Dietary Supplement and Natural Product Brand Building: From Lightbulb to Launch

Tips for building a brand in today’s supplement marketplace

Tips for building a brand in today’s supplement marketplace

When Jeff Hilton says “fascinating things” are happening in the supplement space, grab a chair and take notes. An old hand at health-and-wellness branding, the chief marketing officer and cofounder of BrandHive (Salt Lake City) has had both a front-row seat and a backstage pass to the industry’s evolution since Ronald Reagan was in the White House.

So when he predicts that we’re “in the early stages” of a major shift in how consumers approach health, he does so with some authority. And what his privileged perspective tells him is that an “entrepreneurial surge” is bringing about a bumper crop of brands backed by compelling stories, creativity, and resourcefulness to spare.

But those budding brands-and the industry as a whole-face a very different playing field than the one that existed back when nutritional supplementation meant taking the multivitamin you picked up at the grocery store. “We’re going through a thought revolution and a new-product revolution,” Hilton says, and the theme he sees underlying both is convergence: of channels, media, dayparts-even of foods and beverages with supplements themselves. It’s uncharted territory, for sure, but brands that follow these five key strategies will find “huge opportunity,” Hilton promises, as they navigate it.

Tip 1: Eat, Drink, and Be Healthy

“If you look at the landscape for supplements, foods, and beverages over the next 10 years,” Hilton says, “where the excitement and opportunity are is in the food and beverage sector.” That should come as no surprise to anyone who’s scanned a functional snack or smoothie label and realized there’s not much separating them nutritionally from the multivitamins of yore.

To nascent brands that already embrace edible and potable platforms for functionality, that’s encouragement to keep up the good work. But for old-school supplement marketers, “I think it’s a bit of a wake-up call,” Hilton says. “If I were a supplement manufacturer-and I tell my clients this-I’d be watching my back because I think the big-picture trend is away from popping pills and more toward adding functionality to what we’re already consuming.”

Need proof? Just ask a Millennial, who isn’t “going to pop 30 pills a day,” he says. Even Boomers, he adds, are “increasingly pill averse.” And while capsules and tablets aren’t going the way of the dodo just yet, consumers’ desire to make nutrition not just quick and convenient but an experience that’s “natural” and hedonically appealing explains why demand for functional bars, shots, gels, drinks, and snacks “is going through the roof,” Hilton says.

And remember: “The whole three-meal-a-day paradigm is dead or dying,” Hilton declares. Any brand that grasps how consumers are redefining traditional dayparts-turning breakfast, lunch, and dinner into the midmorning nosh, post-lunch perk, pre-workout refueling, trans-commute nibble, and so on-will meet those consumers where it matters.

Tip 2: Tell ‘Em a Story

And speaking of what matters, consumers don’t just insist on functional options that fit their lifestyles; they want products that fit their psychological and emotional constructs of what health and wellness really mean. That’s a cue to write a backstory for your brand that engages consumers. As Hilton says, “The brands that are succeeding are the ones that are trying to educate.”

It’s a lesson that Janie Hoffman, CEO and founder, Mamma Chia (Carlsbad, CA), knows by heart. “The greatest brands in the health-and-wellness space often come from an authentic place-a desire to better the world or enable people to live healthier lives. It’s this authenticity that can resonate with consumers and create a loyal following.” For her, authenticity involved sharing the benefits of chia with a wider audience. “Those tiny little seeds had a dramatic effect on my health and vitality,” she says, “and it was my passion for them that drove me to create Mamma Chia.”

In a happy coincidence, putting her brand narrative on the table made it easier to stand out on a crowded shelf. “We think less about our competition and focus our efforts more on making delicious, healthy, chia-based products and creating a sustainable and conscious company,” she says. “When your values align with your customers’ and your products fulfill their needs, sales will follow.”

That said, it still doesn’t hurt to stand out, and Hoffman wasn’t shy about giving consumers a product they’d notice. Her flagship chia drink “was unlike anything that existed at the time,” she says. Appearances helped, too, and she chose “a beautiful bottle with bright, eye-catching packaging that drew in consumers.” She’s taken a similar approach with her new Chia Granola Clusters and Vitality Bars, enveloping them in “bright packaging with strong, clear statements about the products’ attributes.”

Tip 3: Make Functionality Worth It

Strong, clear statements about a product’s attributes are as much a part of the “education” mission that Hilton associates with success as are those feel-good product backstories. And given the proliferation of products bidding for consumers’ trust with good-for-you claims, you can understand why.

“Right now,” Hilton says, “I think one of the challenges for the consumer is that they’re trying to figure out the value of functionality.” While they’ll buy the idea of enhanced protein, fiber, probiotics, and omega-3s, do they have the tools to calculate its actual monetary value? As Hilton asks, “Am I willing to pay an extra fifty cents for a yogurt because it’s got nutrients in it versus a salty snack that’s not going to do me any good?”

While that’s the consumer’s decision to make, “we as brands have to put out that knowledge and help create that value by telling them that they’re getting something special,” Hilton says. “We have to do our part in promoting value.”

And to the extent that “value” comes from delivering the nutrition your product promises, Hilton warns against providing what he calls “storefront functionality: a little hint of this or that, but nothing that’ll make a substantive difference” to wellness. Not only is the practice sneaky; consumers are growing increasingly savvy at asking the tough questions to suss it out, too.

Tip 4: Blind Them (Figuratively) with Science

The best shield against that kind of consumer skepticism is evidence-based formulation. “The separation of the wheat from the chaff,” Hilton says, “is going to come from products that are offering true functionality that’s valid and related to science.” That means telling consumers how much of an ingredient your product truly delivers and educating them about the studies demonstrating its efficacy. As Hilton says, “Science is key. It helps differentiate the real products from the imposters.”

It also attracts the attention of capital, while warding off that of regulators. As Grant Ferrier, founder and CEO, Nutrition Capital Network (NCN; San Diego), says, “Investors are skeptical of claims that may not hold up or that may cause FDA or FTC woes. And they certainly view a significant part of the value of a company as being locked up in its intellectual property, not just top-line sales or bottom-line EBITDA”-finance-speak for earnings before interest, taxes, depreciation, and amortization.

“There are still examples of marketing-based companies that show some success with relatively little scientific backing, or with borrowed science based on one ingredient or formula,” Ferrier concedes. “But the true pioneers”-and those companies with the highest potential for profit-“have either a proprietary application of a naturally occurring compound, or a formula that’s been properly tested in the lab, in animals, and, ultimately, in humans in a clinical-trial environment.”

Know Your Channel, Know Your Consumer

That’s a tall order, the precise height of which will vary with the claims a marketer wants to make and the benefits a product proposes to deliver. But the growing role that researchers, investors, and other “outsiders” now play underscores just how many forces are converging on the health-and-wellness sector.

As further proof that “convergence” is a sign of the times, Hilton refers to what he calls “channel convergence”: that blurring of the lines between retail, online, multilevel marketing-all the venues available for making health-and-wellness purchases. Hilton notes that medical practitioners are even getting into the channel game, dispensing supplements in their practices.

So, he continues, “the fact that consumers have control over where and how they buy supplements has turned the paradigm upside down by allowing them to circumvent the retailers entirely.” While this could stymie brands unfamiliar with outlets beyond retail, those with new-channel and new-media chops should find channel convergence an opportunity to get ahead.

That’s how Hoffman sees it. “Social media has been an important marketing strategy for us from the very beginning,” she says. “Engaging your core customers personally and directly engenders brand loyalty and creates a coalition of ‘ambassadors’ who willingly share their love for your brand with the world. And by truly listening to those audiences, you can gain valuable insights that can help drive product development and line extensions.”

And Millennials, for now at least, dominate those online audiences. That being the case, Hilton can’t emphasize enough: “They’re not looking for the same experience or engagement as Boomers.” The ways in which the two groups apprehend health and wellness “are more different than they are alike,” he notes, with the upshot being that “you’ve really got to look at these markets individually.”

Take Millennials’ general opinion that bigger isn’t always better, especially when it comes to the companies that make and market their favorite products. “We know that Millennials love niche brands,” he points out. “Many are actually big-brand averse and would just as soon buy from a small brand because they feel like they can own it and have a part in it.”

And for brands that aren’t trying to conquer the world, that sounds fine. “We don’t believe in being all things to all people,” Hoffman says. “The key to success lies in having a product whose attributes are desirable to a sizeable audience but that aren’t so generic that you’re unable to generate demand.”

And she should know. The changing marketplace converged with her willingness to take a risk at just the right time. “The health-and-wellness industry changes almost daily,” she says. “Smaller, entrepreneurial organizations tend to be more nimble, allowing companies to introduce products faster and self-correct as needed. And don’t underestimate the power of passion! It often requires tenacious perseverance tosucceed in a crowded marketplace.”

Sidebar:

What Comes First: The Ingredient or the Market?

So you want to break into the health-and-wellness market? Well, no matter what, make sure you secure a blockbuster functional ingredient first, and then develop a string of products that direct it at a handful of wellness need states…Or, wait. Maybe you should do the market analysis first, find out which health concerns are top of mind, and then build a stable of ingredients that address them…

…Or does it even matter?

To find the straightest route to success, we asked a few industry insiders what they thought. Not surprisingly, their answers depended on where within the industry they stand.

“Most developers are successful because they’ve devoted scientific research and product-development time to an ingredient or family of ingredients and have honed a formula or process to isolate or stabilize a blend of bioactive compounds. ‘Ingredient-driven’ is the answer. By all means, a developer also has to have an endpoint in mind for a need state with significant market-share potential to validate the business prospects of all their technical work. But starting from market demand and fishing about for a technical solution rarely works for an entrepreneur, although it’s often precisely what the big companies and well-funded investors look to do-i.e., identify five or six major need states and search a portfolio of potential technical solutions to evaluate and possibly invest in, buy, or license.”

-Grant Ferrier, founder and CEO, Nutrition Capital Network (NCN; San Diego)

“Building our brand around an ingredient has been the key to our success. Chia seeds are one of the world’s healthiest foods, with attributes that apply to a variety of different audiences. With chia, we could appeal to athletes, fitness and outdoor enthusiasts, and wellness seekers, as well as to those concerned with energy, weight loss, and heart health. This gave us a broad platform from which to build our brand.”

-Janie Hoffman, CEO and founder, Mamma Chia (Carlsbad, CA)

“I definitely have a bias for outside-in development. Looking to the market is what I do; others may not feel that way. But I think success can come both ways. [Ideally, both approaches] kind of meet in the middle. But my personal bias is always that the marketplace should speak to the opportunity. It doesn’t matter what widget you have if there’s no demand for it.”

-Jeff Hilton, chief marketing officer and cofounder, BrandHive (Salt Lake City)

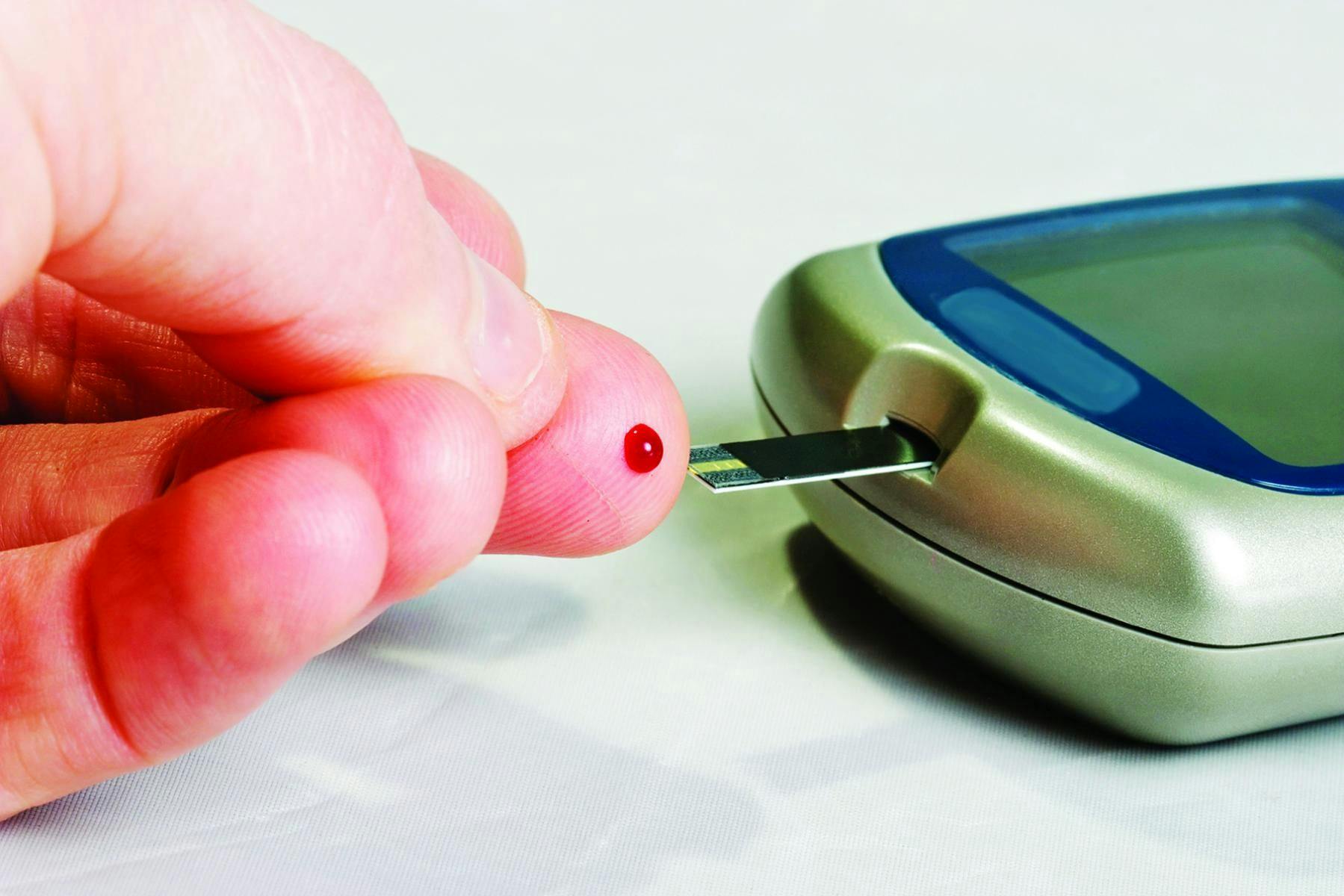

Photo © iStockphoto.com/kaan tanman

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.