Children and Dietary Supplements: Little Kids, Big Market

Product launch update: The children’s nutrition product category is flourishing.

Photo © iStockphoto.com/MarsBars

In an increasingly competitive food, drinks, and supplements market, children are just one of the demographics gaining increased attention from manufacturers. Parents generally drive the healthier choices, with particular interest today in clean-label claims such as organic, no additives/preservatives, GMO- and hormone-free, and low and light alternatives-particularly reduced sugar.

While the majority of parents buy products for their children, they still do consider input from the younger generation with regard to product and brand choice. For assured success, then, supplement manufacturers must aim to satisfy both parents and their children in order to win loyal customers and repeat purchases.

Supplements: A Growing Market

The market for children’s supplements has seen strong growth in recent years, in line with growing sales of dietary supplements as a whole and reflecting increasing consumer interest in using supplements for additional nutritional support. For children, parents tend to focus on areas of general health, immunity, closing potential dietary/nutritional gaps, and boosting cognitive development.

The United States drove new-product activity in supplements in 2015, with North America accounting for over 40% of global children’s supplement launches recorded by Innova Market Insights in 2015-reflecting the highly developed nature of the market (the largest in the world). Europe came next with just under 30% of global launches, trailing the United States despite Europe’s large number of countries.

The United States was responsible for over 34% of supplements targeted at children aged 5 to 12 years. (This 34%, however, equates to just 2.6% of total U.S. dietary supplement introductions over the same period.)

Graphic Appeal

Character licensing is a longtime marketing approach to capture children’s interest, and it’s no different in the kids’ supplement aisle. Character introductions in 2015 included Thomas & Friends from Health Science Labs, Marvel Ultimate Spider Man from Sundown Naturals, and Nickelodeon Spongebob Square Pants and Viacom Nickelodeon Teenage Mutant Ninja Turtles from International Vitamin Corp. Meanwhile, supplements brand NatureSmart licensed a range of Disney themes, including characters from movies like “Frozen,” “Finding Nemo,” “Cars,” and “Mickey Mouse.”

Nutrients for Kids

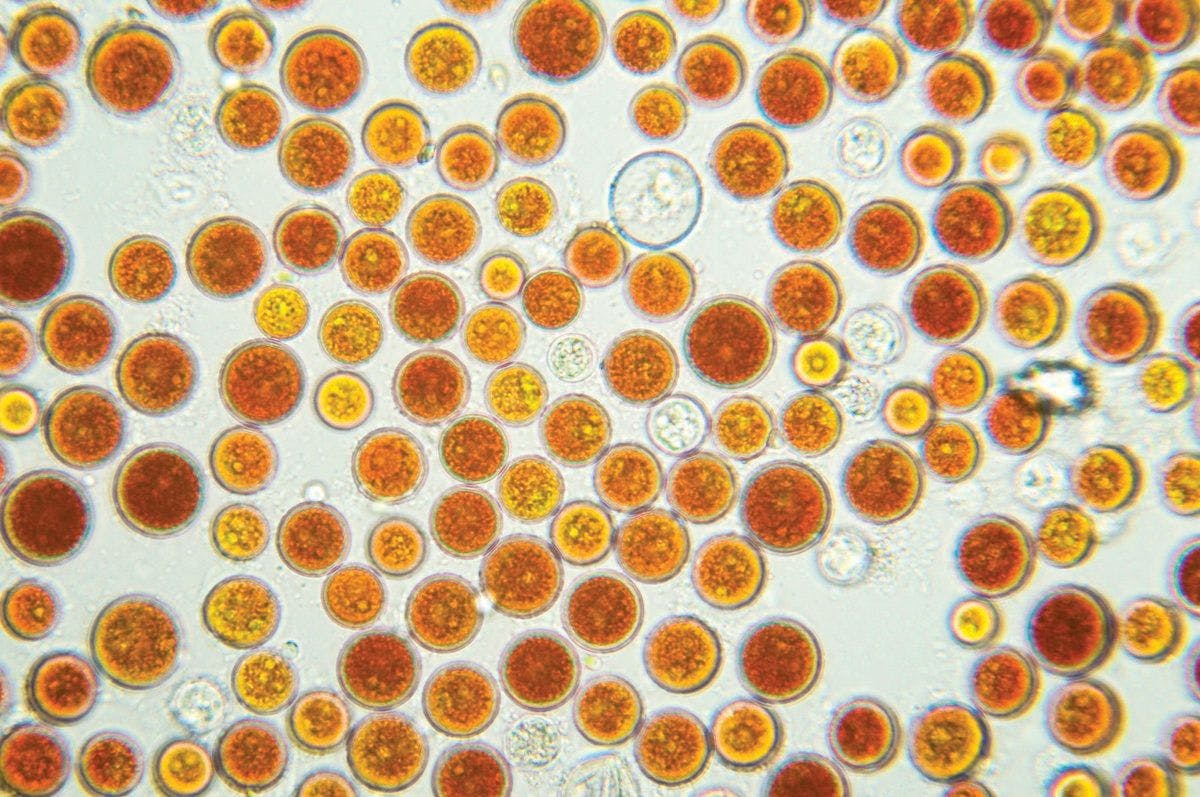

Multivitamin and mineral formulations continue to dominate the children’s supplements market, but kids’ supplements are also branching out to encompass more specific types of supplementation, such as DHA/omega-3 fatty acids, calcium and calcium with vitamin D, probiotics, and fiber. Examples includes Kids First Fiber from Nature Made, Solgar’s U Cubes Calcium with vitamin D3, and Olly’s Lil Olly’s Kids Multivitamins plus Probiotics.

At this year’s Natural Products Expo West trade show in Anaheim, CA, omega-3 brand Nordic Naturals introduced two new kids’ products: Probiotic Gummies Kids (containing 1.5 billion live cultures and prebiotics) and Vitamin D3 Gummies Kids, in “merry berry punch” and “wild watermelon splash” flavors, respectively. Like all of the brand’s kids’ gummies, the products are non-GMO and free of gluten, milk derivatives, and soy, and they contain no artificial colors, flavors, sweeteners, or preservatives.

Delivery Systems

Methods of delivery have also changed in the kids’ supplements sector, with a move away from tablets and capsules and toward alternative, easier-to-consume formats such as powders and liquids. There is still a fairly widespread move into the gummy format, as well as wider availability of chewable options. Plus, there is rising interest in products that straddle the boundary between supplements and foods, such as fortified confectionery drops, chews, and gums, as well as supplement-type beverages.

Hide the Veggies

It’s often easier to get kids to eat more fruits; not so much with vegetables. In response to this, cookbooks have increasingly focused on ways to increase children’s veggie intake by disguising the vegetables in popular dishes-a trend that’s carried over into the packaged food market. Now, a wide range of children’s meals feature “hidden vegetables,” pureed and blended with other ingredients so that their presence is not immediately obvious. Smaller, specialized baby and children’s food brands are highly active in this area-such as children’s brand Kidfresh, which adopted the concept for all of its recipes.

The dried-pasta market has incorporated vegetables for some years, with ConAgra’s leading pasta brands, including Golden Grain, Mueller’s, and Ronco, all featuring a range of Hidden Veggie options, all with the color, texture, and taste of standard lines. Mueller’s, for example, has a range of spaghetti and pasta shapes with added vegetables such as carrots, sweetcorn, and squash comprising one full serving of the daily requirement of vegetables per portion. Similarly, there is ongoing hidden-vegetable activity in pasta sauces-especially using a tomato base with additional vegetables mixed in.

In the snacks space, similar activity includes Funley’s All Natural Super Crackers range: the Cheddar n’ Stuff line (with hidden broccoli), Pizza n’ Stuff (hidden carrot), Ranch n’ Stuff (hidden spinach), and Cornbread n’ Stuff (hidden sweet potato).

Also read:

High-Priority Nutrients for Kids

Weight Management and Nutrition Strategies for Children

Child Vitamin Doses: Small Doses, Big Issues

Innova Market Insights is your source for new-product data. The Innova Database (www.innovadatabase.com) is the product of choice for the whole product-development team, offering excellent product pictures, search possibilities, and analysis. See what food manufacturers are doing around the world: track trends, competitors, ingredients, and flavors. In today’s fast-moving environment, this is a resource you cannot afford to be without.

Innova Market Insights is your source for new-product data. The Innova Database (www.innovadatabase.com) is the product of choice for the whole product-development team, offering excellent product pictures, search possibilities, and analysis. See what food manufacturers are doing around the world: track trends, competitors, ingredients, and flavors. In today’s fast-moving environment, this is a resource you cannot afford to be without. - See more at: http://www.nutritionaloutlook.com/authors/innova-market-insights#sthash.1cDDmTgY.dpuf

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.