The joint-health market is embracing collagen, turmeric

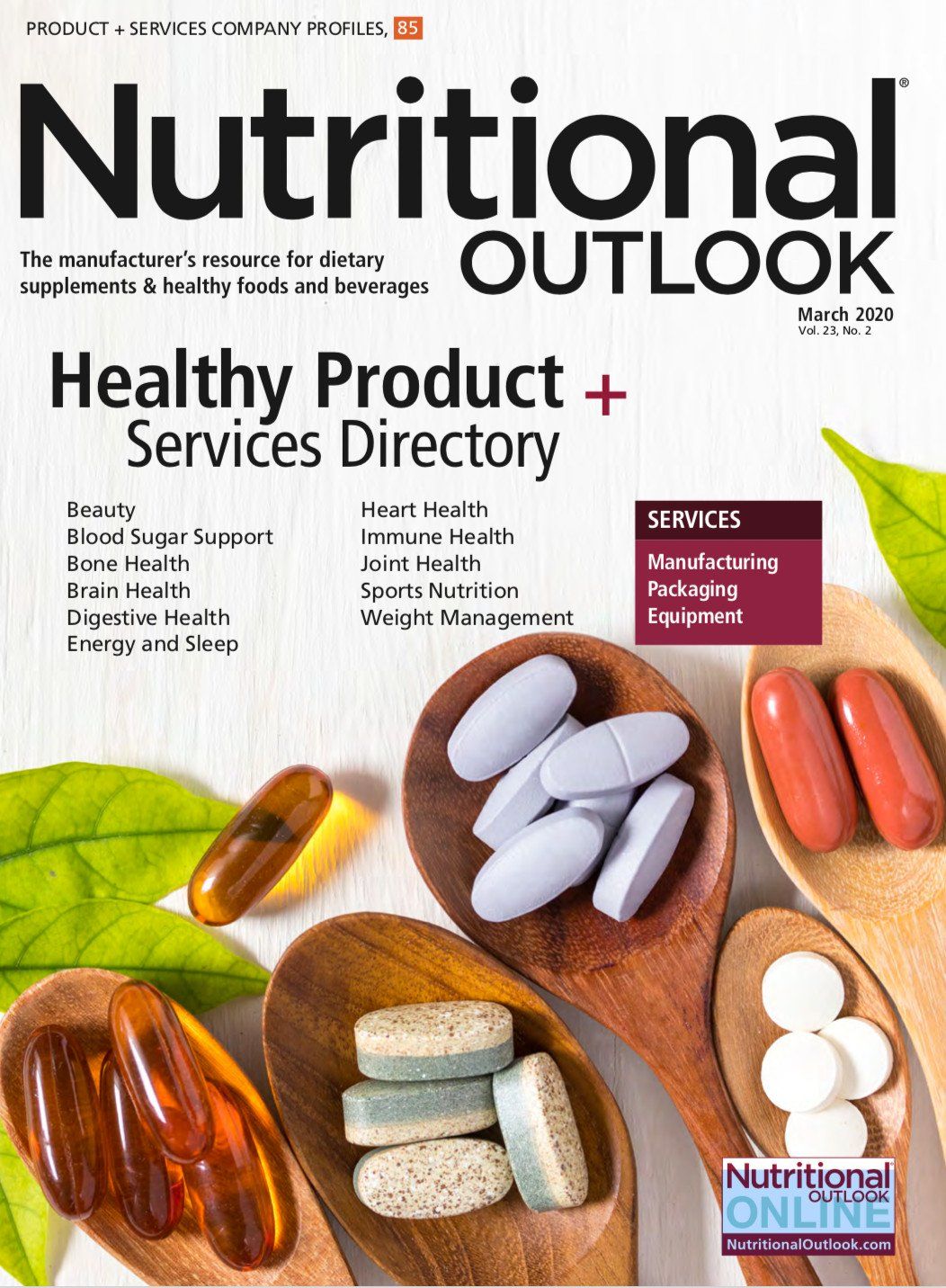

The advantage of ingredients such as curcumin and collagen are their versatility, allowing manufacturers to utilize them in different delivery formats.

Photo credit © LuckyStep - Stock.adobe.com

Remaining active is difficult as one gets older. Part of the problem is our joints, which wear with age and become more inflamed, causing pain. It’s why many consumers today are seeking relief. According to Innova Market Insights, 21% of consumers from the United Kingdom over the age of 55, for instance, said they used prescription medication for joint health in 2017. While pharmaceuticals certainly have their place, dietary supplements can be a viable solution for less serious joint pain and overall maintenance.

“The best analogy I have heard [about pharmaceutical drugs] is from a well-known Australian cardiologist named Dr. Ross Walker,” says Neal Mercado, chief marketing officer at Designs for Health, a practitioner brand of dietary supplements. “He compared pharmaceutical drugs to taking a Ferrari to get from point A to B, versus supplements, which is like riding a bike. They will both get you there. The Ferrari will get you there quicker but may also introduce some risk depending on how fast you drive it, whereas the bike is much less risky but might take a little while longer.”

Assuming consumers do eventually experience a noticeable benefit from taking a joint health supplement, they might find the supplement route a more prudent approach, especially if they are seeking long-term preventative health strategies versus acute treatment of already existing conditions.

One ingredient making a name for itself in the joint health space is curcumin, the active constituent of turmeric. “Curcumin has experienced significant popularity over the past few years due to its demonstrated effectiveness as an anti-inflammatory as well as its positive safety profile,” Mercado explains. Turmeric continues to do well in general. According to market researcher SPINS, during the 52 weeks ending October 6, 2019, cross-channel sales growth for turmeric overall was 1.8% to reach $143 million.

In the joint health category specifically, joint health mainstays such as glucosamine and chondroitin sulfate have higher sales than curcumin, but as the library of research on curcumin and other joint health ingredients such as collagen grows, glucosamine and chondroitin sulfate are at risk of losing more market share.

“Glucosamine and chondroitin have had a longstanding history of use for joint health and have been the subjects of numerous large-scale clinical trials. However, recent meta-analyses have seemed to question the statistical significance of their effect and have introduced some doubt as to their efficacy in the broader medical community,” says Mercado. “Other ingredients such as collagen and turmeric (curcumin) have shown promising results in recent clinical trials.”

Supplementation with collagen supports the structure of the joints. The ingredient has experienced huge sales growth. According to SPINS, cross-channel sales growth of collagen was 82.7% in 2019, to reach $147 million. Collagen straddles multiple categories, including joint health, bone health, and nutricosmetics, with different types of collagen offering a variety of benefits. This allows for combination products that target multiple need states.

The advantage of ingredients such as curcumin and collagen are their versatility, allowing manufacturers to feature them in different delivery formats. For example, Designs for Health has softgel and soft chew options for its curcumin products, and collagen can be incorporated in capsules, chews, and powders. Having a variety of delivery formats helps with compliance because as we age, the number of prescriptions and supplements we take increases.

“Compliance is key-the ingredient cannot work if you don’t take it,” says Mercado. “Pill fatigue is real, and having a variety of dosage forms, including softgels, capsules, and powders as well as bars and chews, really helps.”

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.