Stevia Products Poised to Transform Beverage Market

In the 2007 Health & Wellness Trends Database report, the Natural Marketing Institute (NMI; Harleysville, PA) revealed that U.S. retail sales of health and wellness products topped $100 billion last year. But that dollar figure represents more than just sales-it marks a dramatic paradigm shift in the food and beverage industry, with top manufacturers now looking to develop ingredients and products to sate consumer demand for natural fare. And with the sale of carbonated beverages steadily dropping as consumers choose water or juice over their beloved soda pop, beverage companies are looking for ways to make their iconic drinks palatable to a more health-conscious population.

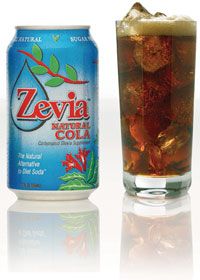

"People today want healthier options," says Ian Eisenberg, executive chairman of Zevia LLC (Seattle), a manufacturer of carbonated stevia products. "My one vice was diet cola. I knew it was bad for me. But there weren't any other alternatives. Once I learned about stevia, that it's all natural and has zero calories, I knew there would be a huge demand."

Cargill Gets in the Stevia Game

And with that demand, it came as little surprise when Cargill Inc. (Minneapolis), in partnership with the Coca-Cola Co. (Atlanta), announced the launch of its own stevia-based sweetener, Truvia, after several years of top-secret research and development. Truvia is the brand name of Cargill's patented rebiana, a high-purity sweetener made from the rebaudioside A, a compound found in the leaf of the plant.

"Rebiana is derived from stevia," says Ann Tucker, director of communications for Cargill. "It is a development that Cargill and Coke worked on for 5 years with the intent to get to the best-tasting part of the plant." Tucker argues that not all stevia is alike-there are more than 200 varieties of stevia and multiple ways to process it, making Truvia a unique offering to the marketplace.

And Cargill is wasting no time on its introduction. Truvia is already commercially available on the Internet and at select grocery chains, and the first products containing Truvia as a food ingredient are expected to hit shelves by early 2009.

All about Stevia

In most senses, stevia is not a new product. A super-sweet plant from the chrysanthemum family native to Paraguay, it has been used as a food additive for decades in countries like Brazil, China, and Japan in everything from soft drinks to yogurts. But it was not approved for use in the United States due to questions about its safety.

American consumers who frequented natural and health food stores could purchase stevia-based products that were marketed and labeled as dietary supplements. The plant was not approved by FDA as a sweetener or food additive.

In fact, the FDA's Web site lists stevia as unsafe, stating that "available toxicological information on stevia is inadequate to demonstrate its safety as a food additive or to affirm its status as GRAS." But even with that warning, consumer demand has steadily grown for stevia products.

"People would use it in powder or liquid form in their coffee, over their cereal, to bake, all the same things they would use sugar or one of the artificial sweeteners for," says Jim May, founder and CEO of Wisdom Natural Brands, maker of stevia-based SweetLeaf. "But because it was only approved as a supplement and not a sweetener, we couldn't describe it as sweet on the label. Imagine trying to market a product when you can't even tell people what it is."

And that is the major difference between a dietary supplement and a food additive-labeling. Zevia, the carbonated stevia supplement, comes in a can that looks very much like a soda can and comes in flavors familiar to those who wander the beverage aisle. But the company cannot call it a beverage.

"It really is all a matter of labeling," says Eisenberg. "Foods have a panel on the back with nutritional facts. We have supplement facts. As a dietary supplement, we can't call ourselves a beverage or a drink. We're a carbonated stevia supplement. We can't say it has zero calories or list the carbohydrates, fats, or other information on the packaging. We have to be very careful about what we say about the product."

Seeking Coveted Approval

When the initial buzz came that Cargill and Coca-Cola were working on their own stevia sweetener-and intended to be the first to bring it to market as a food ingredient-May knew that he had to act fast.

"Coke announced that they'd have the first GRAS stevia product in the United States. Then Pepsi announced they would, too. Then Corn Products International said they were going to do it," May says. "We had the data that stevia was safe, so we decided to go ahead and be the first out of the gate."

May and Wisdom Natural Brands opted to petition FDA for self-affirmed GRAS status. Being a smaller company without in-staff scientists, Wisdom hired an independent panel of former FDA scientists to review research on stevia to verify its safety. The company provided them with thousands of studies to examine.

"It took them about a year to evaluate each study," says May. "And they found that SweetLeaf is safe when used as a sweetener." But because of the specific procedure that Wisdom Natural Brands uses to make its product, the GRAS status only applies to its own brand of stevia product. Since then, Wisdom Natural Brands has been able to sell SweetLeaf as a sweetener proper in stores throughout the United States as well as to food and beverage manufacturers.

Cargill handled Truvia a bit differently. Technically, there is not a formal FDA approval process for natural substances. "But all of our work was done in consultation with FDA," says Tucker. "This is a naturally occurring compound. It's been around for years. FDA had some questions, and we have answered them."

The company published the scientific studies establishing the product's safety in the May 2008 issue of the Food and Toxicology Journal. It also presented those same results to the Toxicology Forum (Washington, DC) in July. But again, Cargill emphasizes that the safety claims are only for its product.

"All stevia is not the same," says Tucker. "The stevia that's available in the marketplace today, there's not a way for anyone to distinguish where it came from, what kind of plant, how it was treated and processed, no quality standards around it. Now there will be."

Transforming the Beverage Industry

With Truvia now on the market and available for Coke's exclusive use in beverages, other big-name beverage manufacturers are looking to create their own natural zero-calorie sweeteners. Both PepsiCo Inc. (Purchase, NY) and the Dr. Pepper Snapple Group Inc. (Plano, TX) have said they are currently developing stevia-based ingredients, and other major consumer packaged goods firms are sure to follow.

"All the big names will use it. And we'll see enormous use of it," says May. "But we have a bit of a head start. I'm currently negotiating with much smaller beverage and food companies now. We have the product and are entering the supply chain, sending out to grocery stores and health food stores."

And Eisenberg sees it as a good thing. "That would put stevia into the food product or beverage category and allow us to change labels," he says. "With that, more consumers would try the product. And that's our main mission-to help everyone kick the diet soda habit and to know that artificial sweeteners are bad for you."

Most see a huge boom in the market coming by early next year. In fact, some estimate that stevia products will take at least 20% of the total U.S. sweetener market within the next 5 years. Despite getting first to market with a GRAS stevia product, May admits that the bigger players could outshine those that have been championing the plant for the last two decades.

"There's no question that there's going to be a huge market for stevia," says May. "I just hope when all is said and done, the big names leave a little bit for the rest of us."

The Nutritional Outlook Podcast Episode 39: Nutritional Outlook's Ingredients to Watch in 2025

February 25th 2025In this episode, Nutritional Outlook interviews Scott Dicker, market insights director from market researcher SPINS, about ingredients and product categories nutraceutical and nutrition product manufacturers should watch in 2025.

Kratom sees impressive sales growth despite its regulatory status and stigma

March 12th 2025Despite its controversy, kratom is a top-selling ingredient that consumers see value in. That said, brands need to work hard to demonstrate safety and quality of kratom products in the absence of legal regulatory status. Will kratom be able to overcome its stigma for even more growth and consumer acceptance?