How are natural product shoppers responding to inflation?

Tips for natural brands to win in today’s retail environment, from the experts at Social Nature.

Inflation has the power to drastically shift consumer spending habits. While consumers are definitely feeling the effects of inflation, particularly in regard to grocery items, many continue to invest in natural products to support their health and lifestyle goals.

In this article, we drill down to the natural-products channel specifically and discuss how natural shoppers are responding to inflation based on data from 6,500 consumers sourced from Social Nature’s better-for-you product-discovery platform. This article will cover:

- Top consumer health goals and where consumers are spending most in order to meet these goals

- What changes consumers are making to their shopping habits across channels and category in the current economic environment

- Winning strategies for getting and keeping consumers

- Tips for new product launches

- Generational differences between Gen Z, Millennial, Gen X, and Baby Boomer shoppers

Consumers’ Top Health Goals

At Social Nature, our data show that 42% of shoppers are spending money on natural products to support their top health goals. Compared to 18 months ago, people are much more health conscious today, with 42% spending money on natural products to support their top health goals.

Jessica Malach

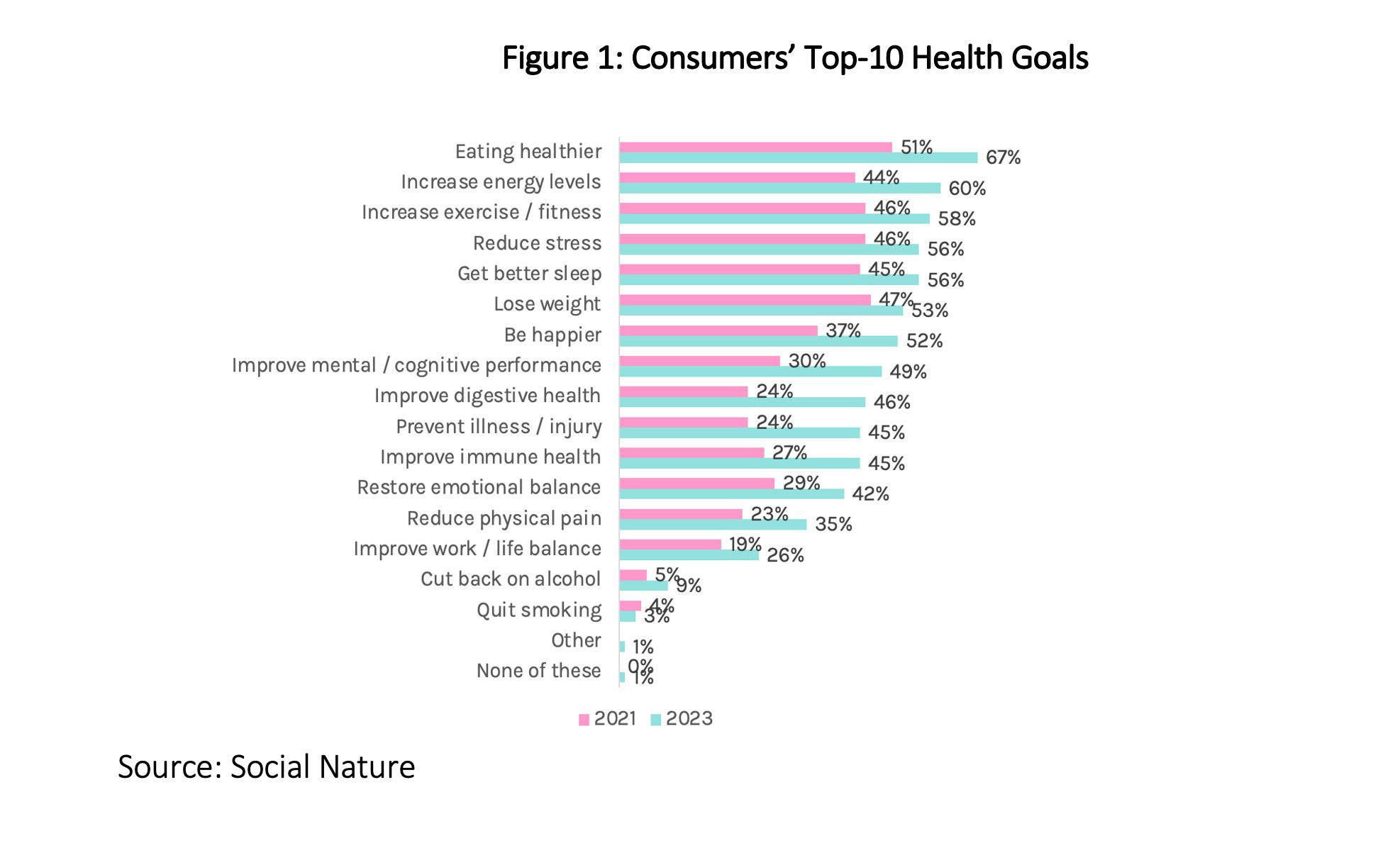

The chart below lists consumers’ top 10 health goals, per our data. The takeaway is that a holistic approach to health remains a top trend.

- Eating healthier (67%, +16%)

- Increasing energy levels (60%, +16%)

- Increasing fitness (58%, +12%)

- Reducing stress (56%, +10%)

- Getting better sleep (56%, +11%)

- Losing weight (53%, + 6%)

- Being happier (52%, +15%)

- Improve mental performance (49%, +19%)

- Improve digestive health (46%, +22%)

- Prevent illness/injury (45%, +21%)

Spending on Health Goals

Thirty-five percent of shoppers are spending more money on supplements to help them meet their health goals. Aligning your product positioning and content strategy to address these top aforementioned health goals where relevant will yield promising results. After all, we know that when a consumer is motivated to achieve a goal, they are more likely to invest in products that help meet that goal.

Our data show that the top three consumer goals today are 1) eating healthier (67%) 2) increasing energy (60%), and 3) increasing fitness (58%). Meanwhile, the health goals showing the largest increases in consumer interest since 2021 are 1) improving mental performance (+19%), 2) improving digestive health (+22%), and 3) preventing illness/injury (+21%). “Prevention” messaging will resonate well with these consumers, especially baby boomers who over-indexed on this goal. (See Figure 1.)

Consumers are also spending more money on products with specific dietary attributes like:

- Sugar-free/low sugar (41%)

- Unprocessed foods (39%)

- Lower sodium (33%)

- Non-GMO (25%)

- Dairy-free products (22%)

This spending is aligned with the top health goal of “eating healthier.” Brands whose products have these attributes are encouraged to highlight them on packaging and in product marketing campaigns.

What Are Consumers Cutting Back On?

Where are consumers noticing most impact from inflation—and therefore cutting back on buying? We looked at which CPG categories consumers are most likely to cease or slow down purchasing in an inflationary period. The top-5 areas consumers are feeling inflation overall are:

- Groceries (92%)

- Gas prices (64%)

- Restaurants and cafes (51%)

- Energy prices (51%)

- Rent or housing (33%)

Consumers are adjusting their spending habits due to rising costs:

- 61% are buying cheaper grocery products

- 59% are cooking more at home

- 45% are buying less groceries

- 30% are changing the grocery store they shop at

Gen Z & Millennials are feeling the greatest impact with rent/housing costs and are most likely to seek ways to earn extra income; hence, they are also most likely to be price-sensitive.

Where Are They Shopping?

Have consumers changed where they shop? Our data show that 45% of consumers are shopping more often at conventional retailers. Up to 28% are shopping more at club stores, and 20% are shopping more at local independent stores. Local independent retailers are not a channel to be forgotten, despite fragmentation, as there may be increased traffic to these stores that offer better local deals. For brands with omnichannel sales, scaling up investments in conventional and club channels will support growth as shoppers migrate their spending to these channels.

What about the impact on the natural channel? Our data show that 44% of shoppers report shopping less often at natural chains. For brands selling in natural channels, it will be important to invest in these chains to keep growing category share despite potentially less foot traffic.

Price Sensitive

More than ever, price is subject to scrutiny, with 83% of consumers looking for cheaper food and beverage products, 61% for cheaper household items, and about 40% for cheaper health and beauty products. Gen Z consumers are making the biggest shifts in their channel habits to save on costs and are the most likely to be price sensitive. However, it’s important to note that “trading down” is less prominent within the pet (25%) and baby products (9%) sectors.

That said, despite seeking cheaper alternatives, the categories with the lowest portion of people willing to sacrifice natural ingredients are:

- Health and supplements

- Baby and kids’ food

- Food and beverage

Hence, natural brands still have an opportunity to take market share, but they must be aware that price pressure exists heavily now. Categories with the highest portion of people willing to sacrifice natural ingredients are haircare and household products. Natural brands competing in these categories are encouraged to pay close attention to pricing and emphasize performance-based claims to maintain growth. Of note, sustainable ingredients and packaging are important to one in three consumers, and in particular to Gen Z.

Plant-Based Is Still Powerful

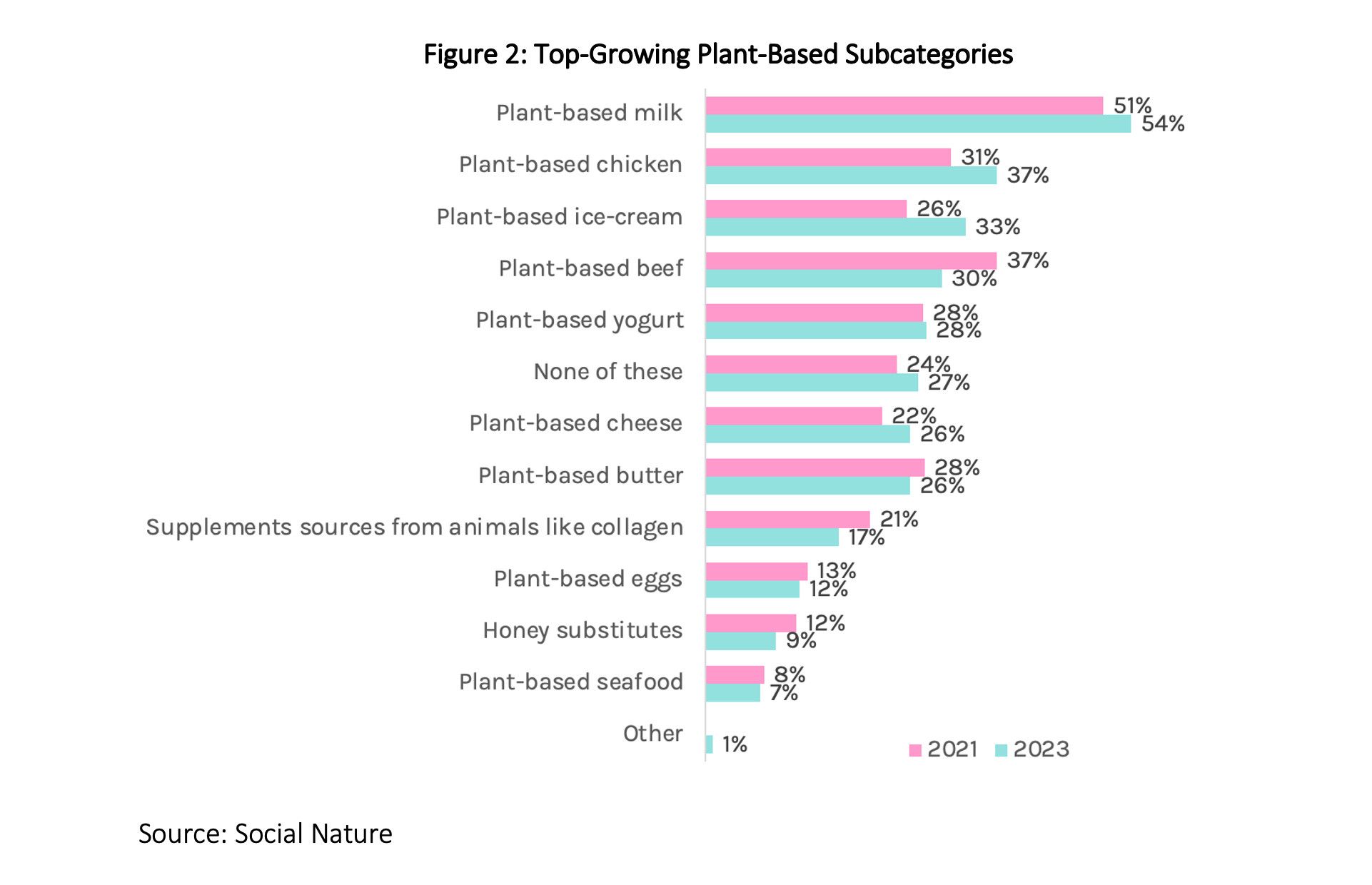

The plant-based category remains important to the market, with 73% of consumers reporting that they buy plant-based products, and 38% buying more plant-based products than they did in 2021 (despite only 5% of shoppers indicating a vegan preference). The category has gone mainstream, and the primary driver of plant-based sales is health benefits (43%), followed by reasons of taste (29%), environmental impact (28%), and animal welfare (25%).

Plant-based brands seeking to broaden their consumer base should focus on the health benefits and any specific dietary attributes of products to acquire new shoppers. Below are some of the growing subcategories in plant-based versus 18 months ago. (See Figure 2.)

- Plant-based milk

- Plant-based chicken

- Plant-based ice-cream

- Plant-based cheese

- Plant-based yogurt

Getting and Keeping Natural Shoppers During a Time of Inflation

Price and rewards remain important reasons that customers will stay with their current brands—or whether they will buy new ones instead. The next most important reason is proven quality.

It’s much more cost-effective to keep a customer than to keep paying to acquire new customers. Doubling down on engaging your current consumer base can support new line extensions and product innovations. Here are the key factors consumers mentioned support their loyalty:

- Price discounts (83%)

- Loyalty rewards (58%)

- Better product quality (47%)

- Natural ingredients (42%)

Top Drivers of New Product Purchases:

- Affordable price (74%)

- On sale (52%)

- Natural ingredients (52%)

- Novelty (49%)

- Proven quality (39%)

- Supports new health goal (27%)

- Already trust brand (25%)

We’ve seen that affordability is key, and when a product is on sale, it motivates customers to try something new. In addition, 27% of consumers said they bought a new product to support a new health goal, so aligning products with top health goals can support new consumer acquisition.

Brand trust remains important and is a less expensive way to scale your growth. Invest in engagement with your current community to lower your customer acquisition costs.

Natural ingredients and proven product quality are also important drivers of new product purchases. But what influences a consumer’s perception of quality? Our data show which top factors influence the perception of quality—and what action you should take in response:

- 24% need to try the product themselves, so invest in a product trial to shorten the pathway to new consumer acquisition.

- 22% can tell a product’s quality by reading its list of ingredients. Ensure that your natural ingredients are easy to read on pack and on your product pages online. Leverage QR codes to tell more of your ingredient story.

- 21% trust recommendations from family/friends, so invest in referral marketing programs with your top consumer fans to build advocacy and reduce your acquisition costs.

- 17% said brand trust is enough. Ensure you fully leverage and engage your current consumer base in your product innovation, from concept to launch.

- 14% said product reviews are important. Ensure you have an ongoing product-review collection strategy. Putting QR codes on pack can be one way to collect reviews while the product is top of mind.

- 5% said influencer recommendations play a role in quality perception. Given this low level of influence compared to other factors, it’s suggested to reduce spending on influencer marketing and to migrate that spending to more impactful strategies like peer recommendations and product trials.

Top Tips for Launching Products in Today’s Retail Environment

Given all of the changes happening, here are some tips for successful new product launches in today’s environment.

- Launch with a special offer or perhaps a BOGO (buy one, get one) strategy if you can afford it. BOGOs are great because they offer tremendous value and move lots of units but don’t drop the SRP.

- Be very focused on where you will invest so that you make the biggest impact where upside is greatest.

- Where do you already have strong brand awareness?

- Which retailers have a shopper base most receptive to your product?

- Align volume of spending with volume of unit movement potential.

- Cut spending in low-performing markets.

- Rationalize underperforming SKUs.

- Align your products with top health goals and dietary attributes to take advantage of increased spending in these categories.

- Invest in product trial to shorten the path to new customer acquisition. It’s the number-one factor in influencing quality perception.

- Prioritize shopper marketing activities that reduce the number of steps in your funnel to get a sale. Avoid spending valuable dollars on digital strategies that don’t drive in-store sales.

- Leverage your consumer base/community. Don’t hold back on community marketing. It will be a cheaper acquisition cost for new launches. Get them excited about your new product launch and involve them in your innovation roadmap. People love to share their opinions, and this will boost engagement and get you set with a group of advocates ready to try your new products and help you share your story once you launch.

About the author

Jessica Malach is vice president of marketing and insights at Social Nature, leading the company’s United States and Canadian consumer insights and brand partner programs. She began her career in the natural health industry in 2004, leading company growth strategies with senior roles at Alive Publishing Group; the Vega marketing team, prior to its $550 million USD exit; Bullfrog Power renewable energy company; and Pinto product data and personalization tech provider, which was recently acquired by SPINS LLC.

HHS announces restructuring plans to consolidate divisions and downsize workforce

Published: March 27th 2025 | Updated: March 27th 2025According to the announcement, the restructuring will save taxpayers $1.8 billion per year by reducing the workforce by 10,000 full-time employees and consolidating the department’s 28 divisions into 15 new divisions.