Plant Protein Is Everywhere at IFT 2016

Everyone wants a piece of the growing plant protein market.

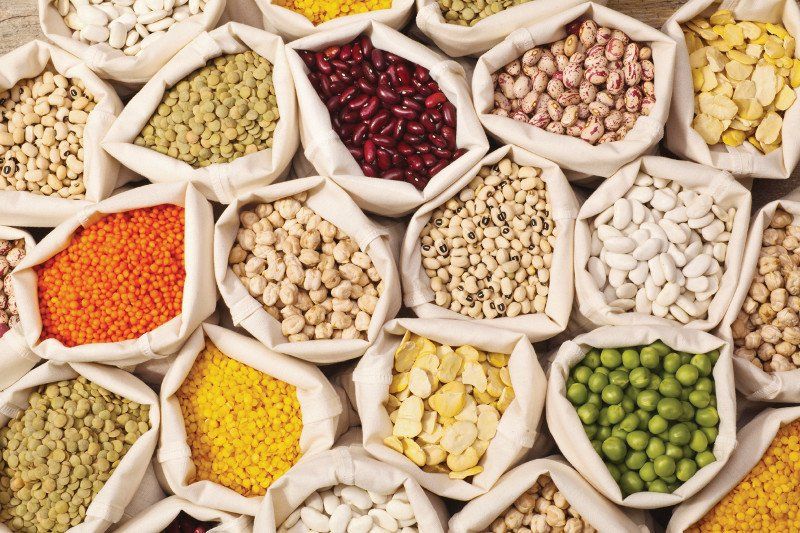

Photo © iStockphoto.com/syolacan

If there was one common trend running throughout the 2016 International Food Technologists Annual Meeting & Food Expo last week, it was plant protein. Everyone, no matter which corner of the food and beverage industry they represent, wants a piece of the growing plant-protein market, it seems. Many ingredient suppliers Nutritional Outlook visited at IFT showcased food and drink prototypes that demonstrated just how far ingredient firms have come in working with plant proteins in formulation.

At the Ingredion (Westchester, IL) booth, the company demonstrated how its new clean-tasting Vitessence Pulse CT faba bean and pea protein concentrates, as well as its Homecraft Pulse pea and lentil flours, boost protein content while maintaining good product taste and texture-challenges common to plant proteins in general.

Pat O’Brien, Ingredion’s manager, strategic business development, explained that, thanks to a proprietary treatment process that Ingredion’s Canadian pulse-crops partner AGT Foods employs, these plant-protein ingredients, as well as the many others in the Vitessence and Homecraft lines, remain clean-tasting and neutral.

“It’s a heat-moisture process,” O’Brien said. “It improves the flavor profile of pulse ingredients. It doesn’t change the label declaration-no enzymes, no flavor maskers, no processing aids. This technology is going to really allow us to use pulse ingredients in new applications where maybe flavor challenges prohibited it before.”

O’Brien said the difference between Ingredion’s plant-protein concentrates and flours is that the concentrates have a higher protein content-for instance, 55%–60% protein. Ingredion's prototype samples included a sweet and savory pulse crisp cluster containing faba bean flour and faba bean concentrate, plant-protein pasta, and a smoothie containing the company’s Vitessence Pulse CT 1552 clean-tasting pea protein.

Suppliers Grow Plant Protein Portfolios

Ingredion isn’t the only ingredient supplier looking to enhance its plant-protein product offerings. Among the companies diversifying their ingredient portfolios with plant-based derivatives is Archer Daniels Midland Company (ADM). With its investment in Harvest Innovations (Indianola, IA) earlier this year, ADM now leverages Harvest’s line of vegetable protein, non-GMO soy chips, soy flour, and flours and pastas made from grains, legumes, and oilseeds.

“This really speaks to the trend,” said Lesley Nicholson, project manager, Archer Daniels Midland Co./WILD Flavors & Specialty Ingredients, of ADM’s recent business move. “We’re focusing on plant-based-not just plant-based protein but plant-based ingredients, period.”

Ingredion’s O’Brien agreed that more companies are seeking a bigger plant-protein footprint. For Ingredion personally, “the pulses are our first entrants into the vegetable-protein area,” he said, adding that it’s “definitely an emerging trend” for suppliers to be looking to play in plant proteins.

Consumer Attitudes toward Plant Protein

Growing consumer interest is unquestionably what’s driving plant-protein demand, especially interest from flexitarians (those incorporating more plant protein in their diets but not omitting animal protein completely). At IFT, market research Innova Market Insights highlighted its latest report showing that vegetarian launches have surged 60% globally over the past five years. Non-meat alternatives are trending even in countries where meat-heavy diets have historically been prevalent, such as Germany. Innova claims its data show that 34% of German consumers have reduced their meat intake over the last two years.

One of the most active plant-protein areas continues to be plant-based meat substitutes. Here, consumers may be willing to accept an interesting tradeoff, noted Lu Ann Williams, Innova’s director of innovation, at IFT. Namely, that tradeoff is that some meat substitutes are not entirely clean label because some of the most sophisticated, meat-like non-meat products on the market are only achievable with a less-than-clear label.

“Think about a hierarchy of needs,” Williams said. “If you want to eat meat-free, you have to compromise, meaning that your meat-free need is higher than your clean-label need.”

What’s clear is that demand for plant-based ingredients like protein is only going up thanks to flexitarian tastes. Ingredient suppliers’ own research seems to bear out these findings.

“We did some consumer research and found that 1 in 3 consumers actually prefers a vegetable-based protein as compared to an animal-based protein,” said Ingredion’s O’Brien. “We’ve seen that continue to grow year on year. Vegetable proteins are a key trend in vegetable-based ingredients. It’s helping to address things like flexitarian diets-people who might not be cutting out animal-based products altogether but who are incorporating more vegetable-based products in their diet.”

Which Plant Proteins Are Hot?

When asked which plant-protein ingredients are especially trending, many suppliers said that, for the most part, interest is growing across the board. Still, they noted some standouts.

“I think it depends on what application areas you’re looking at, but we’ve seen chickpea really taking off given the increased popularity of hummus,” said Ingredion’s O’Brien. “We’ve seen also seen interest in faba bean because it does have a clean flavor profile.”

Pea protein, he said, is “the most established market; there are a lot of products out there using pea-based ingredients.” Ingredion offers both yellow- and green-pea ingredients.

In terms of flavor profile, O’Brien said that the choice depends on the target product flavor. “Typically, I’d say pea-based products have the strongest flavor, and faba bean would have the blandest. Chickpea and lentil would both fall in between.”

ADM’s Nicholson said her company is seeing high interest in beans. “We’re seeing a huge increase in beans of all kinds-navy beans, black beans, red beans-you name it, beans.” Bean flours, she said, are “equally versatile. Those can go into bars, beverages, chips, crackers, snack items, and baked goods.”

Nicholson also pointed to more interest in nuts. “We’re seeing a lot of increase right now around nuts, especially the nut butters being used in lots of applications, from beverages to bars to desserts. So almond butters, cashew butters, those kinds of things.”

Even more than pinpointing one standout protein source, food and beverage formulators may be looking more toward a combination of proteins that works best for their application. “It’s not about any one item; it’s about combining them in interesting ways,” Nicholson said. “Maybe you put almond butter into a protein beverage, but the almond butter doesn’t quite get up to that protein level that you’d like. So maybe you add some soy protein isolate to get your protein level up.”

“It’s all about mixing and matching all of these ingredients to make just the right prototype,” she added.

Also read:

Vegetarian Launches Surged by 60% over Past Five Years

The ABCs of Formulating with Plant Proteins

5 Plant Protein Ingredients for Food and Drink

Jennifer Grebow

Editor-in-Chief

Nutritional Outlook magazine

jennifer.grebow@ubm.com

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)