How to compete in the crowded protein market

How to put the spotlight on your protein product

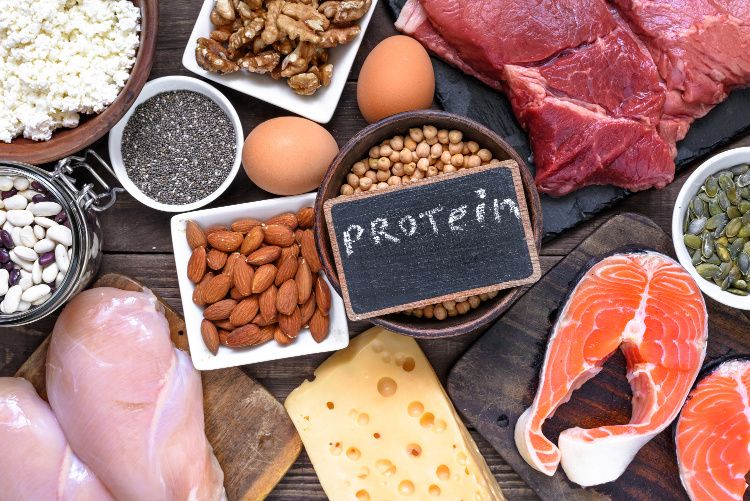

Photo © AdobeStock.com/samael334

The number of protein-promoting foods and beverages launched in 2017 nearly topped 6,000, according to an inventory of Mintel’s Global New Products Database GNPD. But quick: Can you name even two introductions that truly stand out from the pack?

Okay, maybe you can. But you’re a professional; you get paid to keep track of this stuff. The average consumer, on the other hand, likely isn’t as well-informed. And it’s a good bet, too, that outside changes in his or her favorite brands and flavors, the average consumer can’t spare much processing capacity for noticing protein innovations, either-whether in beverages, bars, or beyond.

The upshot is that each of those roughly 6,000 protein-promoting debuts has precious little time or room in which to get its proverbial foot in the door. And that raises the question of how, in such a competitive and crowded protein category, any not-yet-established product can survive-let alone thrive.

Saturation Point

Clearly, some products aren’t. Consider that according to research firm IRI (Chicago), protein supplements alone-which the firm captures as “weight-control powders and liquids, either ready to drink or powder forms” (no bars included)-took in $3.4 billion in total sales at brick and mortar food, drug, and mass retail in 2017. That’s a boost of 3.4% over the previous year’s take, but it’s also a moderation of the annual growth the category had enjoyed since 2012, during which its CAGR was a healthy 8%.

“So it would appear that the protein supplement space may be slowing down or saturating after a good four- to five-year run of strong growth versus the rest of CPG,” observes Lisa C. Buono, client insights principal, IRI health care vertical.

Granted, protein sales may be strengthening online, contributing to a softening in brick and mortar, Buono notes. Nevertheless, another sign that protein supplements may possibly be finding their level, or reaching saturation with domestic households, is the apparent “dwindling of innovation,” as she calls it. “Over the last three years,” she says, “we’ve seen the percentage of dollar sales of protein supplements that were entirely new to the marketplace go from 6% down to 2% in 2017.”

Opportunities Abound

Yet, experts insist, opportunities to keep protein’s demand curve pointing up and to the right abound. After all, there doesn’t appear to be a shelf or section of the supermarket-or supplement shop-that protein can’t colonize.

“Walking through the grocery aisles, you see high-protein claims on everything from cereals to ready meals and even ice cream,” says Stephanie Lynch, vice president of sales, marketing and technology, IDF (Springfield, MO). “There are very few segments that haven’t yet joined the protein trend, and consumers are eating it up.”

It doesn’t hurt that protein also possesses near-universal appeal. “The protein market attracts a broad range of consumers who seek it for sports recovery, weight management, satiety, and other reasons,” Lynch continues. “Athletes and fitness competitors aiming for muscle development seek products that deliver a high amount of quality protein rich in BCAAs and EAAs”-branched-chain and essential amino acids, respectively. “Meanwhile, health-conscious snackers look for protein-packed products that fit their nutritional and lifestyle goals, such as being gluten-free.”

Diet Tribes

Indeed, “lifestyle nutrition” is a key protein growth driver. When SPINS (Chicago) measured sales of products flagging protein as the primary functional ingredient for the 52 weeks ending September 12, 2018, it found growth in nine out of 10 categories when products were also labeled “vegan,” notes Kimberly Kawa, retail reporting analyst at SPINS.

“And both of the categories where Paleo-positioned claims appear-shelf-stable wellness bars and gels, and protein supplements and meal replacements-have double- and triple-digit growth rates. So diet tribe marketing may be a consumer’s cue to look more closely at protein content, sourcing, and quality attributes,” she says.

That’s certainly the case for diet tribes gravitating toward plant-based proteins-demand for which has been growing faster than for protein more generally, observes Jeff Hilton, chief marketing officer and co-founder, BrandHive (Salt Lake City). “And this category has not plateaued, in my opinion. The move to plant-based sources from animal-sourced whey is real, especially as the taste profile of pea and other proteins improves over time,” he says.

But pea protein is only the start. “Hemp and chickpea protein are on the radar and growing in awareness,” he adds. And though not plant-based, cricket protein “is continuing to bang away at the marketplace and pursue the consumer who just can bring him or herself to eat bugs,” says Hilton.

Sage Advice

And that would definitely set a protein product apart from the crowd-which is among the key qualities that Buono believes a new protein product needs to succeed. “Your product must have a point of difference to steal users who’ve already found their preferred protein supplement,” she says-“especially at this time when the category seems to be slowing in growth and shaking out a bit in terms of brand availability.”

As for further means of getting a leg up, Buono notes that protein products with natural ingredients-or just a “‘natural’ feel or positioning”-resonate. “Consumers are craving authenticity and no GMOs these days,” she says. “Make that come through in your protein brand.”

Flavor experimentation is also important. “True, vanilla and chocolate are the primary flavors in this category, and for good reason, as they appeal to broad swaths of the population,” Buono goes on. “But more clever flavors may break through and earn shelf space.”

There’s more advice where that came from. Click on the following slides to see a handful of suggestions for putting the spotlight on your protein product.

Photo © iStockphoto.com/AdrianHillman

Build a Big Tent

A protein product has a better chance of standing out if it courts a broader base of potential suitors. And given protein’s popularity, that shouldn’t be hard to do.

“Protein’s continued growth is driven by the fact that it appeals to all demographic groups,” says Hilton. “Fitness for Millennials and Gen Xers, energy and weight management for boomers, wasting and muscle loss prevention for seniors-protein is an entry point into supplementation for all ages, and people are comfortable with it because they trust the source, dairy or plant.”

Terri Rexroat, vice president, team lead, Latin America, U.S. Dairy Export Council (USDEC; Arlington, VA), agrees, adding that while protein pays dividends for athletes, brands shouldn’t pitch it solely to first-string players. “People often envision the well-established benefits of protein-increased muscle mass when combined with resistance training; aid in muscle recovery after endurance exercise-as being reserved for young, competitive athletes,” she says. “But new research shows that dairy proteins have great benefits for women-without adding bulk-as well as for older individuals in helping fight sarcopenia, or age-related muscle loss.”

With those wider benefits in mind, she suggests brands aim their products at consumers who “embrace all-day protein consumption via on-the-go applications, and who drive demand for the addition of protein to more ready-to-drink beverages and portable snacks.”

In other words, consumers for whom protein fuels daily life. As Hilton says, “Position your protein product for everyday performance-meaning being active, running the kids to soccer, walking in the park. Stay away from sports nutrition positioning; it’s a jungle in there.”

Make Protein Snackable

Photo © iStockphoto.com

Rexroat was on to something in noting the potential of the protein-packed snack.

Indeed, says Hilton, “Protein snacks are hot, hot, hot.” With round-the-clock snacking replacing what he calls the “three-meals paradigm,” protein brands would be wise to give consumers “something to sustain energy between feedings.”

Of course, consumers have treated bars and beverages as snacks in the past. But they expect more now-and brands can give it to them. “Bar delivery and protein-enhanced functional drinks continue to drive the category,” Hilton says. “But protein-fortified snacks and even breakfast cereals are on the horizon. I think the greatest innovation is happening in better-for-you snacks and desserts.”

For her part, IDF’s Lynch believes “the next big thing” will be protein crisps and kid-friendly snack formats. “Fortified snacks could be a solution to helping kids get enough protein and nutrition needed for development,” she says. “Understandably, discerning parents no longer want to dole out snacks with little to no nutritional value, and they’d welcome a healthy option that allows children to enjoy their protein.”

Stephanie Mattucci, associate director, global, food science, Mintel (Chicago), adds a few more entrants to the roster of snack-ish protein vehicles, noting that “overlooked categories, such as cottage cheese, and unexpected categories, such as biscuits, chocolate and ice cream, are leveraging high-protein claims to appeal to protein-seeking consumers.”

Photo © AdobeStock.com/samael334

Promote the Protein

According to Mintel, the average amount of protein per 100 g in high-/added-protein food and drink launches has slightly increased across most regions over the past five years. Yet surprisingly, some brands fail to capitalize on claims that may call attention to their products’ protein content.

“Consumers continue to seek protein in their diets, yet not all categories are using protein claims to their advantage,” Mattucci says. “So brands should consider using high-protein claims, especially in prepared meals and fish, meat, and egg products.”

That said, even though the percentage of global food and drink launches with a high-/added-protein claim has doubled over the past five years, label claims alone “still may not be enough to help consumers know if they’re getting enough protein,” Mattucci continues. But they can certainly help, especially among the 62% of U.S. food purchasers who, Mintel found, agree that information on packaging is important when making food choices.

Photo © iStockphoto.com

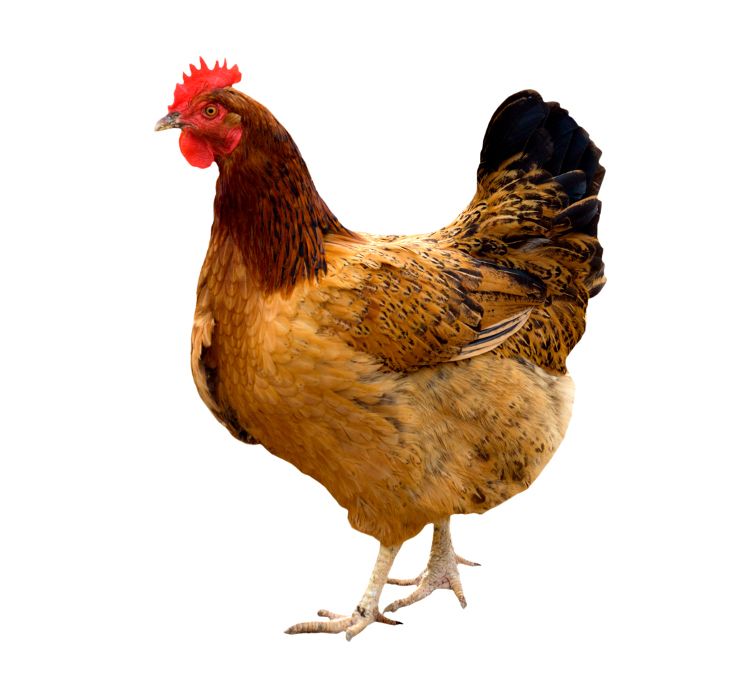

Meat in the Middle

Looking to cut through the noise in the protein bar space? Lynch has a tip: “None of the bars on Bodybuilding.com’s 2018 list of top-ten protein bars is meat-protein-based, showcasing an opportunity for innovation.”

And you thought cricket protein was novel.

Yes, chicken meat may be a mealtime staple, but chicken protein powder is a newcomer in a sector long dominated by whey and soy.

And Lynch makes a solid case for it. “Chicken meets most of today’s nutritionally based lifestyle trends and is a diet-friendly protein for nutrition products, supplements, and packaged foods,” she says. Her company, IDF, supplies a CHiKPRO powdered chicken protein that can go into everything from snacks to supplements and delivers 25 g of complete (PDCAAS score 1) protein per 30-g scoop, along with zinc, iron, and a 2-to-1 potassium-to-sodium ratio.

Certified Paleo and keto-friendly, the powder is also free from common allergens like milk, soy, and tree nuts. USDA granted it an exemption whereby formulators can use it in supplements at up to 100% of the finished formulation without USDA inspection, and with the final product bearing a supplement facts panel rather than a nutrition facts panel-important information from a regulatory standpoint.

But more compelling is the fact that meat-based protein bars are winning consumers over, “in many cases through the combination of trusted protein sources and novel flavors,” Lynch says. “According to Datamonitor, the meat snack category will continue to see impressive growth.”

Photo © iStockphoto.com

Ask Yourself, “Would I Eat This?”

Nobody’s going to keep buying a protein-packed product that’s unpalatable. But protein’s reputation as a “challenging” ingredient from a flavor standpoint is, alas, “well-earned,” says Hilton. “Brands struggle to balance taste, nutritional content, the need for sweeteners, and more.”

But balance is attainable. Hilton notes that he’s seen brands succeed by using a plant-based sweetener sourced from the Indonesian cassava plant, which, he says, “is very popular among those who make their own protein bars at home.”

And Rexroat reminds formulators that dairy proteins are an exception to that “challenging” flavor rule. In fact, research from North Carolina State University found that while plant proteins exhibit “beany, earth, sulfurous, and sour notes” that often necessitate the use of flavor maskers and stabilizers-and complicate ingredient statements as a result-dairy proteins “are mild flavored and exhibit sweet aromatic and milky attributes,” Rexroat says. “These differences in sensory perception allow dairy proteins to offer a superior and more versatile sensory experience because they complement, rather than overpower, the flavors of the foods and beverages to which they’re added.”

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.