Getting personal: Consumers seek nutritional products to support their personal health goals

Innova Market Insights identifies key health concerns driving consumers’ food and supplement choices today.

Consumers worldwide are more concerned about their personal health—and the health of people close to them—as a result of the COVID-19 pandemic. Many are now more proactive about health and specifically looking to buy nutritional foods and supplements. But what defines healthy for people who have different needs and objectives? Based on data from Innova Market Insights, this article dives into some of the main health concerns driving consumers’ food and supplement purchases.

Personal Goals

Personalization is a major focus of the healthy food and drinks market today. Advances in science and technology have made it possible to increasingly personalize nutrition and health products. There is now an understanding that every consumer has different needs, and that to truly achieve holistic health, there will always be areas that specific consumers need to pay more or less attention to.

Products leading demand are those that enable consumers to tailor their eating according to functional or nutritional needs. This includes products that support relaxation or energy requirements, as well as those that fulfill specific nutritional requirements, such as the need for more protein or fiber. Mood support is also gaining prominence, cementing the idea that to consumers, health is no longer just about the body.

Innova surveyed consumers in 11 countries, asking them how interested they are in consuming foods and beverages personalized to support their health goals. Their answers indicated that they are “very/extremely interested”: 47% said they are interested in products to support their functional needs (such as relaxation, sleep, focus, and energy), with a similar number seeking nutritional assistance (e.g., level of protein, carbs, or fiber). Other areas of major consumer interest were mood, lifestyle (e.g., on-the-go, physically active), and body composition. One in three respondents said they are interested in products based on their genetic profile.

It’s also worth noting that respondents aged 26-35 are most likely to want personalized food and drinks going forward. This age group over-indexed the average by at least 7 percentage points for every response related to personalization of health.

In their quest to stay healthy, consumers are also prioritizing getting enough sleep and keeping their mind/body active—even before they start trying to improve nutrition. When asked what steps they have taken to improve their physical health over the past year, respondents ranked physical exercise and getting more sleep first and second, followed by “made changes to what I eat/my nutrition,” “chosen foods or drinks that boost my health,” and “taken more supplements.”

The bottom line is that consumers are taking various steps toward physical, mental, and spiritual well-being. Efforts to stay healthy are now more related to targeting the mind and emotions and not just pure physical health. Even exercising is now linked to mental well-being as a stress relief.

It is not surprising that only a small number of respondents (8%) indicated not taking any action to improve their physical health. The pandemic definitely highlighted, even more so, the importance of health. Concerns will keep evolving and reshaping, but one fact is constant: health will remain a contributing factor in consumer lifestyle choices moving forward.

Changing Priorities

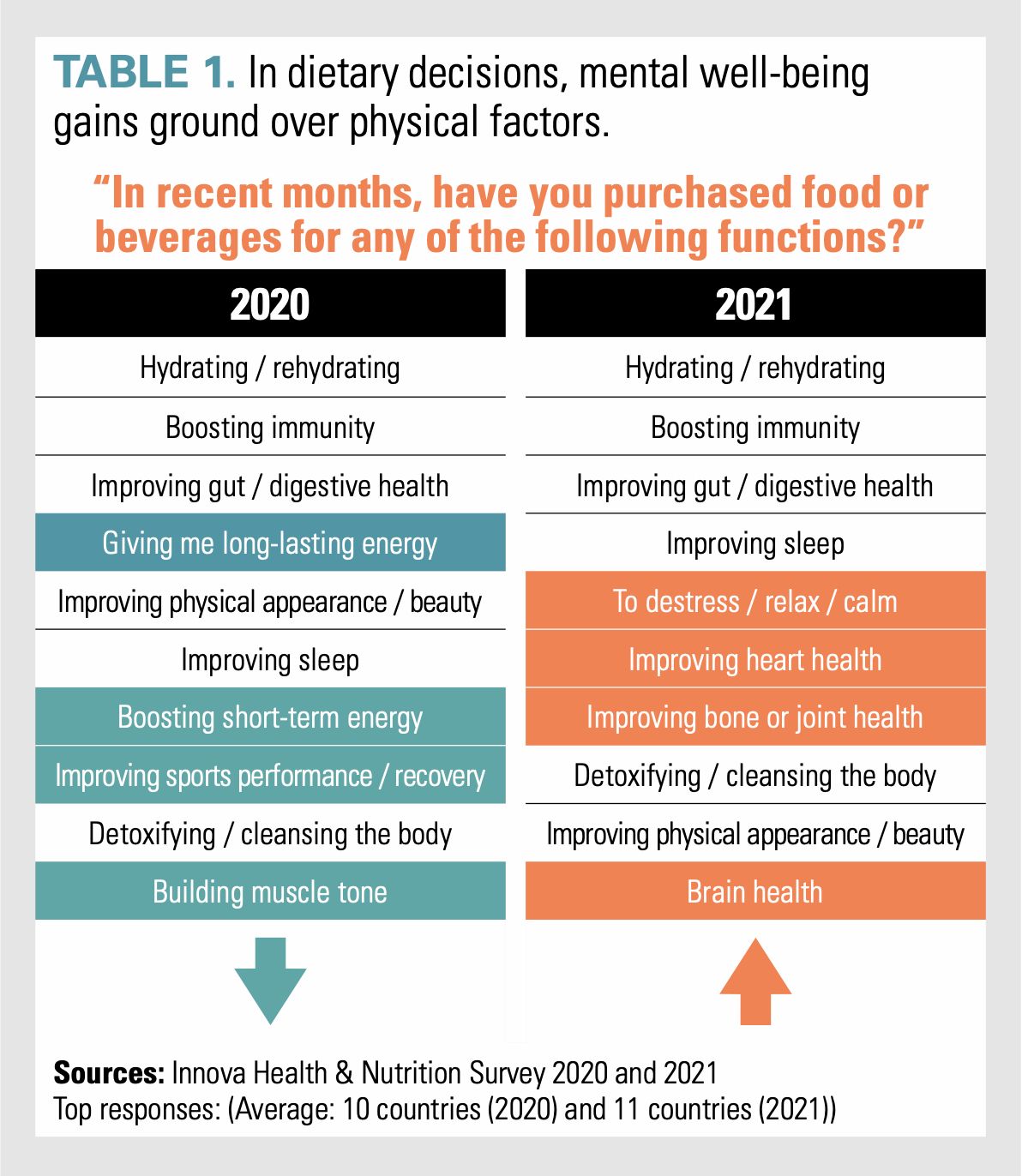

Comparing Innova data between 2020 and 2021, it is clear how consumers’ health priorities have shifted.

There was increased interest in products specifically related to such concerns as heart, bone, and brain health, with the 36- to 45-year-old age group most likely to address these issues through diet. In contrast, concern about physical appearance dropped down the rankings, while concerns over energy, sports, and muscle issues fell out of the top 10 functions completely. Gen X and Millennials remain most invested in these categories.

Some health concerns remain unchanged from year to year in their rankings, however. Immunity stayed a top concern in both 2020 and 2021, cementing its status as a key health issue for consumers. (TABLE 1)

Mental Well-Being

As mentioned, the growth in attention on mental well-being has been remarkable, especially in recent years, and there is a rising recognition that nutrition can contribute. Innova survey responses show that up to 85% of consumers now at least occasionally take action for mental well-being. A further 78% get a spiritual boost by acting on environmental or social causes.

Mental health has influenced product development in supplements, food, and drinks. Innova data shows a 48% CAGR for dietary supplements launched for brain/mood health in 2017-2021. Meanwhile, food and beverage launches with brain health claims grew at a 12% CAGR over the same period.

Immune Health

Improved immunity is now firmly fixed as a health goal. Clearly, the pandemic accelerated new product development in this sphere, but are consumers equally turning to both immune-boosting foods and supplements?

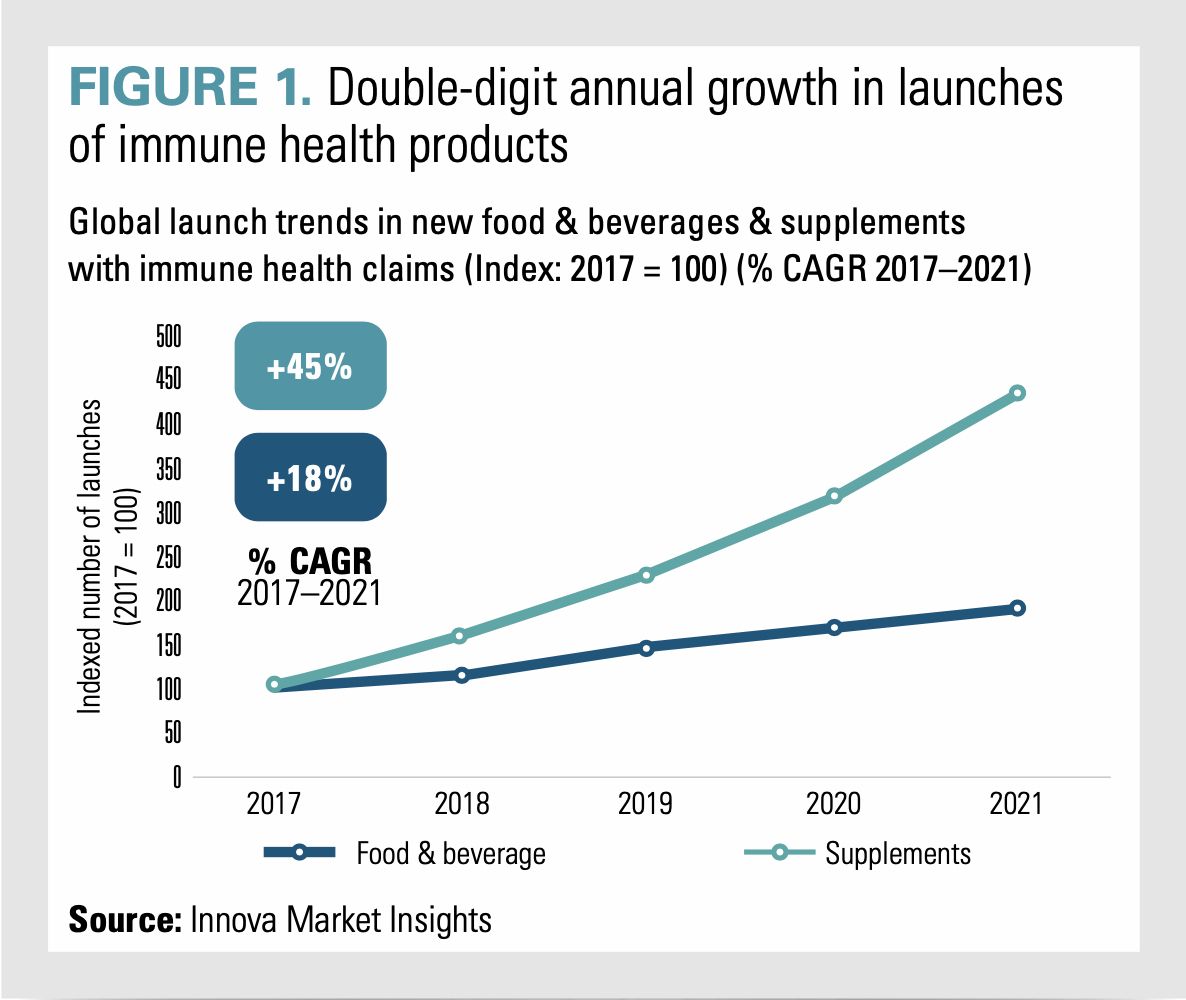

New-product development in immune-boosting supplements has outpaced that of immune-healthy food and beverages over the past few years. Penetration within the supplements category is far more extensive than in the food category, maybe because consumers are looking for whole foods or superfoods to boost their immunity rather than just chasing immunity claims per se. (FIGURE 1)

Figures show that between 2017 and 2021, immune health supplements increased their share of total supplement launches from 25% to 36%. Meanwhile, in food and beverage, immune health penetration is much lower but still rose from 1.0% to 1.6% in the past five years.

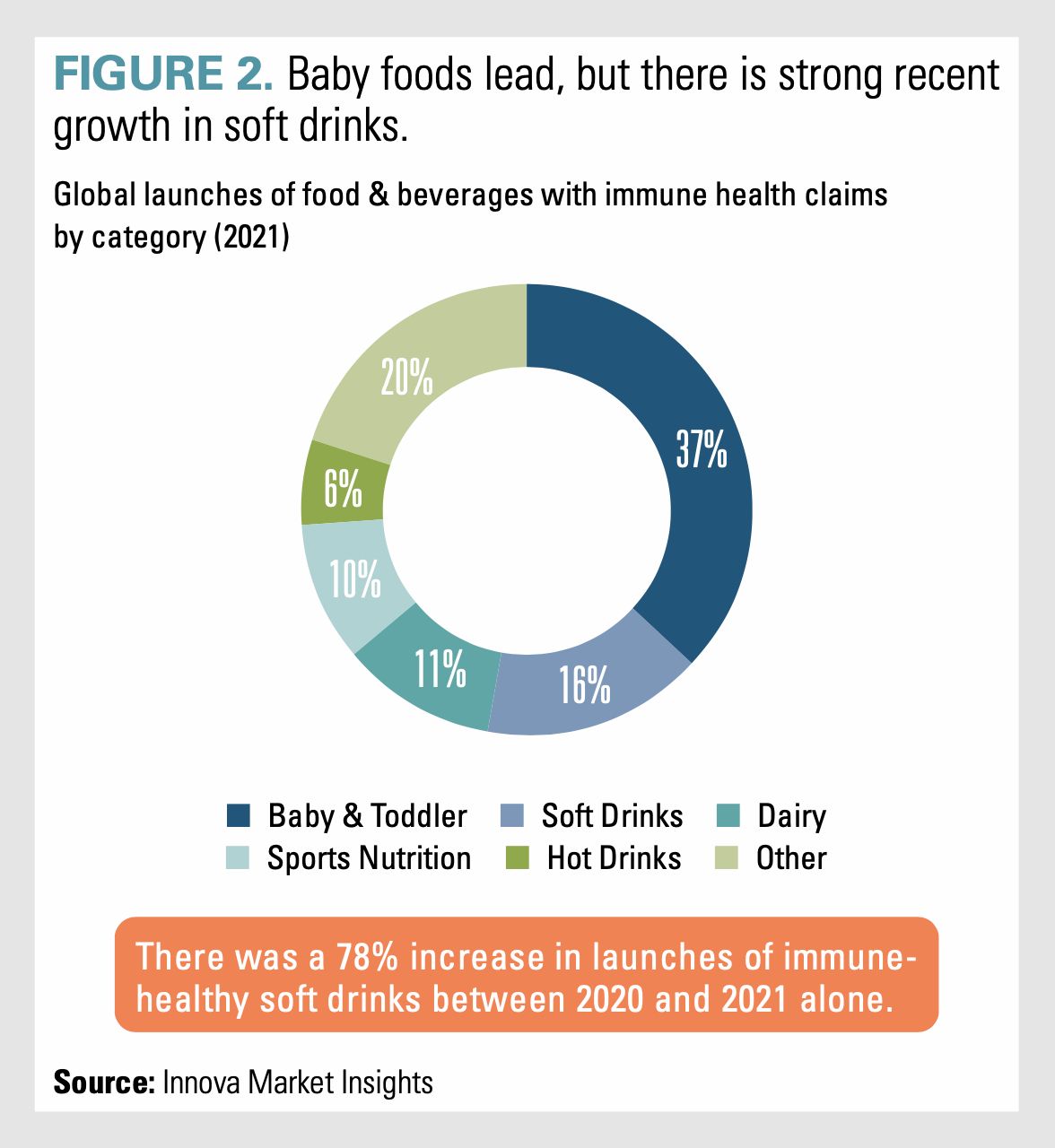

In terms of food and beverages with immune health claims, baby food leads growth, followed by strong performance in the mainstream soft drinks market. In fact, soft drinks had one of the fastest growth rates for immune health claims in 2021, with a 78% increase between 2020 and 2021 alone. Other popular categories are hot drinks, sports nutrition, and dairy products. (FIGURE 2)

Ingredients are at the center of soft drink innovation, ranging from basic choices to complex blends. Among the most popular ingredients to help normal functioning of the immune system are zinc, probiotics, prebiotics, and essential vitamins.

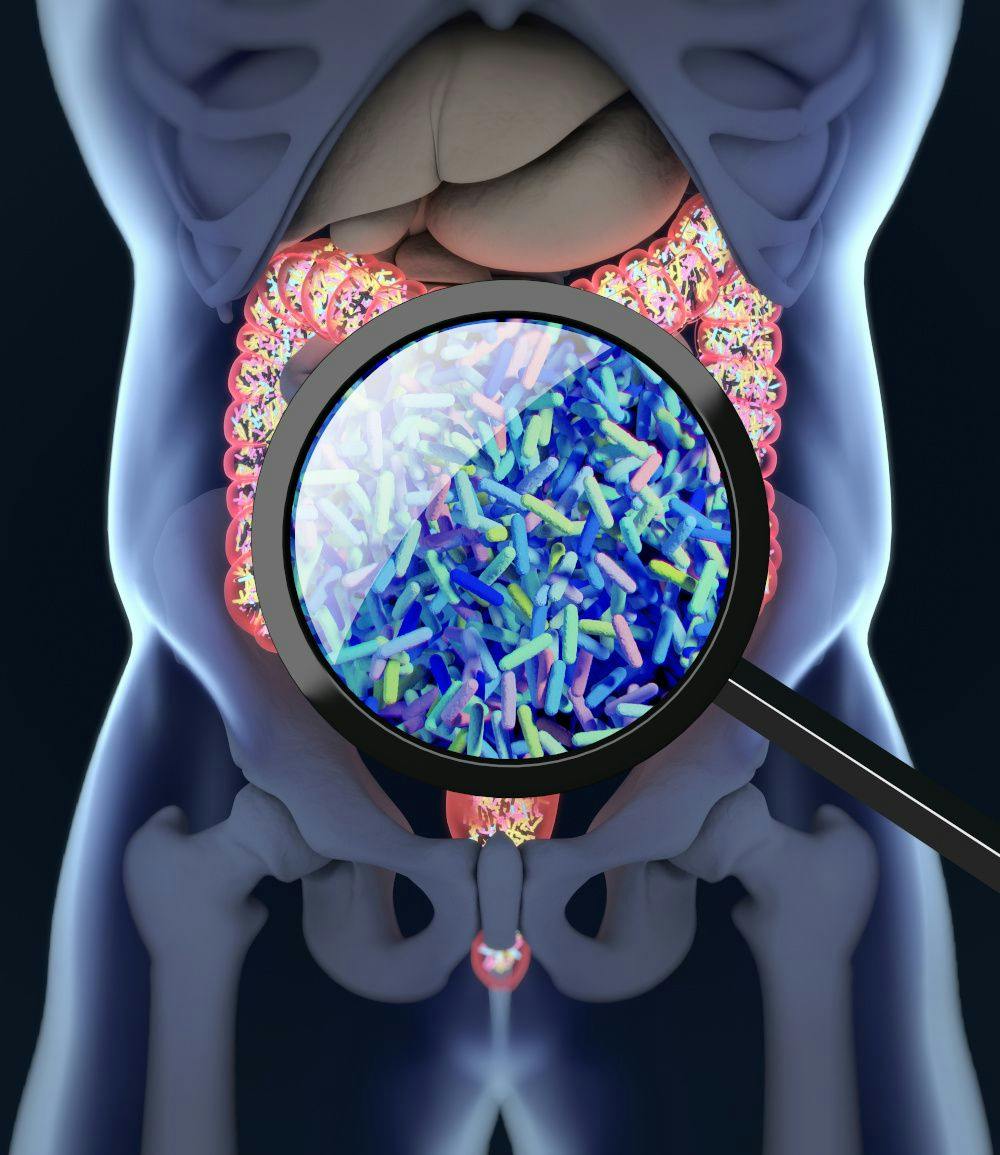

Gut Health

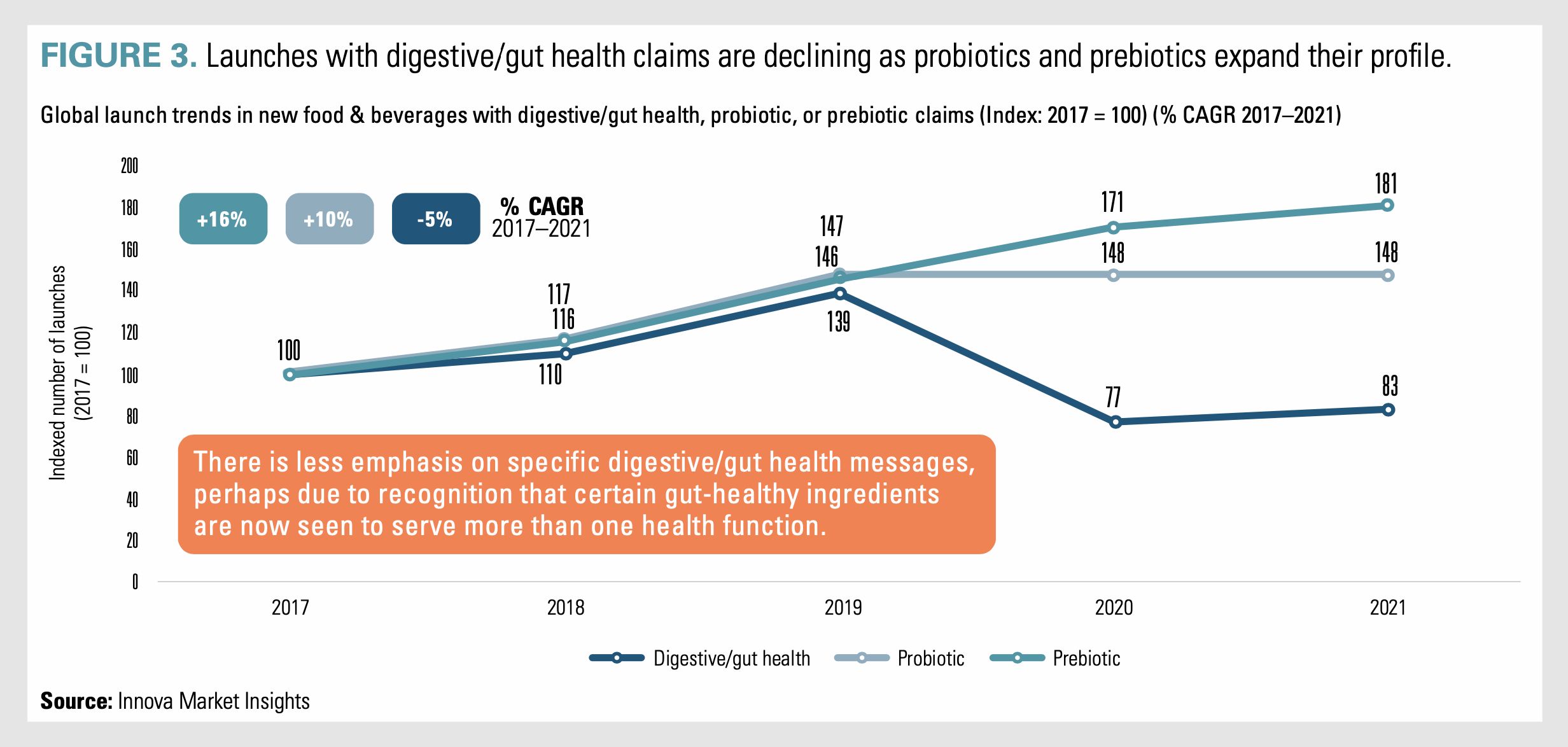

Digestive health is also a leading purchase driver. Consumers now view gut health as holistic and interlocked with other conditions like immunity, energy levels, sleep, and mood.

However, Innova sees a decline in new-product launches simply making “digestive health” or “gut health” claims; rather, products seem to focus on ingredients like probiotics and prebiotics, which are gaining recognition on their own for providing numerous health benefits beyond just gut health. For instance, Innova has found that between 2017 and 2021, the number of global food and beverage launches making a general digestive/gut health claim actually shrank by 5%. By contrast, new-product launches centered specifically on probiotics grew 10%, and new-product launches focused on prebiotics grew 16%. Innova notes that the decline in gut health claims could also be caused by legislation varying across the globe, with some countries allowing claims highlighting certain formulations and other countries restricting particular claims. (FIGURE 3)

Healthy Eating

There is now a personalized approach to healthy eating. From reducing consumption of “bad” ingredients to choosing a more natural course or looking to increase intake of a nutrition booster, dietary consideration is increasingly geared toward balance and health-positive foods. When asked which methods of healthy eating they favor, consumers said they have made changes to what they eat by choosing highly nutritious products or products low in unhealthy nutrients.

When Innova asked consumers in a 2021 survey about their predominant approach to healthy eating, 37.5% said they try to limit or reduce products or ingredients that are “bad for me” (e.g., fat, sugar, salt), 22.7% said they choose natural foods for “inherent” nutrition (e.g., fruits, vegetables, nuts), while 21.2% of respondents said they choose products to “positively” boost their nutrition (e.g., of nutrients like protein and superfoods) or to improve how the body functions.

Overall, consumers seem to have adopted a more “positive” approach to health by removing the “bad” ingredients from their diets and adding more of the “beneficial” ingredients.

Sugar is now public enemy number one, with over 23% of consumers reducing consumption during the year, followed by reductions in sodium/salt, fat, and alcohol. Cuts in sugar, sodium, and fats indicate concern over issues such as weight and heart health, as well as general well-being.

There has also been a growing focus on positive, natural nutrition and increased intake of naturally healthy foods. The 2021 survey respondents reported upping their intake of fruits and vegetables (42% of respondents) in the past year, with significant numbers increasing fiber intake and protein consumption.

There can be generational differences in terms of the preference between reducing ingredients perceived to be bad for health and increasing “good-for-you” elements. For example, Gen Z and Millennial consumers were almost twice as likely as Boomers (27% versus 14%) to say they choose functional products to positively boost their nutrition. Boomers, meanwhile, most widely over-indexed on the average for limiting and reducing unhealthy ingredients.

Sugar

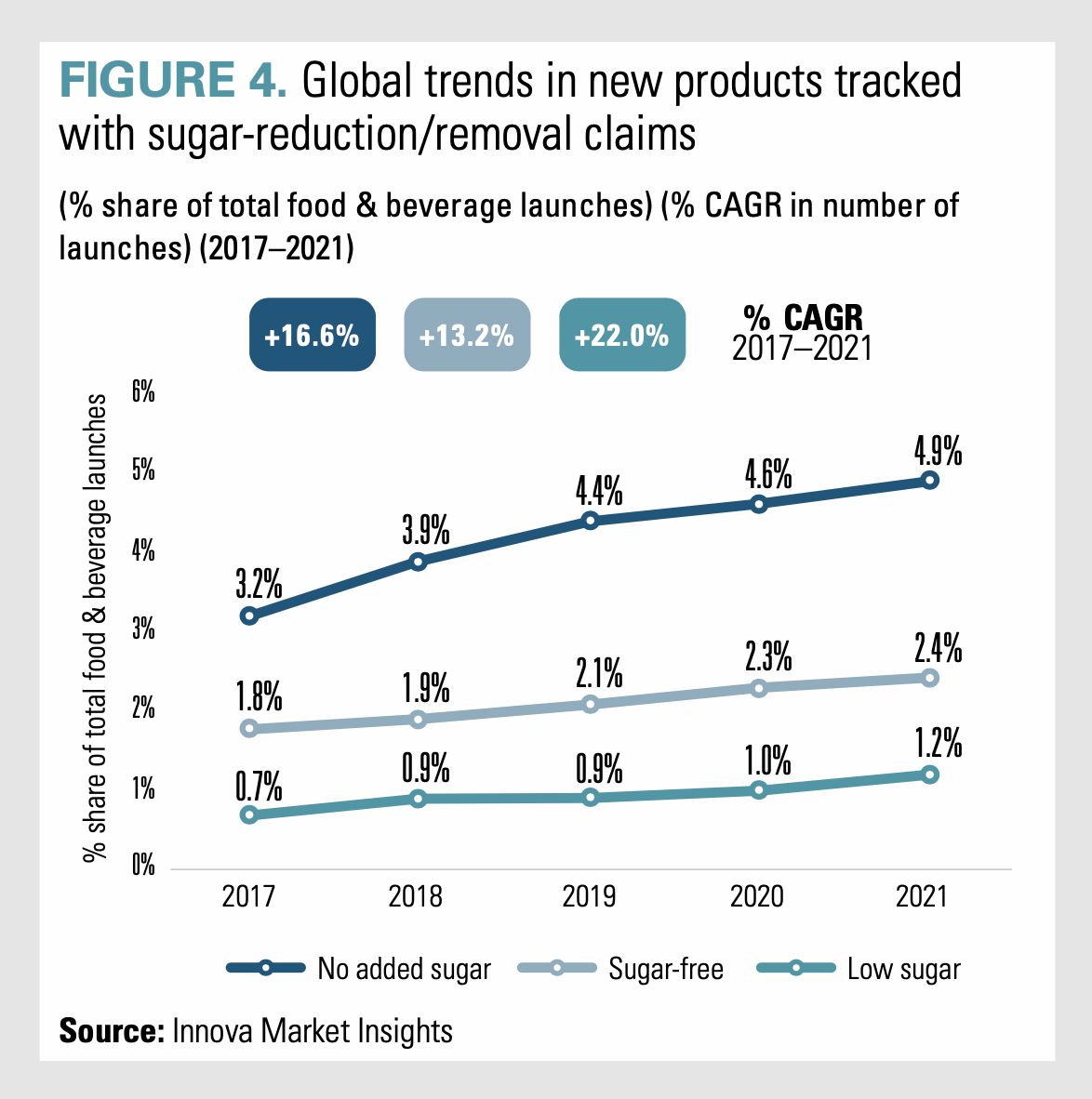

CPG companies are also noting which ingredients consumers are most eager to reduce consumption of—and adjusting their products accordingly. There has been a steady increase in “no added sugar,” “low sugar,” and “sugar-free” new-product development.

Innova Market Insights tracked the percentage of global new food and beverage launches with sugar reduction/removal claims between 2017 and 2021. During that time period, there was a 16.6% CAGR for “no added sugar” claims. This accounts for almost 5% of all new food and beverage products, with penetration continuing to climb.

Similarly, there is also strength in “sugar-free” and “low sugar” positionings. There was a 13.2% CAGR for “sugar-free” claims and a 22.0% CAGR for “low sugar” claims in 2017-2021. (Though “low sugar” claims are experiencing the fastest growth, it’s important to note that this segment is still coming from a smaller base compared to the others.)

The faster growth in “low sugar” and “no added sugar” claims reflects consumers’ growing interest in reducing sugar without resorting to the artificial sweeteners that may be necessary in complete sugar-free formulations. “No added sugar” is now the most common sugar-related claim for foods and beverages, supporting the idea that consumers are interested in reducing sugar without seeking completely sugar-free options. This also supports the idea of positive natural nutrition as a route to holistic health. (FIGURE 4)

Fiber

Fiber is another nutrient consumers are keen to get more of. Innova research shows that after fruits and vegetables, fiber and protein saw the highest net increase in consumption over the past 12 months.

Despite this, new-product development for high-fiber foods has lagged compared to demand, with launches rising only slightly ahead of total food and beverage development between 2017 and 2021. One thing to note is that, just like in the digestive health market, fiber-related claims are now more ingredient-centered, highlighting particular types of fiber—specifically, prebiotics. For instance, Innova Market Insights found that in 2017-2021, new food and beverage launches with a “high in/source of fiber” claim saw a 6.8% CAGR, while new food and beverage launches with prebiotic claims saw a 16.0% CAGR. (By contrast, the CAGR for total new food and beverage launches is 4.9%.)

Fiber and prebiotic claims are now made side by side to reinforce the benefits for gut/digestion. Categories that were previously not classified as high in fiber, such as chocolates, now report gut-related benefits thanks to the addition of prebiotics. Prebiotics also have other benefits such as the reduction of sugar in this type of product.

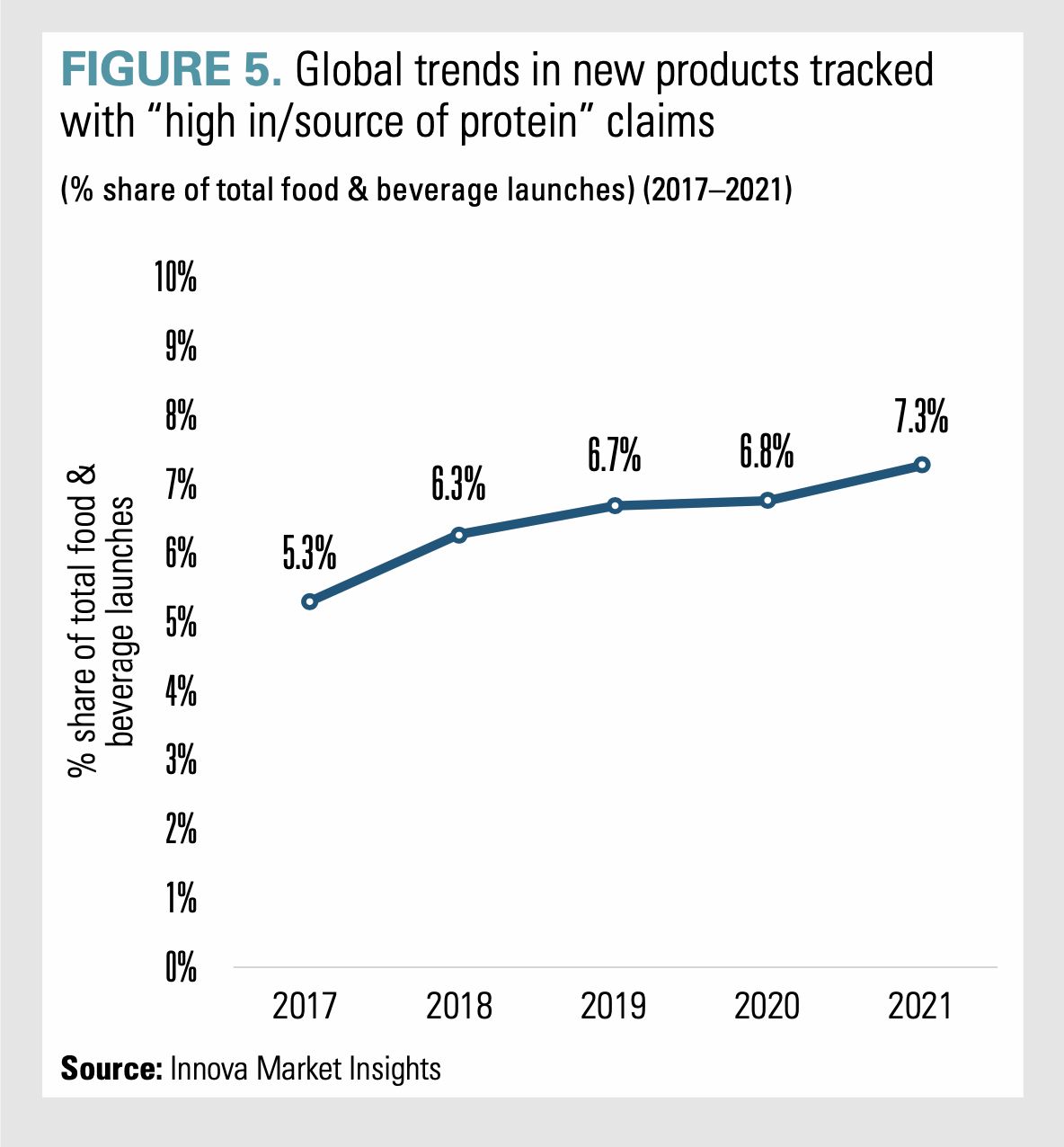

Protein

New food and drink launches marketed as “high in/source of protein” have shown strong growth in the past five years, rising at a 14% CAGR from 2017 to 2021. In 2021, these products held a 7.3% share of total new food and beverage launches globally. (FIGURE 5)

Higher interest in protein also reflects the popularity of positive, natural nutrition for whole-body health: over 7% of new products now make protein claims, and new-product development is diversifying. Consumers can now access protein from many different foods and beverages.

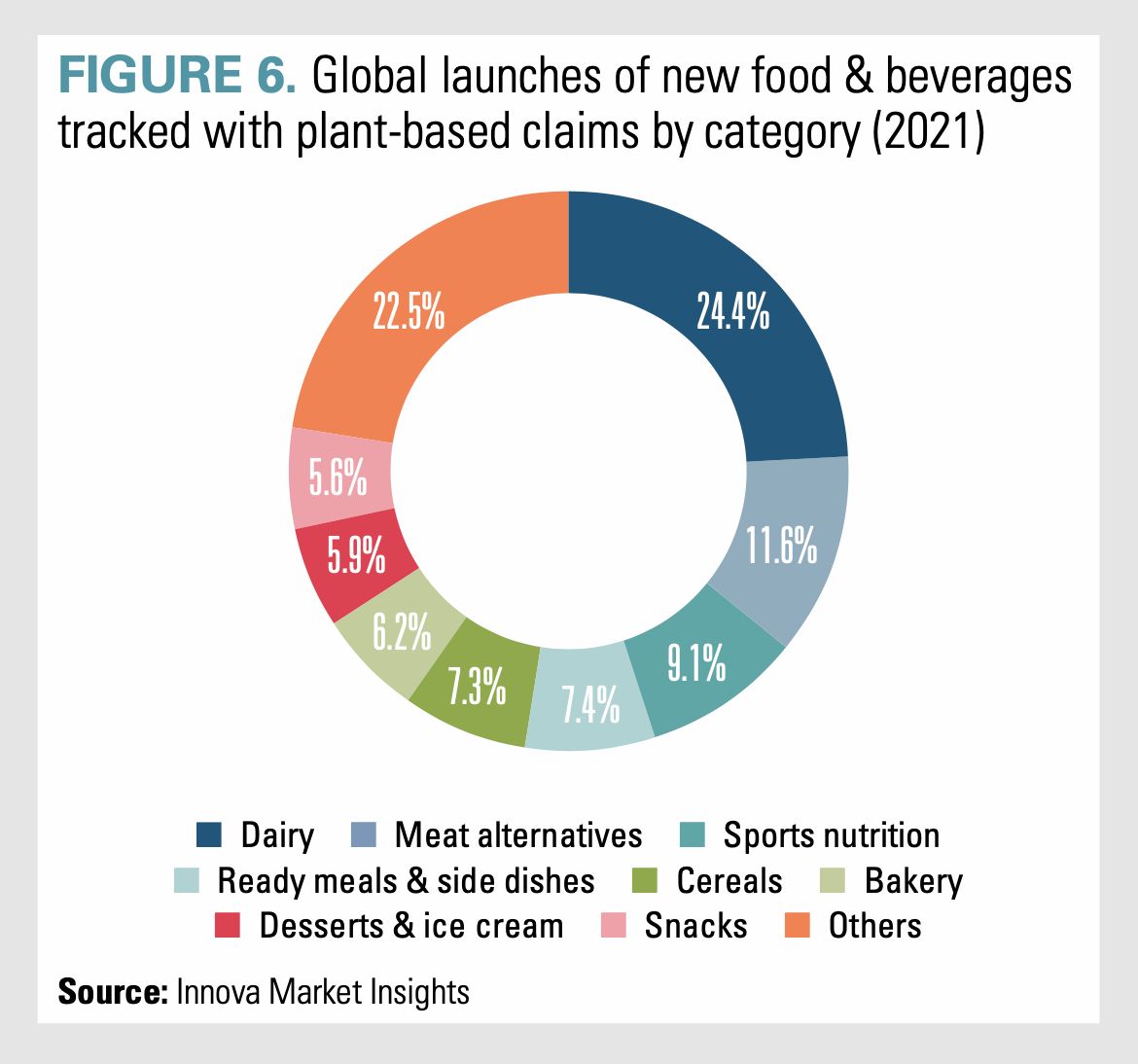

Similar growth/diversification is seen in plant-based foods. Consumers choose plant proteins for their own health and that of the planet, a trend supporting the idea that many consumers are seeking a boosted conscience and spirit alongside a healthier body.

The health of the planet is now catching up to personal health as a reason driving demand for plant-based meat and dairy alternatives. Generation Z and Millennial consumers are most likely to name environmental/ethical reasons for buying plant-based foods.

At the same time, there are more plant-based choices for shoppers. These products are no longer just an alternative to goods derived from animals; they are standing out on their own merits. Innova Market Insights tracked an impressive 53% CAGR in food and beverage new-product launches making plant-based claims globally in 2017-2021, with some launches diversifying well beyond meat and dairy alternatives. (FIGURE 6)

Health and Wellness for All

There’s a product for everyone in today’s sophisticated health and wellness market. Product choices continue to expand as marketers drill down into specific consumer wants and needs. For the consumer hungry for healthier products and better nutrition, the future looks bright indeed.