Navigating men’s personal care and nutricosmetics

Approaches to men’s personal care and nutricosmetic products.

© Atlas / Stock.adobe.com

As a personal care or nutricosmetic company, are you doing enough to capture the male demographic? A recent survey1 of 800 men over the age of 18 found that 56% of the surveyed men spent between $26 and $100 per month on personal care products. When asked what type of products they are buying more of compared to five years ago, 57% said they were buying more supplements, 56% said they were buying more facial skincare products, 44% said they were buying more body skincare products, and 39% said they were buying more haircare products.

Men’s personal care needs include typical maintenance, such as for dry skin, sun protection, wrinkles, and acne, but they include more specialized needs as well. For example, in the case of facial skincare, there are shaving-related concerns like irritation and ingrown hairs. For men with facial hair, there are beard-care products. When it comes to haircare, there is the typical cleaning and conditioning needs, but as men age, concerns about hair loss drive purchasing in that direction, with hair growth and hair loss–prevention products making up 20% and 17% of purchases, respectively, according to the survey.

In some cases, men feel dissatisfied with the results of their facial skincare products and continue to seek out products that work best for them. More specifically, the survey found that “33% of men don’t feel their moisturizer is working for them, 33% don’t find their products for dark undereye areas or bags to be sufficient, and 28% believe their products to address fine lines and wrinkles are lacking.”

Indeed, men have different needs than women when it comes to skin and hair health. “Marketing to the male audience should be inclusive to their interests and physiological differences over the female audience,” says Paula Simpson, BSc (Nutritional Sciences), RNCP, R. Herbalist, and founder of Nutribloom Consulting. “Skin and hair aging are driven by differentiation in physiology, endocrine, and lifestyle drivers and should be considered when marketing to the male audience.”

For example, one review of research found that sebum content is higher in men because sebum is influenced highly by sex hormones, and men have thicker skin, higher levels of skin pigmentation, deeper facial wrinkles, and more prominent facial sagging in the lower eyelids. However, parameters like skin elasticity saw no significant differences between the sexes.2

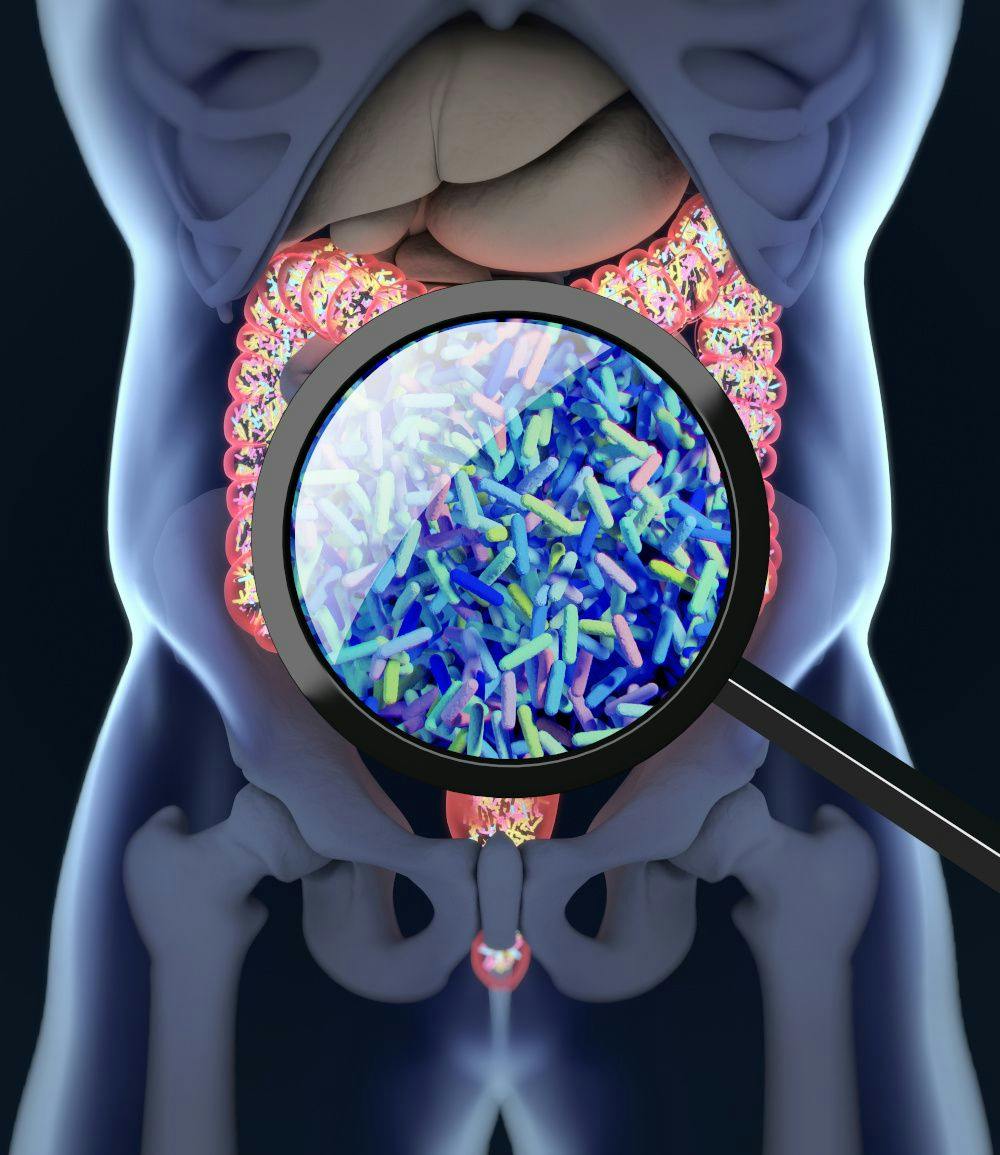

“Skin physiology does differ due to interplay between estrogens and androgens in men and women,” elaborates Simpson. “This modulates dermal thickness, sebum production to skin, scalp microbiome diversity, and surface pH, which influences rate of skin aging, hair condition, as well as the incidence of conditions such as acne.”

In terms of the best way to market personal care and nutricosmetic products to men, Simpson suggests using realistic claims and appealing to lifestyle. “I think men are more likely to seek out multifunctional and skin minimalist–type products and brands,” Simpson explains. “As per aesthetic-focused supplements, products catering to lifestyle focus with aesthetic benefits, or targeted aesthetic concerns such as hair thinning, are strong drivers for product loyalty.”

Men may be less inclined to participate in an elaborate skincare routine and will therefore value ease of use of a multifunctional personal care product. This may translate to products with more focused benefits like a shampoo that is designed to strengthen thinning hair. But when seeking specific results, men may be more inclined to pick up a supplement.

In terms of lifestyle, men like products they can identify with or that represent something they aspire to. For example, current trends in menswear show an overlap between high-end men’s fashion and rugged workwear. You don’t need to be a tradesman to wear a Carhartt jacket, but it may make you feel a certain way. Therefore, it may be beneficial to appeal to specific lifestyles that can draw in different, and often multiple, subsets of the male demographic.

“I believe lifestyle-focused brands are more likely to succeed with this market versus direct beauty-focused claims,” concludes Simpson.

References

- Herich, D. Survey: Men’s Attitudes On Beauty & Personal Care. Global Cosmetic Industry. 2022, 190 (9): 37-40. https://gcimagazine.texterity.com/gcimagazine/october_2022/MobilePagedArticle.action?articleId=1823533#articleId1823533

- Rahrovan, S.; Fanian, F.; Mehryan, P.; Humbert, P.; Firooz, A. Male Versus Female Skin: What Dermatologists and Cosmeticians Should Know. Int J Womens Dermatol. 2018, 4 (3): 122-130. DOI: 10.1016/j.ijwd.2018.03.002

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.

2 Commerce Drive

Cranbury, NJ 08512

All rights reserved.