Asia Pacific Ripe for Health and Wellness Market

Emerging markets like Asia Pacific are the real opportunities in health and wellness.

Global demand for healthy food and drinks is rising, driven by the many individuals more aware of their nutritional intake. Such products-particularly those with a functional positioning-are often more expensive than conventional packaged food and beverages. Despite this, global sales were up 3% in 2012–2013 in constant-value terms, reaching an impressive US$749.6 billion in 2013-equivalent to 34% of total beverage and packaged food sales globally.

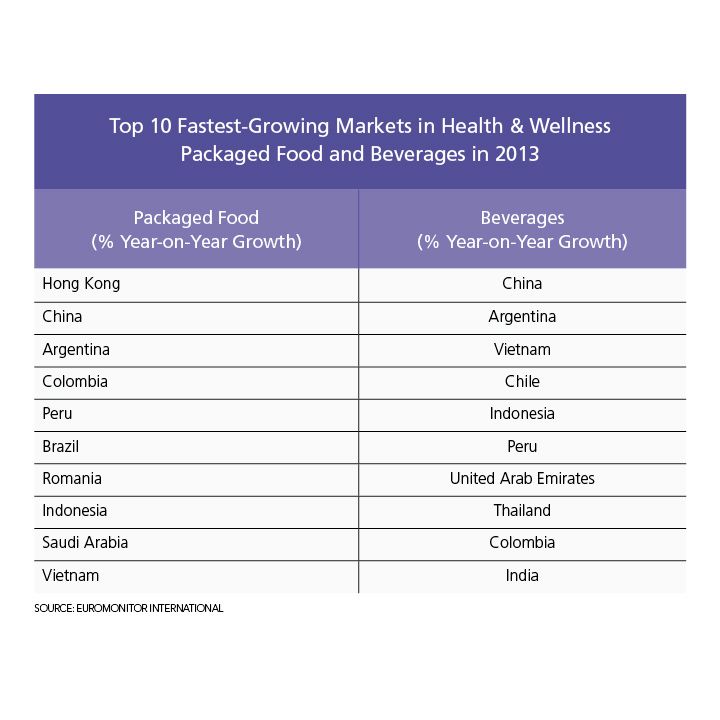

However, it is emerging markets that are driving the global engine of growth in health and wellness (HW). Euromonitor International’s HW data show that, in 2013, of the top 10 fastest-growing countries in HW packaged food and HW beverages, five and four of them, respectively, were in Asia Pacific. (See Table 1)

While China (inclusive of Hong Kong) led the way, partly driven by the incredible demand for fortified/functional milk formula, opportunities do not only lie here. Indonesia, Vietnam, Thailand, and India are significant growth markets-albeit from a smaller base-with increasing disposable income levels and rising availability of healthier food and drinks paving the way. In addition, rising health concerns related to dietary intake are also helping to fuel demand.

Diet-Related Issues Are a Growing Concern

Developing countries are increasingly facing the same challenges as developed ones where non-communicable diseases like diabetes and obesity-related conditions are concerned. According to Euromonitor International’s Countries & Consumers data, in Vietnam, for example, which ranks as the third-top growth market in HW beverages, obesity in the population aged 15+ rocketed by 92% over the 2008–2013 period; in China and India, obesity rates rose by 57% and 37%, respectively.

Owing to a multitude of factors resulting from rapid social and economic change, extremes of malnutrition and obesity exist side by side in the emerging markets of Asia Pacific. This puts a firm focus on affordable maternal and child nutrition, as well as weight management and diabetes products-hence, driving demand not just for HW products but more specifically for fortified/functional food and drinks.

Asia Pacific: 30% of Global HW Sales by 2018

In 2002–2018, the percentage of global HW sales attributed to the Asia Pacific region will rise from 20% to an expected 31%. (Click on images to see Graph 1)

A key driver of this growth is, of course, milk formula. As consumers in Asia Pacific-and, more specifically, China-become more educated about nutritional issues, and disposable income levels rise, demand for more functional milk formulas with additional omega fatty acids, probiotics, prebiotics, and a multitude of vitamins and minerals is growing. In 2013 alone, annual growth in functional milk formulas reached 18% in China.

However, while milk formula has a part to play in the strong growth, there is increasingly demand for health benefits from everyday food and drink products, as well.

Dairy Brands Capitalize on Digestive Health

In 2013, annual HW growth in Asia reached 10%, with the market predominantly driven by fortified/functional dairy brands. Wahaha, Yakult, Wang Zai, and Yili were the top four brands in Asia Pacific in 2013. While these brands resonate with different consumer groups, a common feature is their ability to promote their products’ additional digestive-health benefits.

In fact, digestive health is the third-largest HW category in Asia Pacific, behind general well being and weight management. There is a growing awareness of probiotics and the association of digestive health with retaining a slim figure.

In dairy products, it is not just the well-known vitamins and minerals that are attracting consumer attention, either; inulin, magnesium, and manganese are starting to appear in more products.

Supplements Gaining Traction

Asian consumers are looking beyond food and drinks and to supplements to boost their well being. The three highest-selling single-nutrient supplements are calcium, ginseng, and protein, and the region will post the second-highest amount of new supplement sales of US$6.9 billion over 2013–2018, behind only North America. Interestingly, despite the fact that Asia has the largest value sales of any region, it has the third-lowest per capita spend for supplements overall, indicating that vitamins and dietary supplements are relatively affordable to a large number of the population.

In tune with rising interest in digestive health, as products linked to traditional medicine continue to perform well, so, too, will probiotic supplements. For now, the region posted a constant value CAGR of just 2% over 2008–2013 for probiotic supplement sales. While Japan is the most established market in the region for probiotic supplements, in South Korea and China, demand is growing fast, with a CAGR in constant-value terms of 13% and 10%, respectively, recorded over the same time period.

Energy Boosting in Demand

Energy-boosting product sales rank next behind digestive health in Asia Pacific, with sales of US$7.8 billion in 2013. Led by TC Pharmaceutical Industry Company’s Red Bull in China and Otsuka Holdings Company’s Oronamin in Japan, the market continues to evolve with the launch of snack bars such as Soy Joy and more natural alternatives.

While caffeine remains important to the energy-boosting market, B vitamins, ginseng, taurine, and royal jelly, among many others, are also increasingly gaining presence in products, particularly soft drinks.

Linked closely to energy boosting are products that boost cognitive performance. As research on brain health and memory gains traction, this positioning has the potential to be successful in Asia. However, in order to see success, manufacturers must build consumer trust around the efficacy of products and use well-established ingredients such as omega fatty acids, vitamin E, and Ginkgo biloba. In fact, China is gearing up to be an important market for omega fatty acid supplements, particularly targeting the aging population. The country recently introduced omega fatty acid intake guidelines. It estimates that only a quarter of the population currently ingests enough omega fatty acids. These guidelines recommend 250–2,000 mg per day for adults.

A Willingness to Try Novel Ingredients

Despite rapidly increasing sales of HW products, the Asia Pacific market is far from saturated. In fact, it has the second-lowest per capita consumption of HW products of any region, only above Middle East and Africa.

To stay ahead, manufacturers should capitalize on the rising interest in functional ingredients in the region and launch new variants incorporating more novel functional ingredients. Manufacturers expanding in Asia Pacific have the significant advantage of targeting consumers who are more willing to try and have faith in new functional ingredients. Consumers’ willingness to try novel ingredients is a key to success.

Also read:

Global market overview for dietary supplements: Opportunity areas and drivers

For further insight, please contact Diana Cowland, senior health and wellness analyst, Euromonitor International, at diana.cowland@euromonitor.com.

Charts and tables courtesy of Euromonitor International

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.