2024 Nutraceutical and Natural Product Industry Outlook: Insights from Nutritional Outlook’s Editorial Advisory Board, Part 2

Photo © AdobeStock.com/Miha Creative

Nutritional Outlook’s Editorial Advisory Board members highlight potential challenges for the nutraceutical, natural product, and health and wellness industries in 2024.

What will be the biggest challenges for nutraceutical and natural product companies in 2024?

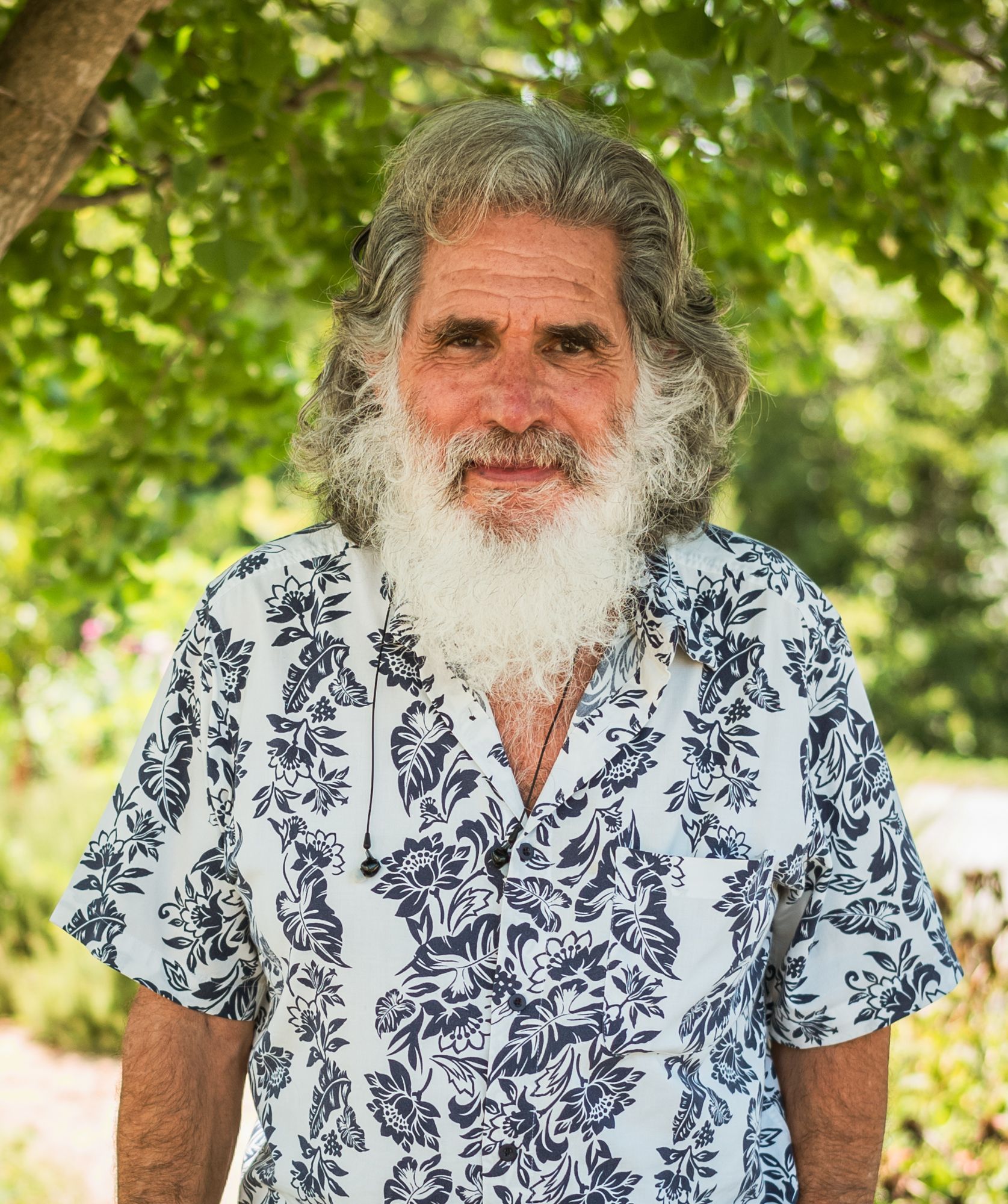

Lu Ann Williams

Global Insights Director

Innova Market Insights

Lu Ann Williams

Pricing, trust and efficacy. Quality products are expensive and consumers are having to make difficult choices. They are looking for quality ingredients that bring them benefits (just look at what is happening with collagen!), so it’s also a big opportunity.

There is also a lot of messages, storytelling and influencing in the category so it’s a challenge to navigate all of that and to decide where and how to participate. There continues to be a lot of misinformation but you can also catch a wave.

I think efficacy is still one of the big challenges and combine that with all the messaging out there, it’s great to be able to ride a wave but harder to overcome communication challenges.

John E. Villafranco

Partner

Kelley Drye & Warren LLP

John E. Villafranco

Determining just what the FTC intends to do regarding health claims. The FTC’s December 2022 Health Products Compliance Guidance, and staff statements over the past year, have created all kinds of confusion, leaving marketers and researchers scratching their heads. Must a company possess randomized controlled clinical studies before making so-called “health benefit” claims for dietary supplements or food? Is there a requirement for full product testing or will companies be able to rely on testing on individual ingredients? Are nutrition researchers, nutritionists, and pharmacologists suitable scientific experts to assess claim substantiation or do companies need to line up experts with expertise relevant to the disease, condition, or function related to the claim at issue?

With the answers to these questions unclear, marketers are left with the difficult choice of heading out onto thin ice or never strapping on their skates. Health claims not backed by RCTs will carry risk unless they are so muted as to be ineffective in communicating product attributes to consumers. But the FTC’s guidance is just that – guidance – a statement by current FTC staff attorneys on what they believe the law to be. What the law actually is will be determined by judges in litigation. Only then will marketers and researchers in this space have the guidance they require to ply their trades confidently and without fear of regulatory action.

Ashish R. Talati

Partner

Amin Talati Wasserman

Ashish R. Talati

I think staying ahead of the social media driven consumer trends and integrating AI into product development and marketing will be crucial. For example, we are seeing timeline for a new product launch being cut down significantly with the use of AI. In terms of compliance, we are seeing more and more customs detentions for seemingly minor labeling issues. We are seeing more class action demand letters and that will continue in 2024.

Paula Simpson, BSc (Nutritional Sciences), RNCP, R. Herbalist

Founder

Nutribloom

Paula Simpson, BSc (Nutritional Sciences), RNCP, R. Herbalist

We’re in an era of information overload. Attention and brand loyalty will be a challenge without a good strategic marketing plan.

Kantha Shelke, PhD, CFS

Principal, Corvus Blue LLC

Senior Lecturer, Food Safety Regulations, Johns Hopkins University

Kantha Shelke, PhD, CFS

- Consumer Education: Educating consumers about the benefits and proper usage of nutraceuticals is becoming increasingly important to stay above the sea of supplements with similar offerings. Companies may need to invest in educational campaigns to help consumers make informed decisions and understand the value of their products in the context of purity, how they work, and why they matter.

- Ingredient Sourcing and Supply Chain Disruptions: Factors like climate change, geopolitical events, and pandemics will continue to affect agriculture and production. Ensuring a stable supply chain will continue to challenge suppliers and manufacturers. There will be a need for companies to diversify while staying close to their source.

- Environmental and Sustainability Concerns: Consumers are increasingly conscious of environmental sustainability. Nutraceutical companies will face consumer pressure to adopt eco-friendly practices, reduce their environmental footprint, and demonstrate a commitment to diversity and sustainable sourcing.

Harry B. Rice, PhD

Vice President, Regulatory and Scientific Affairs

Global Organization for EPA and DHA Omega-3s (GOED)

Harry B. Rice, PhD

Hands down, the omega-3 industry’s biggest challenge going into 2024 will be a continuation of last year’s challenge – reduced supply of fish oil – which actually began in 2022. While the situation is specific to Peru, they are by far the largest supplier to the worldwide dietary supplement industry so the impact is broad. This year saw the cancellation of the first of two anchovy fishing seasons in the largest fishing area – north-central region of Peru – due to a high number of juvenile fish. Thankfully, the second fishing season took place, but the quota was set at 26% less than last year and the oil yields were very low, translating to less EPA/DHA in the oil.

While this year is an extreme example of what’s considered to be a normal variation in production, the long-term outlook for omega-3s remains promising. In fact, GOED understands the 2024 fishing seasons in Peru are predicted to be strong due to a large biomass of anchovy, as well as more food for the fish becoming available. Together, this should result in a higher content of EPA/DHA in the fish.

Also, let’s not forget that we can get EPA/DHA from other fish sources (e.g. salmon, tuna, cod liver and pollock) and marine sources (e.g. krill, calanus), as well as a genetically engineered canola that produces EPA/DHA and, as mentioned above, EPA- and DHA-rich microbial (i.e. algae) oils.

I want to follow up on an issue I mentioned in both 2022 and 2023, regarding a 2016 final rule from the United States National Marine Fisheries Service (NMFS) and the National Oceanic and Atmospheric Administration (NOAA) implementing a provision of the Marine Mammal Protection Act (MMPA) requiring any global fishery exporting products, including fish oil, to the United States to comply with rules to address injury and mortality of marine mammals. The final rule established the criteria for evaluating a harvesting nation’s regulatory program for reducing marine mammal bycatch in such fisheries and the procedures required to receive a comparability finding. Under the regulations, a comparability finding for a fishery is necessary to import fish and fish products into the United States from that fishery.

The 2016 final rule called for an exemption period on import prohibitions for foreign nations to receive a comparability finding for their commercial fishing operations. The current exemption period was due to expire on December 31, 2023, but, in November, a final rule was issued to extend the exemption period until the end of 2025. The 2016 final rule required NMFS to finalize comparability findings by November 30, 2023, but they were unable to do so primarily because of the large number of foreign fisheries. Had the exemption extension not been in effect by December 31, 2023, importation of fish oil from all fisheries in the 134 countries that applied for a comparability finding would have been banned, resulting in an impairment of US trade interests in fish oil.

Irfan Qureshi, ND

Irfan Qureshi, ND

Natural products companies are expected to continue to face headwinds in specific areas related to regulatory and quality issues. Those who successfully navigate these challenges are likely to thrive. Specifically, for companies marketing products on Amazon, the issue of product quality and how to convey a quality message for their products will continue to be at the forefront. We’ve seen fraudulent products being sold on Amazon as well as issues where products sold on the platform fail to meet label claim. As a company that stands for quality and integrity of the products sold, the question of being able to build a reputation of trust in the minds of consumers among the jungle of products available on Amazon, at all kinds of price points, is of paramount importance. Conveying this message to their end consumers through education around product integrity as well as increased transparency are ways in which companies can set themselves apart from the crowd. Obviously, this serves the company’s own business interests but also the needs of the consumers, who are looking for products that are effective. Continuing industry efforts to weed out bad players are also of paramount importance to enhance consumer confidence in dietary supplements and natural products.

On the regulatory front, navigating issues at the state level of consumer access to supplements will continue to be a challenge. Certain categories of supplements may, therefore, become more difficult to market. At the federal level, uncertainty related to FDA’s interpretation of which ingredients constitute a dietary ingredient will pose questions for companies as well. N-acetyl cysteine (NAC) is a prime example of this but there are others that FDA may deem as questionable. Navigating these regulatory hurdles will be a constant issue. Continuing to educate lawmakers on the importance of consumer access to safe and effective natural options will be critical as well as challenging FDA where appropriate on issues of significance from a dietary ingredient perspective. This will be necessary to maintain freedom of access to supplements while also effectively addressing concerns that lawmakers and regulators may have.

George Paraskevakos, MBA

Executive Director

International Probiotics Association

George Paraskevakos, MBA

The landscape of probiotics, prebiotics, postbiotics, and synbiotics is constantly evolving, shaped by scientific advancements, and changing consumer preferences. As the industry continues to innovate, there will be increased offerings of diverse array of products tailored to meet the growing demand for products that improve health and well-being.

The landscape for probiotics, prebiotics, postbiotics, and synbiotics companies is dynamic and promising. As these sectors continue to evolve, some key challenges and opportunities are foreseen.

Challenges:

1. Definitions: The lack of a regulatory definition for prebiotics and postbiotics has led to confusion in the industry and the marketplace. When scientists cannot agree on a definition or appropriate use of terms, there is even more confusion at the consumer level.

2. Scientific Understanding: Enhancing the scientific understanding of these products' mechanisms and their impact on individual microbiomes is important in the context of supporting category definitions and education.

3. Education: Educating consumers, scientists, regulators, media, and healthcare professionals about the different types of biotics is essential. These stakeholder groups are unique, and messaging will need to be segment- and stakeholder-dependent. This includes educating these groups about differences among products within each category of the biotics, e.g., strains matter, the type of prebiotic matters, and synergies between products also matters. It is imperative to relay scientifically accurate messages to all sectors and stakeholders.

Opportunities:

1. Health & Wellness Trend: Growing consumer interest in health and wellness presents a significant opportunity for these products for long-term benefits. Seniors are seeking products to benefit their quality of life. IPA understands the importance of reaching the health care professionals as they are the ambassadors to reaching consumers. We will continue our education programs to continue fueling this outreach.

2. Personalized Nutrition: Advancements in understanding individual microbiomes can lead to personalized products supporting specific health needs.

3. Technological Advancements: Innovations in delivery systems and technology offer opportunities to improve product efficacy, shelf stability, and product delivery via new pathways.

4. Expanded Applications: Exploring new applications and delivery formats, including supplements, food and beverages, infant food and supplements and companion animal health.

5. Partnerships and Collaborations: Collaborating with strategic stakeholders, institutions and associations will lead to further opportunities, new insights, and innovations. IPA signed a multitude of MOU’s this past year across different geographies in the world to help with the expansion and dissemination of proper education within the categories we are now taking on.

In closing, the International Probiotics Association (IPA) is committed to advancing the field of probiotics, prebiotics, postbiotics, and synbiotics through a comprehensive approach that encompasses several key differentiators.

IPA distinguishes itself by having a commitment to scientific integrity, global regulatory advocacy, support for quality standards development, fostering innovation, and promoting education and awareness. These core principles drive our mission to advance the field of probiotics, prebiotics, postbiotics, and synbiotics for the benefit of consumers globally.

Let’s raise our Biotics with cheers to the bright future that 2024 presents for us all!

Susan H. Mitmesser, PhD

Senior Vice President, Chief Science Officer

Pharmavite

Susan H. Mitmesser, PhD

The pandemic served as a monumental trial and awareness event for our industry that’s resulted in immense growth for the category. In today’s world, as illustrated by consumers’ ever-evolving vitamin and supplement routines, moving the category forward requires agility and the understanding that we need to continuously test, learn, adapt, and grow in order to support our consumers. To continue successfully meeting consumers’ needs with high-quality, science-based vitamin and supplement solutions, Pharmavite’s innovation pipeline effectively links science and consumer insight at the onset to ensure a strong innovation capability, pipeline, and programs to bring new offerings to life.

With consumers more focused on health and wellness than ever before, we’re also presented with the opportunity to educate them on the benefits of vitamins and supplements and illustrate how they’re an essential component to healthy living – if we can effectively engage and support them. Pharmavite has been earning the trust of consumers, healthcare professionals, and retailers through the development of innovative, science-backed vitamin and supplement solutions for over 50 years, and we continue to prioritize our industry-leading support by engaging consumers when and where it’s most valuable for them and with information that’s relevant and allows them to optimize product benefits, supporting HCPs to ensure they understand the assortment and offerings that best support their patients’ needs, and more.

Meeting consumers’ ever-evolving needs also means we must continue evaluating and challenging ourselves to rethink the research models we use to test ingredients that come from foods – whether that be incorporating organ-on-a-chip technologies or leveraging AI – to produce better, more efficient research outcomes.

Michael McGuffin

President

The American Herbal Products Association (AHPA)

Michael McGuffin

Compliance with new and changing regulations can be challenging for nutraceutical and natural product companies as the regulatory landscape for our industry evolves. Manufacturers and marketers of cosmetics, for example, will be subject to new requirements under the federal Modernization of Cosmetics Regulation Act (MoCRA) in 2024, including new serious adverse event reporting requirements and significantly expanded government access to manufacturer records. At the state level, companies selling products to New York customers are dealing with a new age restriction requirement, intended to apply to weight loss and muscle building products, which may nevertheless impact many unrelated dietary supplement products.

In addition, AHPA members have continued to experience unsupported and inconsistent practices from U.S. Food and Drug Administration (FDA) investigators, including with respect to the standards applied during inspections, as well as an increased frequency of inspections. These problems underscore longstanding concerns with FDA’s regulation of food, which has come under heightened scrutiny following the infant formula shortage and subsequent evaluation by the Reagan-Udall Foundation. For the agency’s part, FDA plans to reorganize and create a unified Human Foods Program (HFP) to improve the agency’s regulation of food, including dietary supplements. The reorganization would move the Office of Dietary Supplement Programs (ODSP) under a new Office of Food Chemical Safety, Dietary Supplements & Innovation.

AHPA has received assurances from Dr. Cara Welch, director of FDA ODSP, and Jim Jones, deputy commissioner for Human Foods who will oversee the unified HFP in his newly created position, that ODSP will retain the same staffing, scope, and responsibilities in its new “super” office and that FDA is committed to transparency. However, it remains to be seen how this change in organizational structure will impact ongoing concerns with how the agency regulates dietary supplements.

No matter what challenges the natural products industry will face in 2024, we encourage our community to continue bringing their concerns to AHPA as we engage with FDA to ensure that the interests of our members are represented.

Douglas “Duffy” MacKay, ND

Senior Vice President, Dietary Supplements

Consumer Healthcare Products Association (CHPA)

Douglas “Duffy” MacKay, ND

As we prepare to head into 2024, industry faces a multitude of challenges that demand careful consideration. Notably, recent updates to the Federal Trade Commission’s (FTC) advertising guide and the issuance of Notice of Penalty letters in April have captured the industry's attention. CHPA perceives these developments as inconsistent with the Dietary Supplement Health and Education Act (DSHEA) and long-established FTC regulatory guidance, which is why we filed a Citizen Petition in September 2023, urging the Commission to withdrawal the Notice of Penalty Offenses. We certainly anticipate further engagement on this issue in 2024.

Another concern we expect to continue into next year, revolves around the prevalence of illegal, counterfeit, and adulterated products posing as dietary supplements. Safeguarding American consumers from unscrupulous actors distributing counterfeit and stolen goods remains a top priority for CHPA. In fact, our advocacy efforts this Congress, helped secure the passage of the INFORM Consumers Act, effective since July, which aims to establish a more transparent and accountable marketplace. Despite this legislative milestone, reputational risks persist, necessitating ongoing vigilance, and the industry recognizes the urgency of modernizing current regulations to address these evolving challenges effectively.

Finally, as manufacturers begin to recover from the disruptions caused by COVID-19, lingering supply chain issues persist necessitating vigilant forecasting. CHPA remains committed to working closely with key stakeholders, including the U.S. Food and Drug Administration (FDA), Congress, the Department of Health and Human Services (HHS), the Assistant Secretary for Preparedness and Response (ASPR), and the White House. This collaborative approach aims to comprehensively address critical industry issues, ensuring that consumers maintain access to the essential self-care products they need to support their overall health and well-being.

David Foreman, RPh

Founder and President

Herbal Pharmacist

David Foreman, RPh

With the industry steadily growing, I see issues with sustainability being the biggest issue.Along with sustainability we will see a rise in adulteration too. When there is demand, there is an increase in the opportunity to create “look alike” ingredients (i.e., adulteration). One last area is the ability to capture the younger generations interest in viable options to fit a daily lifestyle (functional food and beverages), while also supporting a cause or mission. Even though I am a “boomer”, my generation is not all that hip, and we will need to have an influx of younger people running our companies from top to bottom.

John R. Endres, ND

Chief Scientific Officer

AIBMR Life Sciences Inc.

John R. Endres, ND

Hemp Cannabinoids: All indications point to cannabinoids being a key point of regulatory interest in 2024. The FDA maintains concern for safety and determining the threshold above which CBD, for example, may not be reasonably expected to be safe (supplements) or reasonably certain to be safe (foods) from consumption in foods and dietary supplements. Yet, many products continue to be sold on the market in the U.S. Several GLP- & OECD-compliant toxicological safety assessments have been published investigating the safety of repeated oral consumption of CBD-containing ingredients with conclusions (NOAELs—No Observed Adverse Effect Levels) and determinations of safe levels in humans as a result, using appropriate safety factors. The challenge will be to establish a risk-based regulatory framework for manufacturers to work within and FDA enforcement to ensure the established requirements are being met by all manufacturers.

Mark Blumenthal

Founder & Executive Director

American Botanical Council (ABC)

Founder, ABC-AHP-NCNPR Botanical Adulterants Prevention Program

Mark Blumenthal

One of the biggest and most persistent challenges for members of the herb, dietary supplement (‘nutraceutical’), and natural products industries is the ever-present challenge of adulteration and fraud in the global marketplace for botanical ingredients.

I suspect that some of my friends and colleagues in the natural products industry might be getting a bit tired of hearing and seeing me continually raise this issue, and I don’t want to appear to be fixated on this subject. I’d prefer to be discussing the growing amount of clinical research on herbs and other natural products that continues to show safety and health benefits. And yet, adulteration warrants the considerable attention of all responsible parties in the natural products industry.

The fact is that there are people in the global marketplace who cheat:They offer for sale ingredients that are either diluted in ways that are not appropriately declared on certificates of analysis; and/or they offer ingredients that are intentionally mislabeled in such ways as to contain concealed chemical compounds that are used to intentionally deceive many widely used laboratory analytical methods employed to confirm identity of the ingredient – the number-one requirement in any quality control regimen.

The ABC-AHP-NCNPR Botanical Adulterants Prevention Program (BAPP) has published 84 peer-reviewed documents that are freely available on the BAPP homepage on the ABC website. These publications can help responsible members of the industry ensure the authenticity of their ingredients and that the ingredients comport with appropriate cGMP rules. By being informed and using BAPP resources, responsible, ethical companies can defend themselves (and their brands) against economically motivated adulteration. (Available here; free; but registration required).

As I have said and written numerous times, this is not a new phenomenon. There is a long history of adulteration of herbs, spices, botanical drugs, conventional foods, wine, et al. – going back more than 2000 years to Greco-Roman times. A must-read article for anyone who is not familiar with this history is the late Steven Foster’s seminal item – the first publication of BAPP in 2011 – called “A Brief History of Adulteration of Herbs, Spices, and Botanical Drugs” in ABC’s peer-reviewed journal HerbalGram (issue #92: available here).

Although BAPP has documented the unfortunate but incontrovertible fact that many popular herbs are subject to intentional adulteration and fraud, it is much more challenging to determine the actual extent of such adulteration. How many products in a particular herb category are subject to adulteration? This is a very difficult question, both to ask, and to answer. BAPP is currently working on a paper that attempts to bring more clarity to this challenge.

Nevertheless, at BAPP we are heartened to receive positive comments from responsible parties in the herb industry that they utilize BAPP publications (as well as authoritative publications from other sources) to determine their specifications for botanical ingredients that they purchase from their suppliers. As part of this process of revising specifications, some companies report that they have had to change their suppliers in order to obtain ingredients that conform to the revised specifications. This process results in higher quality (and, presumably, more reliable, beneficial) ingredients in consumer health products.

Finally, as part of BAPP’s mission in 2023, BAPP expanded the number of companies who have adopted and utilized the BAPP “Best Practices SOP for the Disposal / Destruction of Irreparably Defective Articles” – an SOP initiative that was completed after several years of consulting with numerous industry quality and regulatory experts and was completed after community input in two rounds of public comment.

The BAPP SOP allows responsible elements of the herb industry to become more empowered in taking the initiative to remove ingredients that are adulterated (or contaminated) to the extent that they cannot be lawfully reconditioned for human use. Ultimately, although it is industry-centric, the BAPP SOP is essentially a consumer-supportive measure in that it provides more opportunity for the responsible elements of the botanical community to ensure that ingredients in foods, dietary supplements, cosmetics, and even in some nonprescription/over-the-counter drugs are authentic and have a better opportunity to provide the claimed healthy experience for the consumer. At the end of the day, this is why this industry exists – to bring benefit to consumers so they can enhance their health by using authentic herbs, fungi, and other natural products.

Judy Blatman

Judy Blatman Communications

Founder/President

Judy Blatman

When it comes to facing challenges in 2024, I’d be remiss in not giving a nod to this: the FDA reorganization that more or less makes dietary supplements an afterthought, a misfit, or an orphan of sorts. Are we back to post DSHEA passage days where the agency responsible for regulating dietary supplements sat on its hands, waiting for the industry to self-implode. Or, are regulators signaling that there’s more afoot for supplements in this reorg specifically with regard to how they’re regulated? Is this move a pre-cursor to the dismantling of DSHEA? Or does it mean that the regulators just didn’t know where supplements fit in? It seems to me that now would be a really good time to be a member of a trade association. There’s plenty of them—pick your favorite and be active.