Is 2020 the year FDA will finally make CBD a legal ingredient in dietary supplements and food? 2020 Ingredient trends to watch for foods, drinks, and dietary supplements

CBD is out of the bottle. How will FDA rein in the skyrocketing CBD market?

Photo © AdobeStock.com/jessicahyde

Is 2020 the year FDA will finally make CBD a legal ingredient in dietary supplements and food? No one (but FDA) knows. And this is where we find ourselves yet again at the start of 2020 when it comes to hemp cannabidiol (CBD), today’s biggest ingredient disruptor: with many questions and few answers.

But first: What a year it’s been for CBD. Since President Trump signed the 2018 Farm Bill into law in December 2018, legalizing industrial hemp as an agricultural crop-with hemp defined as cannabis containing less than 0.3% tetrahydrocannabinol (THC) content-and removing it from Schedule I of the Controlled Substances Act, the CBD products market has exploded. Today, CBD is infused in everything from hair gel and toothpicks to personal lubricant, hand sanitizers, and even bed sheets.1

Despite being sold on shelves and online, CBD dietary supplements and food are still not legal according to FDA. For dietary supplements, FDA’s primary reasoning for why CBD can’t be a legal dietary supplement ingredient is that before CBD was ever sold as a dietary supplement, it was first publicly researched as an investigational new drug (IND) by GW Pharmaceuticals. This means that, under the Federal Food, Drug, and Cosmetic Act’s “IND exclusion clause,” CBD is ineligible to meet the definition of a dietary supplement under the Act’s Section 201(ff)(3)(B)(i) and 201(ff)(3)(B)(ii).

Last year saw many try to get FDA to forge a legal pathway for CBD products. Last October, dietary supplement and natural product associations-the American Herbal Products Association (AHPA), the Council for Responsible Nutrition (CRN), the Consumer Healthcare Products Association (CHPA), and the United Natural Products Alliance (UNPA)-sent a joint letter asking Congress to create legislation to create a waiver for CBD under the definition of a dietary supplement (FD&C Act Section 201(ff)(3)) that would specifically authorize legal use of CBD in supplements. The Natural Products Association (NPA), meanwhile, was involved in pushing forth an amendment to a House spending bill last June that would have had FDA perform a Health Hazard Evaluation of CBD and ultimately set a safe usage level for consumers. The amendment language, which made it through the House bill, was unfortunately ultimately excluded in the version of the spending bill passed by the Senate.

Federal and state lawmakers, as well as state attorneys general, have also asked FDA to provide either more oversight over CBD, set a safe usage level, or to at least adopt a policy of enforcement discretion for CBD products. Notably, last September, Senate Majority Leader Mitch McConnell (R-KY) added report language to the 2020 spending bill to require FDA movement on CBD. The ultimate 2020 spending bill that President Trump signed last December requires that FDA, within 60 days, update Congress on its progress in developing a policy for enforcement discretion for CBD, and within 180 days, evaluate the market to determine the scope of CBD products that are mislabeled or making illegal claims.

But enforcement discretion does not make CBD legal in supplements; it merely means that FDA will exert discretion in how it enforces against CBD companies. And so the supplements industry is still seeking a true legal pathway forward for CBD.

The two potential pathways most commonly discussed are: 1) to somehow create a regulatory exception for CBD in Section 201(ff)(3) of the FD&C Act that would include CBD within the legal definition of a dietary supplement, or 2) to see the Secretary of the U.S. Department of Health and Human Services promulgate a new regulation for CBD specifically declaring CBD as both a legal dietary supplement and/or food ingredient.

This January, a newly proposed bill opted for the first pathway (carving out an exemption for CBD in the FD&C Act’s definition of a dietary supplement). Proposed by House Agriculture Committee Chairman Collin Peterson (D-MN), the bill would essentially ensure that the IND exclusion clause in Section 201(ff)(3)(B)(i) and 201(ff)(3)(B)(ii) does not pertain to CBD. For instance, under the text stating that a dietary supplement is not “an article authorized for investigation as a new drug…,” Representative Peterson’s bill would add the phrase “other than hemp-derived cannabidiol or a hemp-derived cannabidiol containing substance.”

Whether this bill will pass is anyone’s guess. “What makes it really hard to say is [that] we are kicking off an election year,” says attorney Kevin Bell, partner, Arnall Golden Gregory LLP (AGG; Washington, DC). “If anything is going to get done with it, it would need to move faster than in a non-election year. At some point, you’re going to reach the middle of the year, and legislators-that’s not going to be what the focus is going to be on in an election year because you don’t know what’s going to change, not only from the general election, but also how that might affect committees and things like that.”

While some welcome the Peterson bill, the regulatory route it takes-having Congress dictate a narrow exemption for CBD supplements in the IND exclusion clause-isn’t necessary most optimal, some say.

“We would have preferred to see FDA do this on its own using that discretion that’s under 21 U.S.C. § 321(ff)(3),” says Steve Mister, president and CEO of the Council for Responsible Nutrition (CRN; Washington, DC). (Editor’s note: 21 U.S.C. § 321(ff)(3) is the same provision, but codified, as the FD&C Act’s 201(ff)(3) provision.) “That would have been the preferred way to market because then FDA would have more say in what the exclusion looks like. But given what we’re seeing out of FDA, which seems to be inaction, and the larger environment around it-all the things that are happening in the face of FDA’s inaction-we think this is a good alternative.”

“I think [the Peterson bill] is interesting, but it’s a little drastic,” says Robert Durkin, of counsel, Arnall Golden Gregory LLP (AGG; Washington, DC). Durkin is the former deputy director for FDA’s Office of Dietary Supplement Programs. “The agency could help the Secretary do basically the same thing if the Secretary were to promulgate a regulation…I think a better option would be for the Secretary to promulgate a regulation.”

Why? “Well, what [a new regulation] does is it establishes a precedent and a paradigm for the agency to do this in the future if it has to,” Durkin says. “They wouldn’t have to wait for a legislative fix. And, it’s really likely that CBD is not the only dietary ingredient to be affected like this. It’s a solution that can be used in the future.”

It’s also important to note that, by only amending the definition of a dietary supplement, Rep. Peterson’s bill would still not create a legal pathway for CBD in food, leaving a now quickly growing segment of the CBD market still illegal. “Food would still be in the same trap,” Durkin says. But, say some, leaving CBD out of food might just be FDA’s preference. “They’d much rather have this in dietary supplements than conventional food,” he adds.

“I think FDA has some real concerns about [CBD in food] that make it different than supplements,” says Mister. “Because supplements are, by definition, supposed to be pills, powders, concentrated liquids, capsules, things like that. By their very nature, they’re not allowed to be presented as a food substitute. And so the very act of taking a supplement becomes very intentional.”

He continues: “The problem they have with food is they’re concerned about the cumulative effects of CBD if it’s in everything-you know, you get up in the morning and you have a CBD-infused coffee, and then you have a CBD-laced bottle of water on your way to work, and then you have a CBD-infused brownie. Pretty soon, without realizing it, you’re starting to get an awful lot of CBD into your system. That’s, I think, what’s problematic about food. It’s very hard to do this in a way with food that you alert people to the potential dangers of overconsumption, and it’s also hard to warn vulnerable populations away from it. If you don’t want pregnant women using CBD, are they going to think about that when they’re at the grocery store and they pick up cookies or coffee that has CBD in it? Whereas with a supplement, you can label that supplement in such a way that cautions people: Do not use this product if you’re pregnant or nursing.”

It’s further important to note that if a bill like Rep. Peterson’s passes and makes CBD a legal dietary ingredient, CBD would be subject to all of the regulations and enforcement that all other legal dietary ingredients face-for instance, adhering to the new dietary ingredient (NDI) process and safety data requirements, the current good manufacturing practices (cGMPs) law, as well as labeling compliance.

“Oh, absolutely,” says Mister. “And I think that’s something that some people don’t understand, because they think that somehow it’s exempting CBD from all of the regulatory framework, and that could not be more wrong. What it does is it simply says it meets the definition of a dietary ingredient, but before anybody can bring anything to market, it would still require that you meet all of the requirements for a dietary supplement…So it’s not like a CBD supplement is going to get a free pass under this legislation, but what it does is it says, ‘This is the swim lane for CBD.’”

Short of passage of the Peterson bill, could FDA take more action on sorting out CBD’s legality in 2020? “It’s hard to say,” says AGG’s Durkin. “I know that the agency never wanted to be put in this situation where this is dragged out for so long. I think an answer on CBD is long overdue, whether it comes from the agency in the form of regulations, or from the legislature in the form of a law. It’s just hard to say when that’s going to happen.”

Although FDA has so far not changed its position on CBD’s illegal supplement/food status, it is most definitely hearing all of the noise surrounding CBD. (In efforts to open communication, FDA hosted a public hearing last May to gather information on cannabis and cannabis-derived compounds.) Regarding enforcement, in 2019 the agency did issue more warning letters for violative CBD products it identified in the market. In 2019, it issued 22 warning letters, largely to blatantly violative companies, such as those making illegal disease claims.

FDA is facing a lot of pressure, not only from the new directives it faces from the 2020 spending bill, but more importantly from stakeholders and lawmakers to find a fix due to the mess that’s growing around CBD-everything from companies selling questionable and potentially harmful products without oversight, to growing class action lawsuits over CBD and also the patchwork of state laws that are emerging as states try to take matters into their own hands to protect their own. Meanwhile, the CBD playing field remains uneven and unfair, as companies still cautiously abiding by FDA’s legal stance are keeping out of the market.

“I do think that what’s happening in the larger marketplace is creating some real strong pressures on FDA to do something,” Mister says. “So, you have hemp farmers who are now growing hemp and finding that there’s not a market for their product, and so the price for hemp has dropped because there’s just not the marketplace because people can’t put it in supplements; they can’t put it in food. You’ve got these class action litigations that are really now impacting the industry…You’ve got states-and I would not underestimate the impact that is having-a number of states are jumping into this vacuum and saying, ‘Well, we’ll fill the void if FDA’s not going to do anything.’ Some states are making it completely illegal; many other states are saying, ‘We’re going to allow CBD in our state, but we’re going to put various kinds of restrictions or requirements on it.’ So you have one state that says you have to have a QR code on the label; another says you have to register your product with the state; another says we want certain warnings on the label. That’s going to put increasing pressure on FDA, because think about this: If they wait three years to do something, how are they ever going to roll back all of those state bills? You’re going to have this crazy patchwork in addition to whatever FDA does. So, I think all these things are putting very strong pressure on Congress and FDA to do something, and to do it now.”

Of Rep. Peterson’s bill, says AGG’s Bell, “if you can help try to lead or influence a horse to water, and that horse is the FDA, this is a good way to do that.” He adds that “really, the primary purpose to put it out there was more to spread the idea of a recommendation and potentially, hopefully, influence [FDA] by virtue of it coming from a member of Congress, or several members of Congress…”

How should companies proceed in these uncertain times? Beyond the possibility of receiving FDA warning letters, Mister advises, CBD companies should be even more concerned about ramped-up enforcement that could come from the FTC over fraud and misleading advertising. Already, the FTC has indicated that it is beginning to investigate CBD firms, and those FTC cases “will involve significant settlements of money,” Mister says, and have “a lot more teeth than a warning letter. So that would be my bigger concern.”

And, says AGG’s Durkin, FDA could further enforce against CBD companies through the cGMP process. “I think the agency’s priorities will remain committing their limited resources towards products that are making disease claims. After that, I think if products labeled to contain CBD are found during a routine [cGMP] inspection, I think we can expect the agency to insist that those products be removed from commerce or destroyed before they close that inspection. They’re not gonna walk away from that anymore-not that I would say they ever have-but I don’t think they’re going to miss the opportunity to enforce the Act when they find this violation through day-to-day business.”

We asked a few well-known supplement companies selling CBD or hemp extract products what advice they would give other CBD companies on how to try to stay out of trouble with FDA. Their advice mirrors advice one would give about any other kind of dietary supplement product.

“If you’re selling CBD, there’s no surefire way to avoid landing in hot water with the FDA, since their position is that it is not currently lawful to sell CBD products as dietary supplements,” says Gene Bruno, MS, MHS, RH(AHG), senior director of product innovation for Twinlab. “That being said, it is also clear that they haven’t take measures to shut down the sales of all such products currently on the market...” His top advice to companies includes avoid making “outrageous, red-flag” disease-treatment claims; avoid using CBD isolates, “since indications are that when all is said and done, this material will be exclusively available to GW Pharmaceuticals as the major component of their prescription drug, Epidiolex;” and “If you really want to reduce risk, offer hemp extract products, not CBD products.”

Stuart Tomc, vice president of human nutrition, CV Sciences (San Diego, CA), adds: “Companies should be following all of the applicable rules that are in place to protect consumers, For example, if a company is selling a dietary supplement, then the company’s marketing surrounding the supplement should follow all dietary supplement rules. Those rules include having evidence that the level of CBD in their product is safe. The company’s marketing messaging for the product should not make any unsubstantiated claims, the product should be made in a cGMP facility, and the company should be collecting and monitoring consumer complaints or adverse events.”

The biggest fear of all, for all involved-FDA, lawmakers, responsible CBD companies-is what were to happen if a consumer were to become ill or injured from a CBD product for reasons including that it was misbranded, adulterated, or otherwise dangerous.

“First and foremost is public health,” says Daniel Fabricant, PhD, CEO and president of the Natural Products Association (NPA; Washington, DC). Fabricant has been vocal in urging FDA to determine a safe CBD usage level for consumers, also keeping in mind that CBD users today could include children or pregnant women.

“The CBD being sold in stores and online is made up of who-knows-what and comes from who-knows-where. If the FDA, on their own, or as mandated by Congress, doesn’t act soon to set a safe level of consumption for CBD, then we are inviting another vaping-like crisis or worse.”

He adds that he’s “not sure of the delay by the agency to set even an interim level…[T]here’s so much in the public domain, like the WHO document on CBD, that could be easily used as a starting point.”

The Market

Short of regulatory clarity, expect the CBD market to continue the same extraordinary growth it saw in 2019 and even ramping up to last year. The journal HerbalGram, published by the American Botanical Council (Austin, TX), reported2 that by the end of 2018, CBD had skyrocketed to the top as the number-one top-selling herbal supplement in the U.S. natural channel, effectively pushing turmeric, the previous number-one natural seller since 2013, down to the number-two spot. CBD was the top-selling and the fastest-growing natural-channel ingredient that year, with sales reaching nearly $53 million and growing 332.8% from the previous year. The HerbalGram report stated: “According to SPINS, roughly 60% of the CBD products sold in the U.S. natural channel in 2018 were in the form of alcohol-free tinctures, followed by capsules and softgels. The vast majority of the CBD products were marketed for ‘non-specific health focuses,’ with mood support and sleep as the next most-popular uses.”

2019 saw the same impressive growth for CBD in the U.S. natural channel, according to data provided by SPINS for this story. In the U.S. natural channel in 2019, CBD ranked as the number-two bestselling ingredient, growing 113% to $90 million in sales. (For more insights on CBD's cross-channel growth in 2019, read our article, 2019’s Biggest ingredient sales trends (positive and negative) for dietary supplements.)

That growth looks set to continue, other developments notwithstanding. At last November’s Council for Responsible Nutrition The Conference, market researcher and presenter IRI (Chicago) predicted that U.S. market sales of non-THC cannabinoids, including CBD, could reach $18 billion by 2024, including sales in the general retail supplement channel and in dispensaries-and not even capturing data from other retail outlets not tracked where CBD might be sold, such as in household stores or other types of retail stores-and largely driven not only by wider consumer acceptance of CBD but also growing availability.

During his presentation, IRI’s Robert Sanders, executive vice president, healthcare and nutritional supplement practice leader, also pointed out that “a leading indicator for what’s going to happen in the [mainstream] marketplace…will be driven in a large way by what’s going on in dispensaries. So if dispensaries are doing things, you can expect that to be a rationale for other retail channels that want to do the same thing.” He also said that dispensaries’ share of the market will shrink as market share held by other retail outlets, including mass-market and grocery stores, grows. And, while CBD supplements are driving most of the CBD sales in traditional retail outlets, moving forward, much of CBD’s growth will stem from edibles (food, candy, drinks) and topicals (beauty/skin products).

Already, CBD is being sold in mainstream national stores like CVS, Walgreens, Rite-Aid, Kroger, GNC, Ulta Beauty, Sephora, Bed Bath & Beyond, and clothing stores. Says CV Sciences’ Tomc, “Retailers are gaining confidence that CBD derived from agricultural hemp is here to stay,” although he adds that “conservative retailers…are standing on the sidelines.”

For the time being, many large CPG players will be waiting to engage until FDA makes CBD products legal. “I think the temptation may be too much for a few players, and they will get in, but I think most of your large CPG companies are just not going to wade into this area as long as there is uncertainty about whether it’s a legal product," CRN's Mister says.

He adds: “And that’s really unfortunate, because if you were to ask FDA, ‘What’s the kind of company you would like to see in this space?,’ they would like to see big established companies that have very well-developed quality-control systems in place, that have a commitment to their consumers, and that are too big to get wrapped up in a lot of lawsuits. Those are the kinds of companies that are going to do it right, and instead, those are the ones that are sitting on the sidelines in many cases….And that’s exactly the kind of company that FDA would rather come in and take market share.”

And, indeed, the CBD market today is largely populated by smaller companies-including some new-to-business companies with little knowledge of dietary supplement best manufacturing practices or supplement regulation requirements.

“New brands have continued to enter the marketplace, typically with small companies not previously affiliated with the dietary supplement industry,” says Twinlab’s Bruno. “That’s not to say that existing supplement companies haven’t introduced CBD/hemp products-they have. It’s just that the sheer number of new brands are from the smaller companies.”

CV Sciences’ Tomc echoes this. “The dietary supplement market has been flooded with start-ups and new CBD brands that have migrated to the dietary supplement category. These companies are not familiar with dietary supplement regulations that are currently in place to protect consumers. Therefore, the market has been flooded with non-compliant products with claims that may not be allowed, or claims that may fail to meet specifications when tested.”

Opportunities are ripe for irresponsible CBD companies coming to market to make a quick profit with questionable products-and, in the process, risking the reputation of both the CBD market and the larger supplement market as a whole. An NPA poll conducted last year found that 47% of Americans would stop using CBD products if they or someone they knew got sick from using CBD, Fabricant points out.

“My biggest concern about the CBD supplements industry is irresponsible players,” Bruno says. “Unfortunately, many new brands to the industry aren’t necessarily planning on a long-term commitment and so are less concerned with following cGMPs, and more concerned with maximizing profits to the exclusion of all else…When I was at SupplySide West in 2019, I met someone with a brand who had illegal levels of THC in his product and was happy about it, since he figured it would get customers to keep buying the products.’”

AGG’s Bell says, “The last few years when I’ve gone to SupplySide West and people come up and ask me questions about cannabis and CBD…you know, at some point in time, you look at what it’s starting to populate, these trade shows and conferences, and say, ‘90% of you people probably won’t make it. You won’t be here.’ You try to figure out how much of this is a quick buck versus the ones who are really serious about this.”

It’s a major concern for any CBD company doing its best to act responsibly. Says CV Sciences’ Tomc, “The biggest concern is the risk for consumers to be harmed by a poorly made product. This gives responsible industry a black eye at a time when the industry is working hard to provide FDA with the science needed to establish that there are, indeed, high-quality hemp-derived CBD products that are safe when used correctly.”

Says AGG’s Durkin: “There are some very good players making products that contain CBD, and although they’re violating the Act by doing that, they go through great efforts to make sure that they’re adhering to all other aspects of the Act in that they’re putting a quality product on the market. I don’t want to see those good players suffer because someone doesn’t put the same effort in and puts a product out there that causes harm.”

For better or for worse, Bruno also points out that for newer companies trying to enter the CBD market now, eventual market saturation will become an issue. “At this point in time, any new CBD brand wishing to enter the retail will likely have a hard time doing so. There are already more than 1500 such products, and unless you can differentiate your product in a major way, it won’t really be worth the effort to try and be a player. In my opinion, one viable approach is for a new CBD brand to focus on products that provide other cannabinoids besides just CBD.”

2020 Ingredient Trends to Watch for Food, Drinks, and Dietary Supplements:

CBD

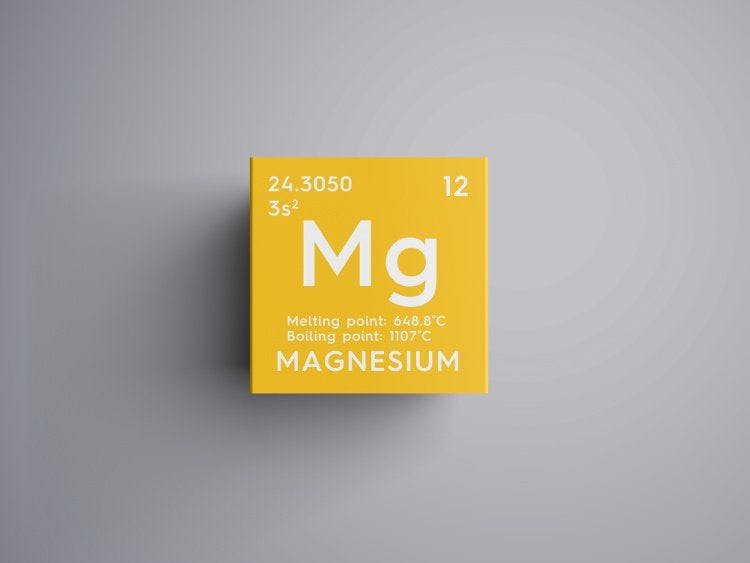

ElderberryMelatoninMCTsMagnesiumAshwagandhaCollagenDietary Fiber/Prebiotics

References:

- Dimengo N. “The 12 Weirdest CBD Products.” GreenEntrepreneur. Published November 1, 2019. Accessed at: www.greenentrepreneur.com/slideshow/341602

- Smith T. “Herbal supplement sales in US increase by 9.4% in 2018.” HerbalGram, no. 123 (2019). Accessed at: http://cms.herbalgram.org/herbalgram/issue123/files/HG123-HMR.pdf

Prinova acquires Aplinova to further increase its footprint in Latin America

April 7th 2025Prinova has recently announced the acquisition of Brazilian ingredients distributor Aplinova, which is a provider of specialty ingredients for a range of market segments that include food, beverage, supplements, and personal care.