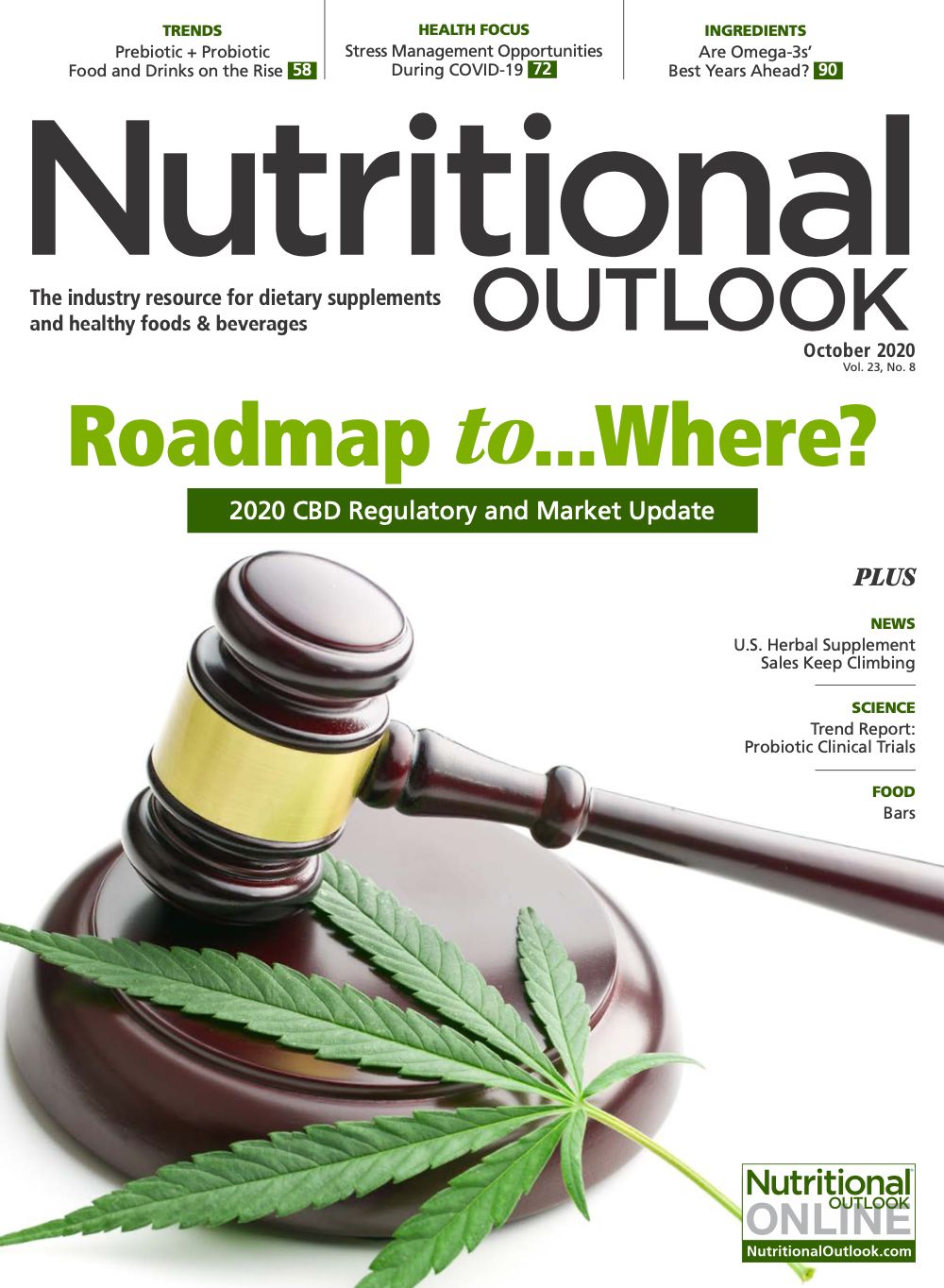

Are retailers finally ready to embrace CBD?

Given the tide that’s sweeping CBD into the mainstream, more retailers may choose to begin stocking products made with the superstar cannabinoid.

Photo © AdobeStock.com/MysteryShot

In August, the American Botanical Council’s latest HerbalGram Herb Market Report1, tracking U.S. herbal supplement sales in 2019, bestowed upon hemp cannabidiol (CBD) the title of top-selling ingredient in natural channels—the second year in a row the ingredient earned that distinction. Drawing upon sales data from SPINS and Nutrition Business Journal, the latest report noted that in 2019, CBD sales grew 71.3% in the natural channel alone, to $91 million in sales. What’s even more remarkable is that CBD sales grew a whopping 872% in the mainstream channel, to $35.9 million, earning it a place for the very first time among the top-40-selling herbs in the mainstream market—and quickly skyrocketing right up to ninth place in that channel.

All of this sales growth for CBD is pretty remarkable when you consider that, even now, many retailers regardless of channel don’t carry CBD products. But given the tide that’s sweeping CBD into the mainstream, more of those retailers may choose to go with the flow and begin stocking products made with the superstar cannabinoid. We spoke with category watchers for their predictions.

A COVID-19 Bounce

Looking back, it seems it was only a matter of time before CBD-containing items started colonizing mainstream store shelves. And indeed, says Sandi Gonzales, vice president, retail sales and marketing for hemp brand Balanced Health Botanicals (Denver, CO), “Every day we see more retailers accept CBD, understanding the incremental sales that CBD can produce for their stores.”

What’s more, it’s possible that the COVID-19 pandemic—so devastating to demand elsewhere—actually strengthened CBD’s retail wave. As Jessica Lukas, senior vice president of commercial development for cannabinoid data firm BDSA (Boulder, CO), points out, “A majority of consumers look to CBD for health benefits, citing many consumption drivers relevant to the COVID-19 situation: sleep, anxiety, relaxation, unwinding, and stress management.”

In fact, consumers’ top-three reasons for turning to CBD are pain relief, better sleep, and relaxation, according to BDSA’s in-depth and trending Consumer Insights service.

So it should come as no surprise that data from BDSA strategic partner IRI (Chicago) show an 89% increase in CBD product dollar sales through June 2020 in the channels IRI tracks, and a whopping 130% increase in CBD edible and beverage sales compared to the same period in 2019.

Jon Dunham, vice president of customer commercialization, Charlotte’s Web (Boulder, CO), is hardly surprised. “If COVID-19 has taught our society anything, it’s how each of us can take better control over our own wellness options and solutions,” he says. “We believe the market will be bright for hemp-derived CBD once we are on the other side of this pandemic.”

Staying on Topical

While each retailer will stock its own CBD product mix tailored to its consumers’ needs, Gonzales points to growth in personal care, topical, and even supplement/ingestible products “across channels and in retail outlets where you wouldn’t expect to find CBD,” she says.

And as evidence, she offers the buzz surrounding Wegman’s commitment to CBD, “and the amount of space they’ve dedicated to the category.”

But while growth continues in a number of CBD categories overall, mainstream retailers, at least, seem to feel safest sticking with topical products: creams, lotions, salves, cosmetics, and the like—and for good reason.

“The FDA policy that prohibits prescription-drug ingredients from being added to foods and supplements doesn’t apply to topical products,” explains Douglas “Duffy” MacKay, ND, senior vice president, scientific and regulatory affairs, CV Sciences (San Diego, CA). “Therefore, topical products don’t have the same regulatory uncertainty as foods and supplements,” he notes.

That being the case, even “risk-averse retailers” have embraced hemp-derived CBD topicals since the 2018 Farm Bill removed the shackles of being a “controlled substance” from hemp, MacKay says. “Today, you can find topical CBD products at mainstream retailers across the country.”

Legal Limbo

Yet if mainstream retailers have no compunction stocking topicals, “many specialty retailers, natural shops, vape and smoke shops, on-premise, C-stores, and beyond are carrying ingestible products like tinctures, gummies, beverages, etc., despite their not being completely legal,” Lukas says. Meanwhile, “CBD food and beverage offerings are just getting started in mainstream retail channels.”

To some extent, they do so at their own risk—for, as MacKay points out, the regulatory matrix surrounding hemp-based CBD supplements, foods, and beverages is complex and unresolved.

“There are retailers that understand the nuances of FDA’s CBD policy and recognize the legal arguments acknowledging that a hemp extract with CBD isn’t the same as the CBD ingredient used in prescription medications—that it can be used in foods and supplements as long as all FDA requirements are met,” he explains. “These retailers rely on responsible brands to comply with all applicable FDA regulations for manufacturing, claims, and adverse events.”

Alas, he continues, “There are thousands of CBD products being sold online, in bodegas and flea markets and through direct-to-consumer marketing with zero retailer vetting.” He points out several peer-reviewed government studies showing that “hundreds of no-name brands” failed to contain the labeled amount of CBD or had unacceptable levels of environmental contaminants. That’s bad for the consumer and the industry.

Vet for Yourself

So responsible retailers may have to vet their selections for themselves.

As Gonzales says, “Retailers are following FDA guidance and ensuring they’re doing the right thing for consumers. It’s top of mind for every retailer carrying CBD.” They’re also doing their own due diligence in evaluating CBD brands they do business with, she adds.

How? Membership in organizations like the U.S. Hemp Roundtable, and certifications from such groups as the U.S. Hemp Authority, carry weight with retailers—and maybe even consumers.

“There are also many other certifications that aren’t CBD-specific but that can signal to a retailer that a CBD partner is reputable,” Gonzales says, citing Leaping Bunny, NSF International, cGMP certifications, and more. “Companies undergo a lot of scrutiny to obtain these certifications,” she says, “so if you qualify, that’s a big indicator that you’re going to be a good partner.”

All of which makes MacKay breathe more easily. “Responsible retailers are extensively vetting CBD products,” he says. “These retailers address the regulatory gray area by vetting more extensively than for other herbal products in their stores.”

Such oversight may take the form of QR codes linking to third-party lab results—something you don’t see on other herbal products, MacKay notes.

And indeed, Dunham says, “In the absence of sensible federal and state regulations for hemp CBD, we err on the side of providing full transparency to 20-plus testing results for every lot of our products.” Thus, a QR code on every product the company makes links consumers and retailers directly to the third-party lab test results corresponding to the Certificate of Analysis for that product’s lot.

Eating It Up

Yet it’s hard to imagine anything turning back this tide.

“As consumers become more comfortable with CBD, edible and beverage opportunities in retail are ready for the taking,” Lukas says. “New technology, more distribution, and innovative flavors and product launches are just some of the opportunities that manufacturers and retailers can tap into.”

After all, she points out, consumers are already comfortable choosing functional foods and beverages for their wellness benefits; savvy brands that can play to these consumer “comfort zones,” she says, while also wrapping in perks like low doses, elevated flavors, and controlled experiences, “will have a leg up on the competition heading into 2021.”

“Consumers and retailers are ready for hemp-derived CBD ingestibles,” Lukas declares. “So the future—to some degree—is in the hands of the regulations that FDA puts in place.”

In the meantime, “Retailers still want to sell products that their consumers are looking for,” Gonzales says. “As CBD gains exposure and popularity with mainstream Americans, I believe retailers will continue to increase their offerings.”

Reference

- Smith T et al. “US sales of herbal supplements increase by 8.6% in 2019.” HerbalGram, issue 127 (2020).

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.