands is external innovation. “Catalent has partnered with customers over many years to bring new concepts, combinations, and dose forms to market,” he says. “Consumers are increasingly researching the products they buy, especially given that many have had more time at home with internet resources on hand [to do research]. This has highlighted the importance of differentiating product features. We expect this trend to continue as consumers become more discerning and our partners seek to attract them with brands that match the demands of their lifestyles.”

There are many ways in which contract manufacturers have succeeded and overcome the hurdles caused by the pandemic. Oftentimes, it comes down to sheer R&D and capacity. LeDoux says it best: “Companies that have a robust research and product development presence along with a bona fide pilot facility to test out conceptual products prior to scale-up or full production have been extremely successful, given the desire of so many consumer brands to address the needs of the marketplace, as well as dealing with material modifications given supply-chain constraints now two years into a global pandemic.”

Investing in the Future

Safeguarding for the future is rooted in quality, consistency, transparency, and thorough processes. But it also takes capital and commitment. Put plainly, “Contract manufacturing is not an easy business to get into,” Ung says. “Aside from the capital investments related to facility and equipment, there is a huge amount of investment in human capital, manufacturing processes, SOPs, quality infrastructure, etc., that is also required. In some ways, the barrier to entry is quite significant. And so long as the contract manufacturer continues to invest in the business via upgraded equipment, innovation, human capital, etc., that in and of itself can be considered a ‘safeguard.’”

Investments that add capacity and improve and ensure product quality go hand-in-hand with the fast-moving consumer health industry, according to Peizer. Why? “Because of the demand from consumers and pressures from retailers, so there is very little tolerance for rejected batches, or even worse, recalls,” he stresses. “In order to invest appropriately for the long-term, it is critical for contract manufacturers to follow market data on consumer trends and new technologies to meet the needs of customers and consumers both now and in the future.”

Of course, specific built-in investments and safeguards depend on the capabilities of each individual manufacturing firm, but LeDoux notes that there are universal key functions that need to be addressed. This includes: 1) Ensuring the presence of competent staff who are adequately trained and compensated, 2) Making sure there are adequate financial resources available to procure safety stock of inventory components, as well as adequate space to store inventory in temperature- and humidity-controlled environments, 3) Sufficient preventive maintenance scheduled to preserve essential capital equipment, and 4) Appropriate product liability coverage for products and services.

It’s been repeatedly said these days that, as Holtby states, “In many ways, just-in-time manufacturing is gone.” He says the growing globalization of the “multilayered and complex supply chain” makes frequent and thorough checkpoints a more important piece of supplier qualification than ever before.

Solid forecasting is also extremely necessary today and yet can be so challenging to do. And it takes a village to achieve. “We continue to work with key suppliers to ensure supply of quality ingredients through open communication of forecast and ongoing needs,” Holtby says.

Finally, what’s critical for long-term success is understanding consumer trends and how they impact brands, Ung says. “Most contract manufacturers play a more reactive role in fulfilling demand,” he says. “But contract manufacturers that really prepare for the long term will invest time and resources with their customers to truly understand what is driving the growth and evolution of that brand and to partner in new product development, ideation, and other forward-thinking activities.”

What Lies Ahead?

As the market seeks to stabilize, and contract manufacturers continue to push forward, both challenges and opportunities lie ahead—opportunities in emerging markets and in the hope that there will be more of a focus on quality and reliable manufacturing versus cost.

“Contract manufacturers have always competed against each other, but in an increasingly crowded, growing marketplace, the need for companies to differentiate their brands from the competition is important,” Holtby says. “Contractors based in North America find it increasingly difficult to compete with manufacturers based in countries like China and India where operations are a fraction of the cost; quality versus price point is often an issue. Many companies focus on price when choosing a contract manufacturer but forget that quality, service, and on-time delivery are factors that are more important in making a decision.”

Continued cost increases in the supply chain; spot shortages in commodities; challenges in procuring bottles, caps, and heat-inducted foil insert closures; and logistical difficulties in transportation scheduling and costs are just a few challenges.

For Ung, his major challenge today “continues to be a shortage of labor, and supply-chain challenges, which is impacting every business out there,” he says. “As the economy evolves past these, we believe there will be continued focus on supply-chain resources as companies will need the ability to flex up or down quickly and efficiently. Product and formulation innovation should become top of mind instead of supply chain.”

Being able to react to demand as conditions normalize will be one of the most significant challenges, Peizer says. “We believe that some hard-hit categories will rebound faster than others, while others that experienced explosive growth during the pandemic may soften,” he says. Contract manufacturers need to keep their eye on the prize.

Opportunities lie in the continued growth of client acquisition and channel diversification, according to LeDoux. He sees significant growth opportunities emerging in the ASEAN marketplace for U.S.- and Swiss-made goods. Additionally, “Surging consumer demand for properly made dietary supplements, meal replacements, and sports nutrition supplements and compounds” is another opportunity.

And, looking ahead, Ung says sustainability and environmental concerns will come back into focus. “[And] the evolution of the consumer, distribution, and retail trends will also impact what investments contract manufacturers will need to make as the industry continues to move forward,” he says.

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.

2 Commerce Drive

Cranbury, NJ 08512

All rights reserved.