Joint effort: Food and drink brands teach consumers about their own carbon footprints

Market researcher Innova Market Insights details how food and drink companies are growing their corporate sustainability initiatives while educating consumers on the impact of those initiatives.

Photo © Turbodesign- Stock.adobe.com

Global concerns about sustainability did not fall off even as the planet grappled with the COVID-19 pandemic.

For instance, a February 2022 United Nations International Monetary Fund report detailed the results of a survey conducted in February 2021 on 14,500 people from 16 major global economies. The purpose of the survey was to determine “how individual attitudes to climate issues and support for climate policies have evolved in the context of the pandemic.”1 Questions included: “Compared with how you were feeling before the pandemic, how much more or less worried are you about climate change today?” According to IMF’s report, 43% of respondents worldwide reported being more worried about climate change, while 35% of respondents reported no increase in worry about climate change—but said they were already concerned about climate change prior to the pandemic.1 When asked whether, compared to before the pandemic, they were more likely to personally adopt some kind of environmentally friendly behaviors—such as monitoring energy use or changing modes of transportation—the report noted that “most respondents replied that they are likely to participate in some environmentally friendly activities.” The report concluded that “the experience of the pandemic has increased concern for climate change and also increased public support for a green recovery…”

Sustainability is a prevailing concern globally, and more consumer packaged goods (CPG) companies than ever before are taking actionable steps to offer consumers products that are sourced, manufactured, packaged, and delivered more sustainability.

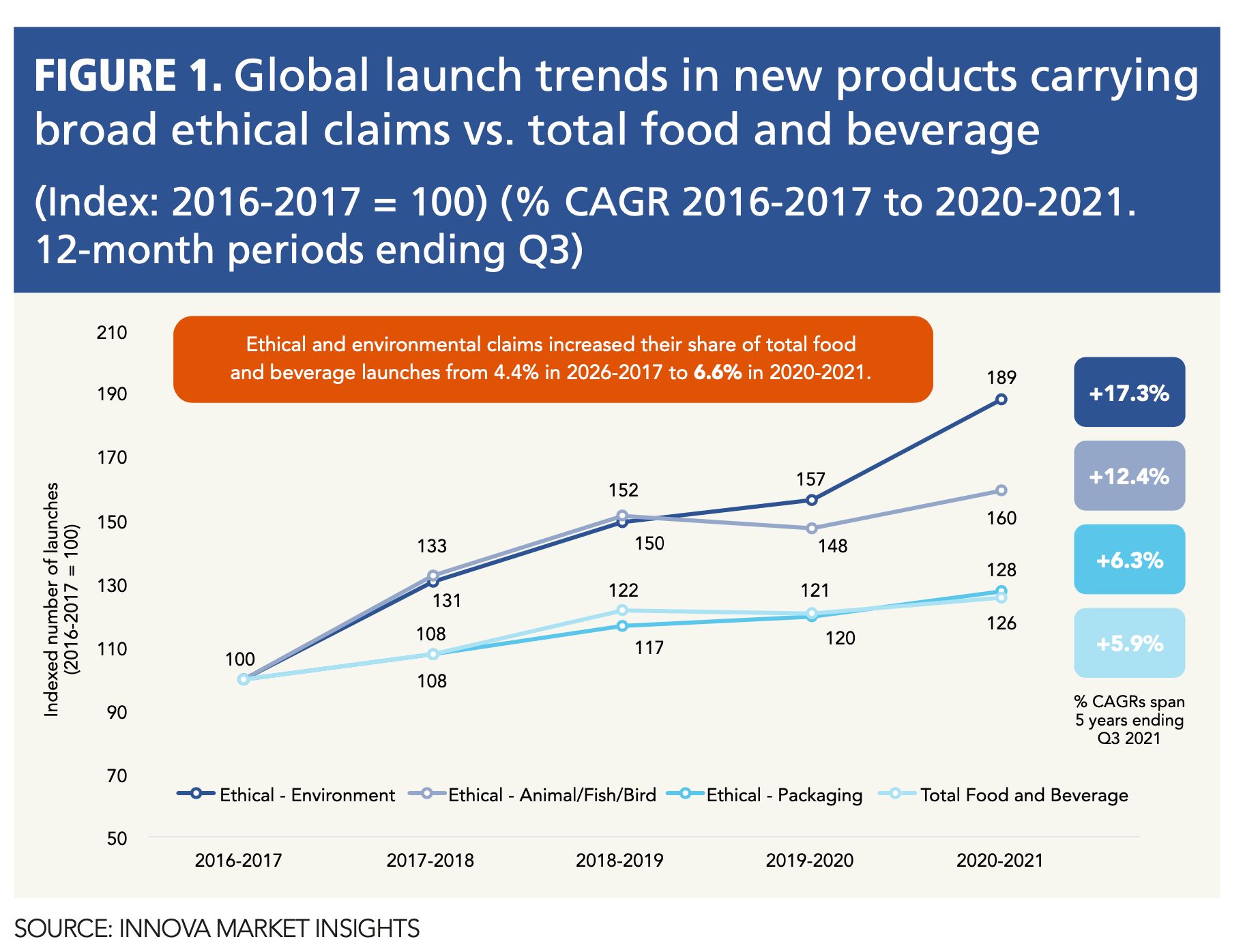

In fact, according to data from market researcher Innova Market Insights (The Netherlands), the growth in environmentally friendly food and beverage launches continues trending upwards. (See Figure 1.) Whereas in 2016-2017, the number of global food and beverages launched making ethical/environmental claims was 4.4%, by 2020-2021 this percentage was up to 6.6%. In fact, Innova notes, “Launches of products carrying environmental and ethical claims are growing faster than total food and beverage launches.”

Sustainable packaging is also now a “firmly established” part of new product launches, it adds. In addition, “Other environmental positions are growing well ahead of the total market, with launches rising at a CAGR that is almost three times faster than for total food and beverage launches. The use of animal welfare claims is also showing double-digit growth.”

Brands Take Action

Food and beverage manufacturers are pursuing sustainability in numerous ways today. Some are focusing narrowly on specific issues related to sustainability. Others highlight how their brands and products have an overall positive cumulative impact on the environment, communicating this through the use of scorecards in different global markets detailing a range of attributes, including levels of carbon emissions.

Some are focused on addressing global water concerns. Innova notes a 27% CAGR in the number of global food and beverage launches making claims addressing water usage in 2017-2021. Such companies include the Arizona Wilderness Brewing Co., which launched a beer in January 2022 that was “created to highlight the water crisis in the Southwest” and is “made with drought-resistant hops and malt from Sinagua, which has offset more than 425 million gallons of water in the Verde river.” The label of the company’s beer can states: “This Beer Saves Water.” Another alcohol company, Stella Artois, emphasizes its collaboration with Water.org “to facilitate clean water for everyone.”

Innova points to other examples of specific environmental focus areas, including a bagged lettuce product from the brand Planet Farms in Italy whose blond baby lettuce “is sourced from vertical agriculture in which plants are grown in multilevel structures using 90% of surface area and 95% less water than similar products grown through traditional agriculture in the field.” Another is Planted Effiloche’s BBQ shreds in the French market which touts its plant-based meat alternative as being made with “81% less carbon dioxide” and “43% less water than pork.”

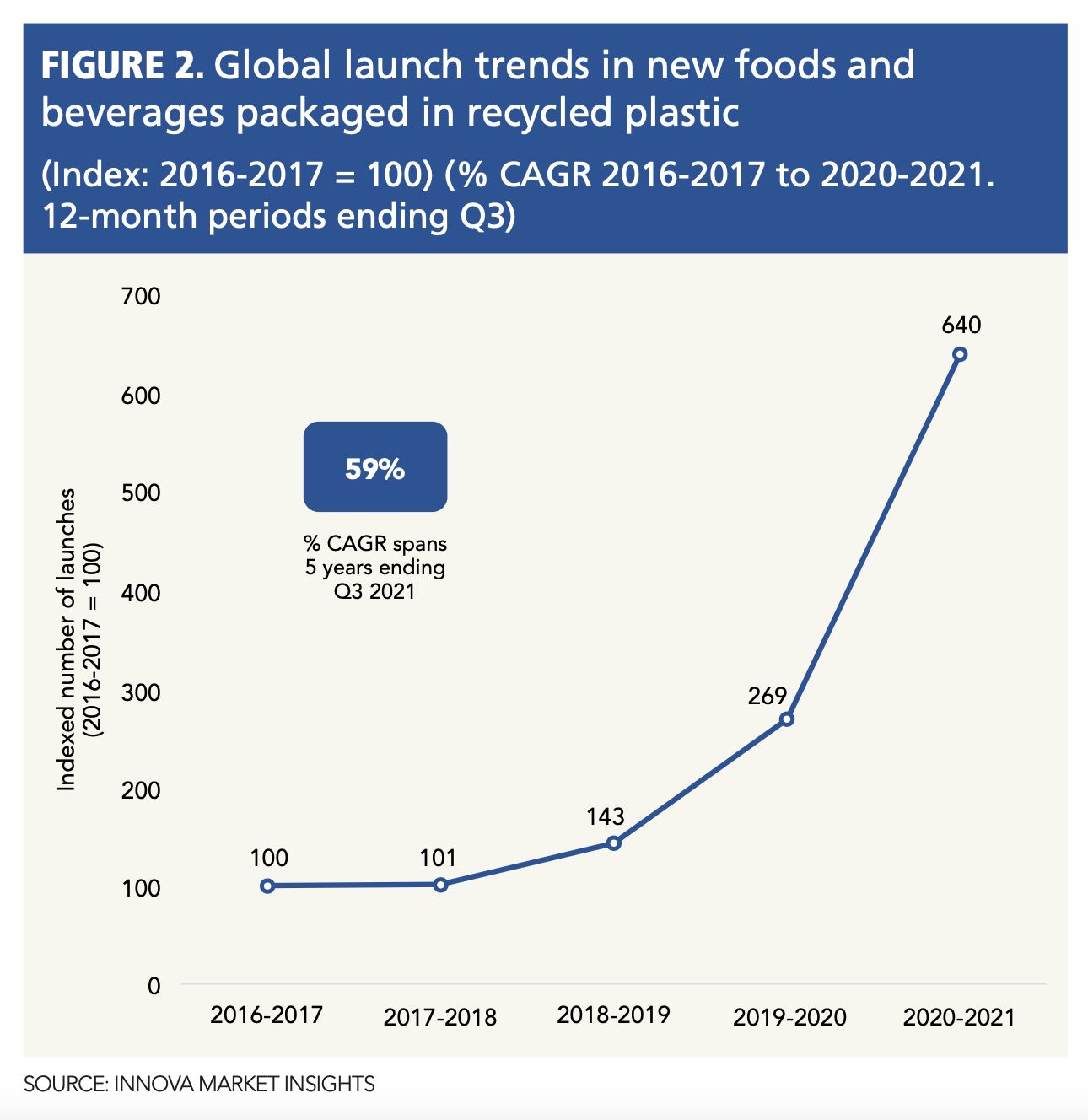

As mentioned, companies’ use of recycled plastic is also “surging,” Innova states. It notes a 59% CAGR for global food and beverage launches packaged in recycled plastic between 2016 and 2021 (See Figure 2), adding, “Many suppliers still target one specific issue that is most relevant to their own products (e.g., plastic use in beverages).” Examples include Carrefour Sensations’ Greeny Juice in France, packaged in a bottle made with 100% recycled plastic, and the Pepsi Max Cherry Cola beverage launched in the UK last year in a bottle that is 100% recycled and “now made from other bottles.”

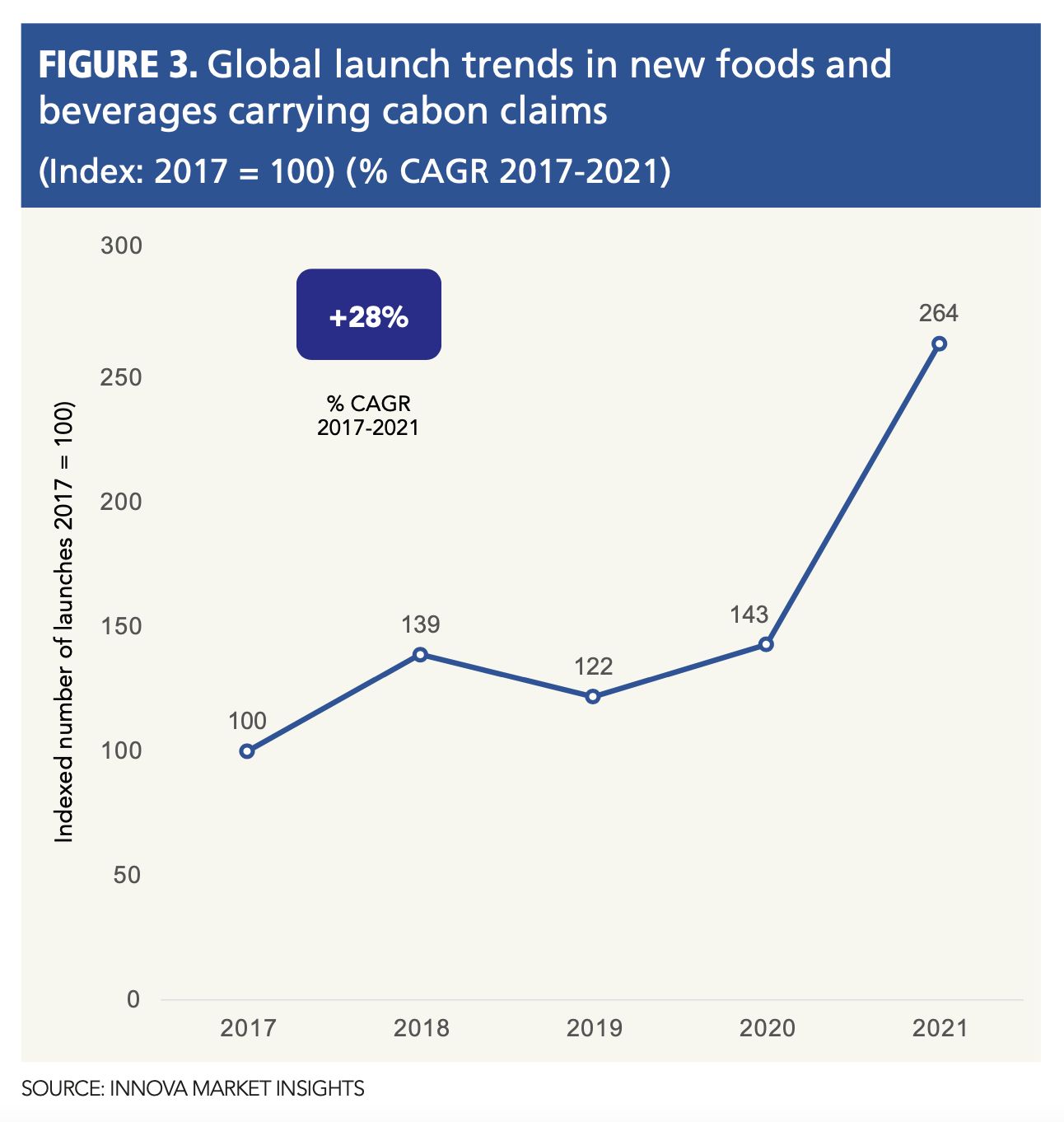

Carbon emission claims are also popular. Innova notes that global new food and beverage launches touting carbon claims grew at a 28% CAGR in 2017-2021. (See Figure 3.) “Complete carbon neutrality is the Holy Grail,” it adds. Such launches span all types of products. Innova points to examples like Lightlife’s Plant-Based Chicken Fillets launched in Canada earlier this year, which are “made by a carbon-neutral company,” and Candy Kittens’ Eton Mess Gourmet Sweets confectioneries launched in the UK last year made with vegan-friendly fruit gums and palm oil–free ingredients and which are carbon neutral.

Working with Consumers

With sustainability claims pervading the food and drink market, companies need to clearly communicate to customers exactly what they bring to the table. They must also substantiate those claims with evidence.

“Brands are moving on from proclaiming their credentials to meeting a clear, agreed-upon, and understandable measurement of their environmental and social impact,” Innova states. “They need to work together and with consumers to build trust in the claims of a positive climate impact, ensuring universal acceptance of certifications and greater public faith in the transparency of brand actions. This requires quick, clear, tangible, and trusted information combined with a product life story that stands up to scrutiny.”

Luckily, the tools to do so are better than ever today. Innova points out that “New schemes are emerging to give overall scores and ratings to help consumers compare and measure, while some brands even quantify their environmental impact (e.g., carbon emissions).”

With these tools, companies are able to spell out for shoppers exactly what their products’ carbon footprints are. For instance, Oatly’s Hafer Deluxe Oat Drink, launched in Germany earlier this year, defines its “climate footprint of 0.33 kg of CO2 equivalent per kg.” Violife Foods’ Vioblock Unsalted Vegetable Fat Spread, debuted in Greece this year, “is a plant-based spread with a defined climate footprint of 0.5 kg of CO2 equivalent per 100 g.”

Making consumers passionate about sustainability issues—so passionate that they will prefer to purchase products from sustainable brands—is also an important part of the endeavor. Consumers won’t appreciate brands’ efforts towards sustainability if they don’t understand the importance and benefits of those efforts.

To this end, some brands are helping consumers measure their own eco-footprints. “Some companies are offering consumers easy online tools to help them assess their own impact on the environment,” Innova says. “For example, Unilever’s The Vegetarian Butcher now offers both home cooks and chefs a chance to see what impact they would have on their eco footprint if they switched from meat to plant-based alternatives.” Another example is beer-maker Corona, whose Plastic Reality AI experience shows consumers the effects of their plastic footprint. “You can’t solve a problem you can’t see,” the company’s website says. “That’s why Corona will show you how the plastic you use goes into the ocean…”

By staying connected and informed, CPG brands and their customers can continue improving the footprint of what people consume each day. It won’t happen overnight, but it will happen together.

Reference

- Mohommad A, Pugacheva E. International Monetary Fund working paper. “Impact of COVID-19 on Attitudes to Climate Change and Support for Climate Policies.” Published February 4, 2022.

Concerns by Region

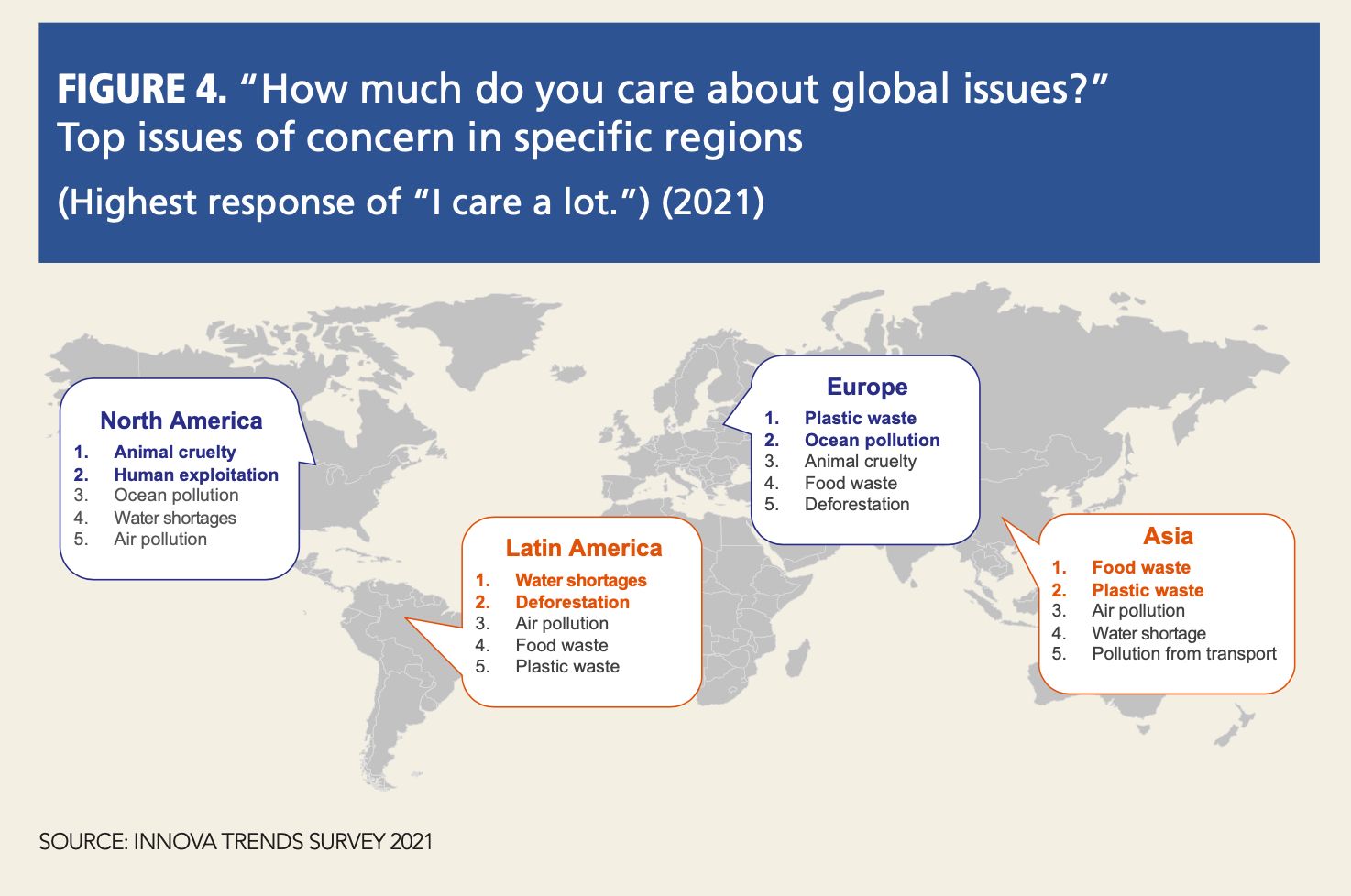

Sustainability priorities differ depending on where a consumer lives. Climate change issues felt closer to home will always take center stage. When Innova Market Insights asked consumers around the world about which global issues most concerned them in 2021, the answers differed by location.

In North America, for instance, the top concern was animal cruelty, followed—in order—by human exploitation, ocean pollution, water shortages, and air pollution. “Pure environmental concerns take second place to animal and human welfare” in North America, it says.

In Latin America, the priorities in order were water shortages, deforestation, air pollution, food waste, and plastic waste. Notes Innova: “Water and deforestation issues are key as they are already impacting local lives and livelihoods” in the region.

In Europe, priorities were plastic waste, ocean pollution, animal cruelty, food waste, and deforestation. “Plastic waste and its role in ocean pollution are hot topics in Europe,” Innova says.

And in Asia, the top concern was food waste followed by plastic waste, air pollution, water shortages, and pollution from transport. “Waste is a significant concern to Asian consumers, while air pollution is also relevant,” says Innova.

Overall, it found, levels of sustainability concern were highest in Latin America and lowest in North America. “When asked about the big environmental issues, consumers care most about animal cruelty, plastic waste, and food waste, although there is some variation by region. For example, water shortages and deforestation are most important in Latin America, and plastic waste and ocean pollution are most important in Europe.”

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)