Plant’s Progress: Innovation is creating a new breed of plant-based food, beverages, and supplements

Companies making plant-based products today are focused on offering a variety of choices in order to meet the needs of diverse consumer groups, including an expanding mainstream audience. Luckily, the growing sophistication of plant-based ingredients is allowing them to do just that.

Photo © Irina - Stock.adobe.com

Innovative plant-based products are entering the food, beverage, and supplements markets at an incredible rate. Shaking off the limiting label of meat-, fish-, or dairy-substitute, this growth aims to satisfy demand for a standalone plant-based category based on health, taste, variety, and fun—one that is the equal of any other. As new products, ingredients, and technologies address concerns and purchase barriers, the consumer base is also rapidly expanding far beyond traditional devotees.

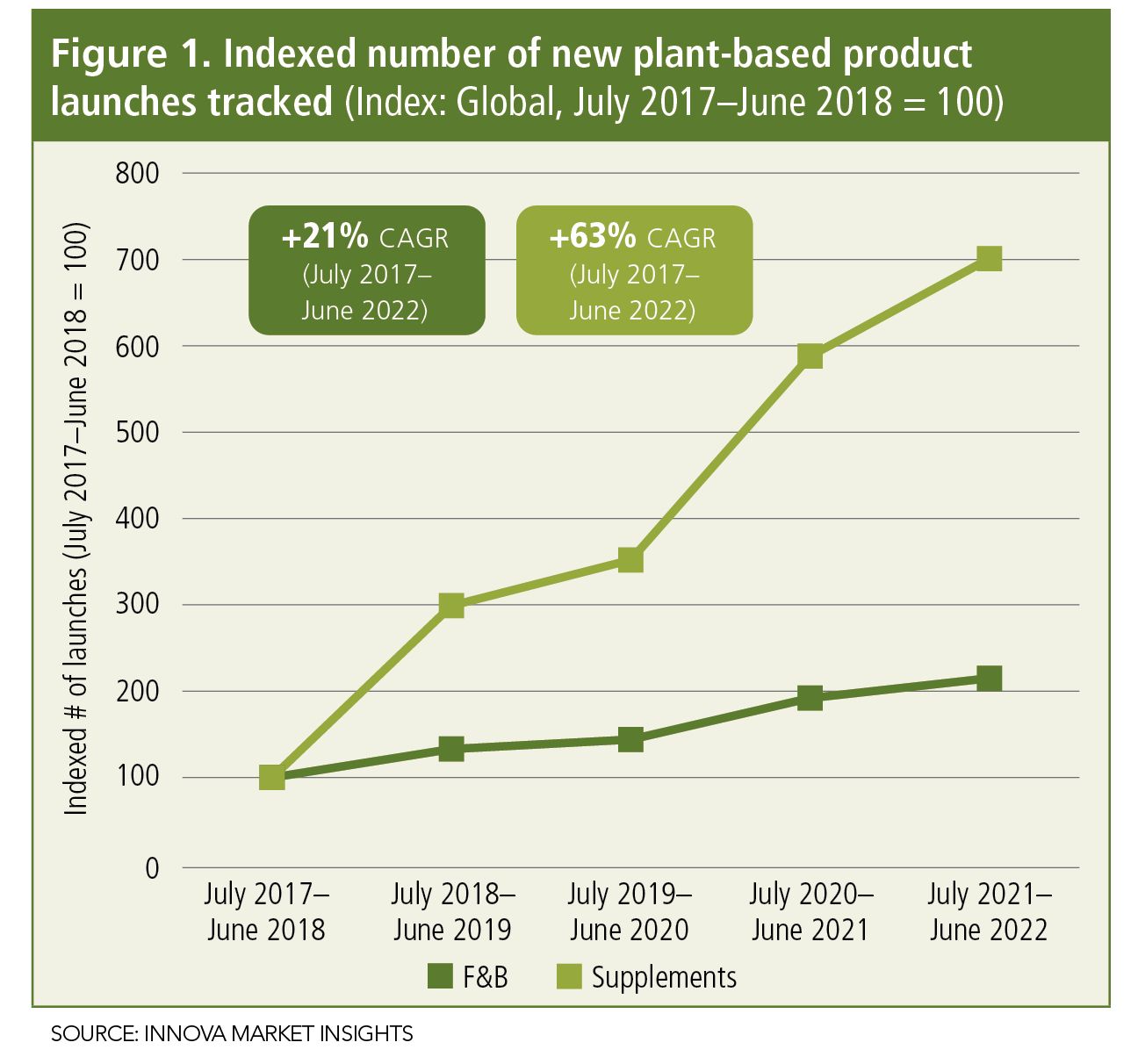

Plant-based products are growing cross-category. For instance, the number of plant-based dietary supplement launches grew more than 63% between July 2017 and June 2022, per Innova Market Insights data. Plant-based food and beverage launches are also on the rise globally, with an average annual growth rate of more than 21% between July 2017 and June 2022. (See Figure 1.)

Many customers going plant-based today say their goal is to achieve a healthy and sustainable balance in their diet and nutrition intake. Flexitarians, for instance, follow a plant-based diet but may also occasionally eat animal products. Today, flexitarians outnumber the combined number of strict vegans and vegetarians, while young consumers are particularly drawn to plant-based products. Therefore, ensuring products appeal to these shoppers is also important.

Companies making plant-based products today are focused on offering a variety of choices in order to meet the needs of all these diverse consumer groups, including the expanding audience of mainstream customers. Luckily, the growing sophistication of meat-alternative, dairy-alternative, and other plant-based ingredients is allowing them to do just that.

Consumer Priorities

More than ever, consumers are seeking better-for-you products. Many see plant-based offerings as healthier. For instance, in a 2021 Innova Market Insights consumer survey, half of global consumers polled said they use dietary supplements to stay healthy, and 37% of consumers globally said they prefer a plant-based alternative because they feel it is healthier.

Similarly, those opting for plant-based food and beverages require at least an equal benefit to food and beverages derived from other sources. The aforementioned consumer survey found that nearly one in two consumers said it is very or extremely important for plant-based products to match their animal-based counterparts in terms of nutritional profile.

Consumers also want to know that plant-based choices are better for the planet. Health may be the number-one reason driving consumers to plant-based, but health of the environment is gaining importance. Expect conscience-driven issues to become more important in the plant-based market going forward. Consumers are more aware of the environment and its connection to nutrition. The environment is not the primary purchase driver for mainstream consumers, but it can be a tiebreaker when choosing between products.

Food

Many varied categories have seen an explosion of plant-based launches over the past five years. In the food and drink sector, some of the fastest-growing categories have been alcoholic beverages (+67% CAGR); meat, fish, and egg substitutes (+57% CAGR); and baby/toddler items (+41% CAGR). Innovation is now focused mainly on improving taste, texture, and nutrition, with a goal of making plant-based foods stand on their own.

Alongside these developments, we are still seeing significant launch activity in the more “traditional” plant-based categories. Meat-substitute and dairy-alternative launches grew at +35% CAGR and +22% CAGR, respectively, from July 2017 to June 2022. Among the other fast-growing subcategories for plant-based are sports nutrition, bakery, spreads, and confectionery.

Supplements

The number of plant-based dietary supplement launches is also growing. Between July 2017 and June 2022, subcategories with the fastest-growing number of launches included hair/skin/nails (+130% CAGR, albeit from a smaller base); women’s specialty supplements (+101% CAGR); and miscellaneous softgels, capsules, tablets, and powders (+100% CAGR). The number of plant-based launches in men’s specialty supplements is also growing quickly (+129% CAGR), but from a much smaller base.

For plant-based product marketers, the supplements space is promising. According to a 2022 Innova Market Insights “Lifestyle & Attitudes Survey,” 27% of consumers globally said they have increased their supplement usage, while 47% said they are at least maintaining the same level. Asia and North America dominated supplement sales globally in 2021.

Plant-based supplements are making use of a growing range of botanical ingredients, such as spices, tea, and fruits. These products are also serving a wider range of health needs (e.g., lung health and mood boosting). Plant-based nutrition will only increase in supplements, including botanical and specialty products. Consumers are still seeking out natural and health-promoting nutritional products, and plant-based supplements can fit in nicely here.

Trending Ingredients

So, which ingredients are winning in plant-based food, beverages, and supplements? Consumers are generally most accepting of the ingredients from nature that are most familiar to them. Almonds and beans, for instance, over-index in terms of their acceptance versus familiarity.

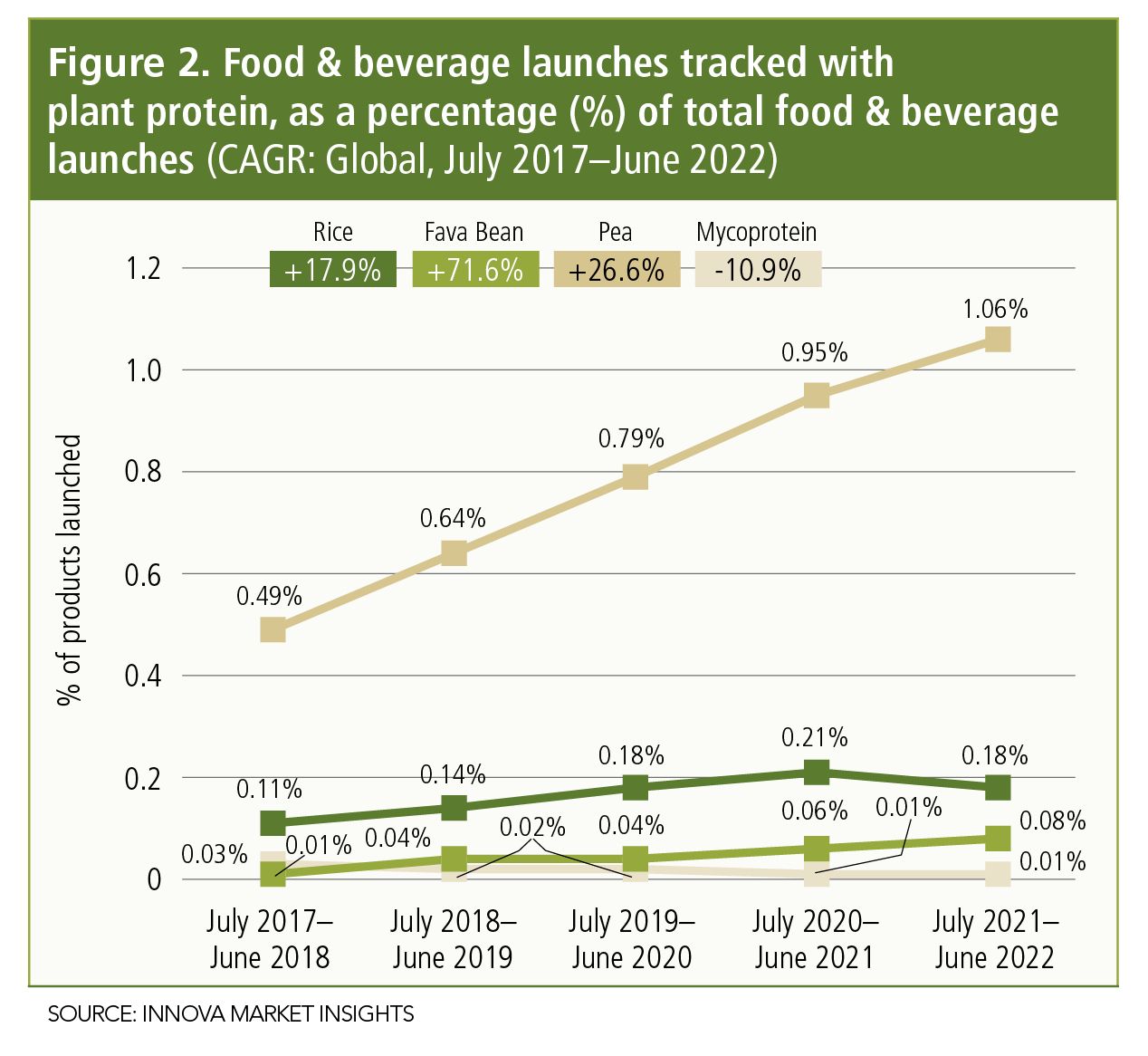

Within all food and beverages carrying plant-based claims, pea protein is now the single most important protein in use. However, growth rates are also high for the likes of fava bean protein, while chickpea is also emerging. In meat alternatives, beans, rice, and pea are showing the best growth. In dairy-alternative drinks, oat and pea are fast-growing. (See Figure 2.)

In the wider supplements market, collagen is an extremely popular ingredient, and now, vegan collagen supplements are trending. For instance, while the number of supplement launches referencing collagen in their product name or product description grew at a 59% CAGR between 2017 and 2021, by comparison the number of supplement launches referencing the words collagen and vegan during that time frame grew 76%.

In terms of other ingredients, traditional plant-based herbs like ashwagandha are growing, as are more “modern” ingredients like cannabidiol (CBD), where regulations allow.

Product Claims

In the food and beverage product category, immune health is a fast-growing health claim associated with plant-based food and beverage launches, showing a +53% CAGR globally in 2017–2021.

Brain and mood health is also one of the fast-growing active health claims within plant-based supplement launches, with a +254% CAGR between July 2019 and June 2022, albeit from a small product base.

Plant-based supplement launches with skin health claims are also on the rise, growing globally at a +51% CAGR in July 2019 to June 2022.

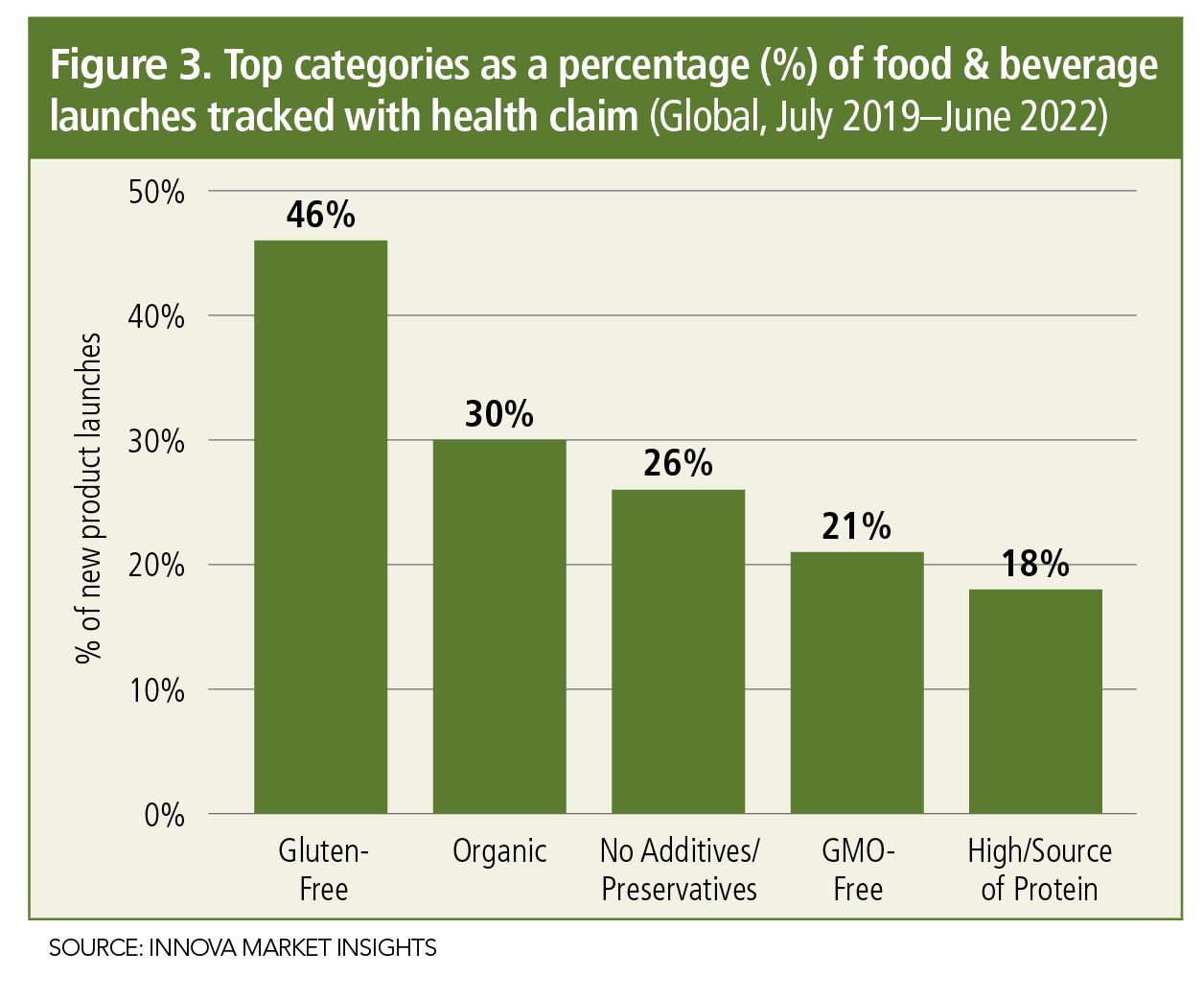

Meanwhile, within the plant-based launches, “free from” claims are growing at a fast clip. (See Figure 3.) Nearly one in two plant-based food and beverage launches today is gluten-free, for instance.

A “source of protein” claim is also growing in plant-based launches, at a +23% CAGR.

Additionally, to satisfy consumers seeking more sustainable products, ethical and environmentally friendly claims are growing among plant-based product launches, at +24% CAGR in July 2019 to June 2022. This is a clear indication that the industry is responding to how personal and planetary health concerns keep intertwining.

Looking Forward

In the future, consumer demand for variety will be the impetus for evermore-complex plant-based product development.

Taste and texture are two of the most important attributes considered when developing new solutions for the plant-based market. Although consumers, especially young consumers, are becoming more positive toward plant-based alternatives in general, price, taste, and flavor are still barriers to consumption. Expectations around these qualities are higher than ever for plant-based innovation, especially as these products are no longer simply alternatives but represent a major area of innovation.

It’s also worth noting that Gen Z consumers are generally more invested in the environment/values/ethics proposition when it comes to purchasing plant-based products. Older consumers, who are often considered the “new” plant-based consumers, will be more challenged in general by their current lack of knowledge around plant-based options.

The plant-based category is a breeding ground for new technologies and, as such, there is clearly a strong link between these two trends Innova Market Insights previously identified in its “Top 10 Trends for 2022”: Plant-Based and Tech-to-Table. The good news is that almost half of consumers surveyed by Innova say they would accept new plant-based food technologies, particularly if they helped improve taste, health, safety, or the environment.

Alongside technological advances, ingredient suppliers are working hard to break down taste barriers with more blending of ingredients to hit optimum quality levels. For now, it’s common to see claims on products referencing a product’s taste as a benefit.

Supply Generates Demand

The sheer volume of plant-based products consumers now see in stores and online is helping to spread awareness about the category. Per Innova Market Insights data, one in three consumers say they have purchased more plant-based food because there are more products available.

And the innovation continues. Supplement formulations now feature a wider range of plant-based ingredient sources, using traditional/medicinal herbs in new ways or in different Western markets. Blending plant-based sources is also increasingly common as a means of achieving the optimum taste, nutrition, or cost profiles for these products.

The challenge for innovators will be to keep “new” consumers in the category who may have become fatigued by supplement usage or health concerns over recent years. They can do so by introducing novel ingredients and fun delivery formats. Quick, easy, and on-the-go formats such as gummies are performing well globally.

Plant-based supplements that address multiple combinations of health concerns will also appeal as easy, time-saving solutions. For instance, the buzz around “adaptogens” and “nootropics” is creating new interest in plant-based products.

As plant-based products burst out of the shadows and appeal to a wider audience, so the plant-based claim is touted proudly and prominently. Many now advertise their hero plant protein ingredients as a major positive, signifying the very things consumers expect from any food, beverage, or supplement. We expect this practice only to increase.

About the Author

Lu Ann Williams is co-founder and Global Insights Director at Innova Market Insights, a global market research firm headquartered in The Netherlands. An expert on trends driving the food and beverage industry, she is a frequent speaker at industry events. Thirty years of global experience, data analysis, and trendspotting give her a unique foundation for insights into what’s coming next in the industry in every region of the world.

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.