Carbon-14 Analysis and Dietary Supplements

How carbon-14 analysis can confirm a dietary supplement’s natural content

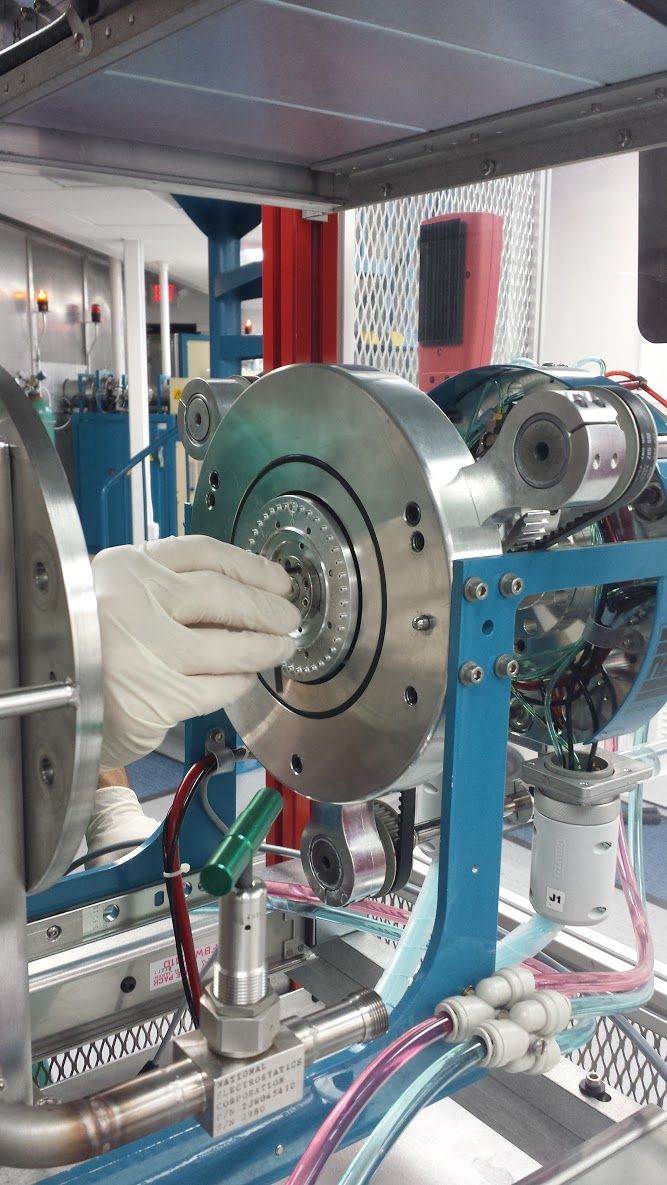

Photo of an accelerator mass spectrometer (AMS) used to perform carbon-14 analysis. Photo from Beta Analytic.

The current regulatory landscape is hazy when it comes to criteria for vitamins and dietary supplements labeled as “natural.” Still, this hasn’t stopped many supplement manufacturers from moving toward natural formulas. Synthetic vitamin complexes derived from petrochemicals can suffer from poor consumer perception, and this alone is enough to push many manufacturers developing vitamins to source plant-based materials instead of synthetic ones.

According to projections from Grand View Research Inc., the market for botanical extracts is expected to grow 9.7% annually through 2024 as a result of the rising consumer demand for plant-derived ingredients in supplements. And the total market value for dietary supplements could reach over US $278 billion by 2024, a testament to the growing popularity of nutraceuticals’ approach to health and preventive medicine.1

Data on the comparative market shares of natural and synthetic dietary supplements is scarce, but a Zion Research report2 focused specifically on antioxidants suggests, for instance, that sales of synthetic antioxidants make up approximately 60% of the total category’s revenue. The report compared revenue generated from synthetic ingredients, including butylated hydroxyanisole (BHA) and butylated hydroxytoluene (BHT), with revenue generated by natural antioxidants such as rosemary extract, vitamin C and ascorbic acid, vitamin A and carotenoids, and vitamin E tocopherols and tocotrienols. The success of synthetic antioxidants is primarily attributed to low cost, but growing demand for natural and organic products means the market share for natural antioxidants is expected to expand considerably in the near future.

Impetus for Carbon-14 Testing of Natural Products

Debates on comparative efficacy of natural and synthetic ingredients aside, synthetic analogues can suffer from increased consumer scrutiny in the “wellness” sector. With the Internet at their disposal and a host of information online, ranging from the scientific to the wildly inaccurate, increasingly inquisitive and health-conscious consumers have the tools available to research products and ingredients more than ever. As a result, companies moving into natural, plant-derived ingredients must ensure that they know how to perform diligent quality assurance when procuring ingredients labeled as natural for their formulas. These companies are now using sophisticated screening methods to vet the purity and origin of their ingredients before product launch. One such tool is carbon-14 analysis, which is used to determine whether ingredients are sourced from petrochemicals or whether they are biobased (plant, animal, or microbial).

Carbon-14 analysis is a tool that is frequently employed, for example, by stakeholders in the curcumin industry, including for turmeric powder and oleoresin, to screen for synthetic adulterants that can be procured at half the price of the natural variant.3 The method can be used to identify chemical additives in natural extracts such as amla, acerola, and baobab-products with an increasing market share and a rising price tag that makes them vulnerable to adulteration.

Carbon-14 testing is also used widely in the fragrance and flavor industry for “natural” ingredients that an importer or downstream user suspects may have been mixed with cheaper, fossil-fuel-derived substances-all in order to avert liability issues and erroneous labeling claims.4 In fact, the test method has been used internationally for over a decade in retail sectors such as cosmetics, personal care, bioplastics, and packaging.

Scope of Carbon-14 Testing in Nutraceuticals

Because many ingredients can be manufactured from coal, tar, or other fossil sources, the quality-assurance manager trying to identify such a synthetic analogue in a dietary supplement labeled as natural will undoubtedly resort to carbon-14 testing. Examples of supplements where carbon-14 testing is useful include vitamins A, E, and K; and vitamins B1, B3, B5, B6, and B12, which are frequently synthesized from fossil resources like petroleum and readily available and extremely cheap due to the enduring low cost of this commodity.

Carbon-14 testing does have its limitations. For a plant-derived vitamin C ingredient, for instance, carbon-14 testing will not differentiate between what type of plant source is used, such as acerola cherries, citrus fruit, or rose hips. Neither is it employed to differentiate the natural extract from ascorbic acid, frequently labeled as “vitamin C complex” and sourced from corn or rice starch. However, since the ingredient sources in all these cases are plant-based, when carbon-14 testing is employed, the percent modern carbon (pMC) in a sample should match that of modern-day plants when measured by accelerator mass spectrometry (AMS), the advanced technology used to perform the measurement, and, as a result, these natural sources will register as “biobased.”

The analysis is extremely flexible in application, as it can be used on samples in solid, liquid, or gaseous form, at any stage of processing-from raw materials to finished products-and requires a small sample size at the milligram/milliliter scale.

Carbon-14 analysis has long been established as a standardized method by such standardization bodies as The European Committee for Standardization (CEN), the International Organization for Standardization (ISO), and ASTM International5 as a way to facilitate comparative and reproducible testing between batches and product lines. Results from a supplier or regulator can be corroborated by duplicate analyses performed according to a standardized analytical procedure, which is welcome news to quality-assurance managers resorting to ad hoc analytical techniques or results that depend heavily on the accuracy of a laboratory’s internal reference database.

As Demand for Natural Products Grows, So Will Demand for Carbon Testing

Market projections promise a bright future for botanical extracts and plant-derived dietary supplements. In this context, tools such as carbon-14 analysis are in high demand because they can help manufacturers determine the veracity of high-value natural ingredients imported from a plethora of suppliers around the world. Such analytical tools are a vital component of quality-assurance work in any nutraceutical company to ensure that claims are substantiated before the brand name and commercial interests are put on the line.

Jasmine Garside is global operations manager at Beta Analytic. Headquartered in Florida, Beta Analytic is an ISO 17025–accredited testing facility providing carbon-14 measurements to top commercial organizations, government agencies, and scientists worldwide since 1979. Visit www.betalabservices.com for more information.

Also read:

Dietary Supplement Contract Manufacturing: Staying One Step Ahead

Radiocarbon Provides “Conclusive Test” for Detecting Synthetic Curcumin, Sabinsa Says

References:

- Grand View Research Inc., “Dietary Supplements Market Analysis by Ingredient (Botanicals, Vitamins, Minerals, Amino Acids, Enzymes), by Product (Tablets, Capsules, Powder, Liquids, Soft Gels, Gel Caps), by Application (Additional Supplement, Medicinal Supplement, Sports Nutrition), by End-Use (Infant, Children, Adults, Pregnant Women, Old-Aged) and Segment Forecasts to 2024.” Published June 2016. www.grandviewresearch.com/industry-analysis/dietary-supplements-market

- Zion Research, “Antioxidants (Natural, and Synthetic) Market for Pharmaceuticals, Food & Beverages Sector, Feed Additives, Cosmetics Industry, and Other Applications: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2014 – 2020.” Published November 2015. www.marketresearchstore.com/news/global-antioxidants-market-natural-and-synthetic-set-for-102

- New Hope Natural Media. “Curcumin Market Overview.” Accessed July 2017. www.newhope.com/webinars-toolkits-and-downloads/curcumin-market-overview-download

- European Flavour Association (EFFA). “Guidance Document on the EC Regulation on Flavourings.” www.effa.eu/docs/default-source/guidance-documents/effa_guidance-document-on-the-ec-regulation-on-flavourings.pdf?sfvrsn=2

- See ASTM D6866, ISO 16620-2, CEN 16640, CEN 16137